A commodity market is a market that trades in primary economic sector rather than manufactured products. cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

Speculation is the purchase of an asset with the hope that it will become more valuable in the near future. In finance, speculation is also the practice of engaging in risky financial transactions in an attempt to profit from short term fluctuations in the market value of a tradable financial instrument—rather than attempting to profit from the underlying financial attributes embodied in the instrument such as capital gains, dividends, or interest.

The London Metal Exchange (LME) is the futures exchange with the world's largest market in options and futures contracts on base and other metals. As the LME offers contracts with daily expiry dates of up to three months from trade date, weekly contracts to six months, and monthly contracts up to 123 months, it also allows for cash trading. It offers hedging, worldwide reference pricing, and the option of physical delivery to settle contracts. Since 2012 it has been owned by Hong Kong Exchanges and Clearing after LME's shareholders voted in July 2012 to approve the sale of the exchange for a price of £1.4 billion.

In finance, a futures contract is a standardized forward contract, a legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price the parties agree to buy and sell the asset for is known as the forward price. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. Because it is a function of an underlying asset, a futures contract is a derivative product.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

A commodity price index is a fixed-weight index or (weighted) average of selected commodity prices, which may be based on spot or futures prices. It is designed to be representative of the broad commodity asset class or a specific subset of commodities, such as energy or metals. It is an index that tracks a basket of commodities to measure their performance. These indexes are often traded on exchanges, allowing investors to gain easier access to commodities without having to enter the futures market. The value of these indexes fluctuates based on their underlying commodities, and this value can be traded on an exchange in much the same way as stock index futures.

A currency future, also known as an FX future or a foreign exchange future, is a futures contract to exchange one currency for another at a specified date in the future at a price that is fixed on the purchase date; see Foreign exchange derivative. Typically, one of the currencies is the US dollar. The price of a future is then in terms of US dollars per unit of other currency. This can be different from the standard way of quoting in the spot foreign exchange markets. The trade unit of each contract is then a certain amount of other currency, for instance €125,000. Most contracts have physical delivery, so for those held at the end of the last trading day, actual payments are made in each currency. However, most contracts are closed out before that. Investors can close out the contract at any time prior to the contract's delivery date.

Osaka Securities Exchange Co., Ltd. is the second largest securities exchange in Japan, in terms of amount of business handled.

Tokyo Commodity Exchange, also known as TOCOM, is Japan's largest and one of Asia's most prominent commodity futures exchanges. TOCOM operates electronic markets for precious metals, oil, rubber and soft commodities. It offers futures and options contracts for precious metals ; energy ; natural rubber and agricultural products.

Central Japan Commodity Exchange (C-COM) was a futures exchange based in Nagoya, Japan that closed in 2011.

Zhengzhou Commodity Exchange, established in 1990, is a futures exchange in Zhengzhou, one of the four futures exchanges in China. The ZCE is under the vertical management of China Securities Regulatory Commission (CSRC).

The Dalian Commodity Exchange (DCE) is a Chinese futures exchange based in Dalian, Liaoning province, China. It is a non-profit, self-regulating and membership legal entity established on February 28, 1993.

Nadex, formerly known as HedgeStreet, is US-based retail-focused online binary options exchange. It offers retail trading of binary options and spreads on the most heavily traded forex, commodities and stock indices markets.

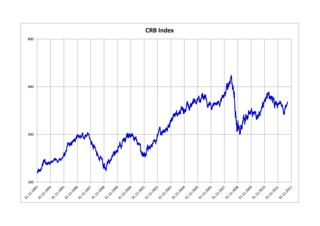

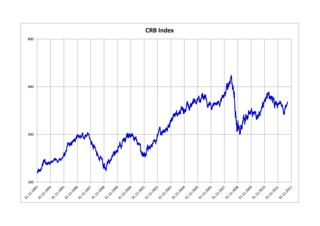

The Thomson Reuters/CoreCommodity CRB Index is a commodity futures price index. It was first calculated by Commodity Research Bureau, Inc. in 1957 and made its inaugural appearance in the 1958 CRB Commodity Year Book.

In finance, a spread trade is the simultaneous purchase of one security and sale of a related security, called legs, as a unit. Spread trades are usually executed with options or futures contracts as the legs, but other securities are sometimes used. They are executed to yield an overall net position whose value, called the spread, depends on the difference between the prices of the legs. Common spreads are priced and traded as a unit on futures exchanges rather than as individual legs, thus ensuring simultaneous execution and eliminating the execution risk of one leg executing but the other failing.

China Shanghai Shenzhen 300 Stock Index Futures, often abbreviated to "Hushen 300 Index", designated by the commodity ticker symbol IF, is a stock market index futures contract traded in China Financial Futures Exchange (CFFEX). The notional value of one contract is RMB¥300 times the value of the Shanghai Shenzhen 300 Stock Index. It is known to be the first stock index futures contract in China.

Iran Mercantile Exchange (IME) is a commodities exchange located in Tehran, Iran. It was founded in 2006. IME trades in agricultural, industrial and petrochemical products in the spot and futures markets. It is mainly a domestic or regional market with the ambition to become more international in the future. As of 2014, about one fourth of IME's commodities were exported. IME offers a variety of services, including providing access to the initial offering of commodities, pricing for Iran’s Over-the-Counter (OTC), secondary markets and end users, providing a venue for government sales and procurement purchases, facilitating a trading platform and user interface, providing clearing & settlement services, risk management, technology services, and training of market participants.