JPMorgan Chase & Co. is an American multinational financial services firm headquartered in New York City and incorporated in Delaware. It is the largest bank in the United States and the world's largest bank by market capitalization as of 2023. As the largest of the Big Four banks in America, the firm is considered systemically important by the Financial Stability Board. Its size and scale have often led to enhanced regulatory oversight as well as the maintenance of an internal "Fortress Balance Sheet". The firm is headquartered at 383 Madison Avenue in Midtown Manhattan and is set to move into the under-construction JPMorgan Chase Building at 270 Park Avenue in 2025.

Venture capital (VC) is a form of private equity financing provided by firms or funds to startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovative technology or business model and often come from high technology industries such as information technology (IT) or biotechnology.

Sequoia Capital Operations, LLC is an American venture capital firm headquartered in Menlo Park, California which specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors. As of 2022, the firm had approximately US$85 billion in assets under management.

Kathryn A. Finney is an American author, researcher, investor, entrepreneur, and businesswoman. She is the founder of Genius Guild, a $20 million dollar venture fund & studio that invests in Black entrepreneurs building scalable businesses that serve Black communities and beyond. She is also founder and Board Chair of The Doonie Fund, a social platform that provides micro-investment to Black women entrepreneurs. Finney first made her mark as a tech entrepreneur when she sold “The Budget Fashionista” after running the site-turned-media company for 11 years.

Jerry Colonna is an American venture capitalist and professional coach who played a prominent part in the early development of Silicon Valley. Colonna has been named to Upside magazine's list of the 100 Most Influential People of the New Economy, Forbes ASAP's list of the best VCs in the country, and Worth's list of the 25 most generous young Americans. He is a co-founder and CEO of the executive coaching and leadership development company, Reboot. He is the host of the Reboot Podcast. He also serves as chairman on the Board of Trustees at Naropa University.

Wences Casares is a Silicon Valley–based fintech entrepreneur. He is the founder of Xapo Bank, and also founded Internet Argentina, Wanako Games, Patagon, Bling Nation, Lemon Wallet, and Banco Lemon. Casares sat on the boards of PayPal and Diem.

GV Management Company, L.L.C. is a venture capital investment arm of Alphabet Inc., founded by Bill Maris, that provides seed, venture, and growth stage funding to technology companies. Founded as Google Ventures in 2010, the firm has operated independently of Google, Alphabet's search and advertising division, since 2015. GV invests in startup companies in a variety of fields ranging from the Internet, software, and hardware to life science, healthcare, artificial intelligence, transportation, cyber security and agriculture. It has helped finance more than 300 companies that include Uber, Nest, Slack, and Flatiron Health.

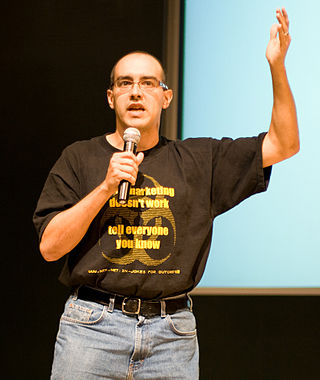

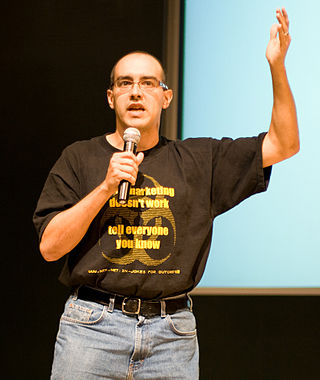

David "Dave" McClure is an entrepreneur and angel investor based in the San Francisco Bay Area, who founded the business accelerator 500 Startups and served as its CEO until his resignation in 2017. He founded Practical Venture Capital soon after, a new venture capital fund that would continue to work with companies he previously funded through 500 Startups.

Mary Callahan Erdoes is an American investment manager and businesswoman. She is the chief executive officer (CEO) of the asset and wealth management division of J.P. Morgan, serving since 2009. With the firm since 1996, she began her career as a portfolio manager, specializing in fixed income trading. From 2005 to 2009, she served as the CEO of the firm's private bank, advising wealthy families and institutions. Her career has led to her being described as the most powerful woman in American finance. She has been noted as a potential successor to Jamie Dimon, as CEO of JPMorgan Chase.

In April and May 2012, large trading losses occurred at JPMorgan's Chief Investment Office, based on transactions booked through its London branch. The unit was run by Chief Investment Officer Ina Drew, who later stepped down. A series of derivative transactions involving credit default swaps (CDS) were entered, reportedly as part of the bank's "hedging" strategy. Trader Bruno Iksil, nicknamed the London Whale, accumulated outsized CDS positions in the market. An estimated trading loss of $2 billion was announced. However, the loss amounted to more than $6 billion for JPMorgan Chase.

Binary Capital is an early stage venture capital firm based in San Francisco. The firm focuses on early-stage consumer technology companies. The founders' previous investment experience included roles at General Catalyst Partners, Benchmark Capital, Lightspeed Venture Partners, and Bain Capital Ventures.

Sarah Kunst is an entrepreneur and angel fund investor, she is currently the managing director of Cleo Capital. Kunst has worked at Apple, Red Bull, Chanel & Mohr Davidow Ventures and was on the Board of Venture for America, She founded LA Dodgers backed Proday and has served as a senior advisor at Bumble where she focused on their corporate VC arm Bumble Fund and on the board of the Michigan State University Foundation endowment. She is also a contributing editor at Marie Claire Magazine.

Thrive Global is an American company that provides behavior change technology. It was founded by Arianna Huffington in August 2016. The company is based in New York City.

Freestyle Capital is an early-stage venture capital firm based in San Francisco, California. General Partners Dave Samuel and Jenny Lefcourt are both entrepreneurs who entered venture capital after founding multiple companies. The firm was founded in 2009 and typically invests in 10-12 companies per year with an average investment between $1.5 million to $3 million. Previous investments include Intercom, Patreon, Narvar, Digit, Betterup, Airtable and Snapdocs.

Michael Eisenberg is an American-born Israeli businessman, venture capitalist, and author.

Anna Fang is a Chinese venture capitalist. She is the founding partner and CEO of ZhenFund.

Republic is a global financial firm operating an enterprise-focused digital merchant bank and a network of retail-focused investment platforms. Backed by Morgan Stanley, Valor Equity Partners, Galaxy Interactive, Hashed, AngelList and other leading institutions, Republic boasts a portfolio of over 2,500 companies and a community of 3 million members from over 150 countries. More than $2.6 billion has been deployed through investment platforms, funds, and firms within the Republic family of companies. It is headquartered in New York City and has operations in the US, the UK, the EU, the UAE, South Korea, and Singapore.

Marie Ekeland, is a French entrepreneur specializing in start-up financing. She is the co-founder of the Daphni investment fund and the founder and president of the 2050 fund.

Fatoumata Bâ is a Senegalese tech entrepreneur, and founder of Janngo Capital. She is credited with the expansion of Jumia, and acceleration of education, and SMEs growth through technology in Africa.

The Startup Ladies is an Indiana-based membership organization focused on supporting women entrepreneurs and investors. Founded in 2014 by Kristen Cooper, the organization works to increase the number of women starting scalable businesses and to address investment disparities faced by women entrepreneurs.