In accounting, equity is the difference between the value of the assets and the value of the liabilities of something owned. It is governed by the following equation:

A land/location value tax (LVT), also called a site valuation tax, split rate tax, or site-value rating, is an ad valorem levy on the unimproved value of land. Unlike property taxes, it disregards the value of buildings, personal property and other improvements to real estate. A land value tax is generally favored by economists as it does not cause economic inefficiency, and it tends to reduce inequality.

A property tax or millage rate is an ad valorem tax on the value of a property, usually levied on real estate. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. This tax can be contrasted to a rent tax which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements.

Rates are a type of property tax system in the United Kingdom, and in places with systems deriving from the British one, the proceeds of which are used to fund local government. Some other countries have taxes with a more or less comparable role, like France's taxe d'habitation.

Real estate appraisal, property valuation or land valuation is the process of developing an opinion of value, for real property. Real estate transactions often require appraisals because they occur infrequently and every property is unique, unlike corporate stocks, which are traded daily and are identical. The location also plays a key role in valuation. However, since property cannot change location, it is often the upgrades or improvements to the home that can change its value. Appraisal reports form the basis for mortgage loans, settling estates and divorces, taxation, and so on. Sometimes an appraisal report is used to establish a sale price for a property.

An ad valorem tax is a tax whose amount is based on the value of a transaction or of property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ad valorem tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event. In some countries a stamp duty is imposed as an ad valorem tax.

Tax increment financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in many countries, including the United States. Similar or related value capture strategies are used around the world.

Affordability of housing in the UK reflects the ability to rent or buy property. Housing tenure in the UK has the following main types: Owner-occupied; Private Rented Sector (PRS); and Social Rented Sector (SRS). The affordability of housing in the UK varies widely on a regional basis – house prices and rents will differ as a result of market factors such as the state of the local economy, transport links and the supply of housing.

A Finance Act is the headline fiscal (budgetary) legislation enacted by the UK Parliament, containing multiple provisions as to taxes, duties, exemptions and reliefs at least once per year, and in particular setting out the principal tax rates for each fiscal year.

A cadastre is a comprehensive land recording of the real estate or real property's metes-and-bounds of a country.

The Valuation Office Agency is a government body in England and Wales. It is an executive agency of Her Majesty's Revenue and Customs.

Farmland development rights in Suffolk County, New York began in 1975 in Suffolk County as the state of New York began a program to purchase development rights for farmland to insure they remained as farms and open space rather than being developed for housing.

In real estate, a lot or plot is a tract or parcel of land owned or meant to be owned by some owner(s). A lot is essentially considered a parcel of real property in some countries or immovable property in other countries. Possible owner(s) of a lot can be one or more person(s) or another legal entity, such as a company/corporation, organization, government, or trust. A common form of ownership of a lot is called fee simple in some countries.

Taxes in India are levied by the Central Government and the state governments. Some minor taxes are also levied by the local authorities such as the Municipality.

The Tithe Commutation Act 1836 was an Act of the Parliament of the United Kingdom with the long title "An Act for the Commutation of Tithes in England and Wales". It replaced the ancient system of payment of tithes in kind with monetary payments. It is especially noted for the tithe maps which were needed for the valuation process required by the Act. British Parliamentary Paper 1837 XLI 405 was published to give guidance on how landscape features were to be indicated on the maps. It is entitled ′Conventional signs to be used in the plans made under the Act for the Commutation of Tithes in England and Wales′

The Municipal Property Assessment Corporation, or MPAC, administers property assessments and appeals of assessment in the Province of Ontario MPAC determines the assessed value for all properties across the province of Ontario, Canada. This is provided in the form of an Assessment Roll, which is delivered to municipalities throughout the province on the second Tuesday in December. Municipalities then take the assessment roll, and calculate property taxes for each individual property in their jurisdiction. MPAC complains that tax payers often confuse MPAC's role as an assessment agency for taxes; MPAC responds that they only provide assessments. Municipalities set the tax rates, and distribute the tax burden based on the assessed values provided by MPAC.

A tax increment reinvestment zone (TIRZ) is a political subdivision of a municipality or county in the state of Texas created to implement tax increment financing. They may be initiated by the city or county or by petition of owners whose total holdings in the zone consist of a majority of the appraised property value. To get funding for a TIRZ area applicants have to follow three steps.

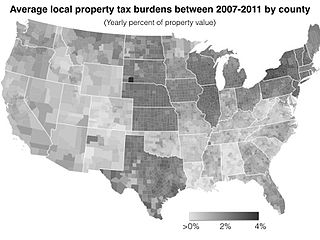

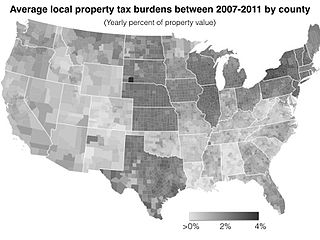

Most local governments in the United States impose a property tax, also known as a millage rate, as a principal source of revenue. This tax may be imposed on real estate or personal property. The tax is nearly always computed as the fair market value of the property times an assessment ratio times a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners. For the taxing authority, one advantage of the property tax over the sales tax or income tax is that the revenue always equals the tax levy, unlike the other taxes. The property tax typically produces the required revenue for municipalities' tax levies. A disadvantage to the taxpayer is that the tax liability is fixed, while the taxpayer's income is not.

The two-volume Return of Owners of Land, 1873 is the first complete picture of the distribution of land in the British Isles since the 1086 Domesday Book. The 1873 Return is sometimes called the "Modern Domesday". It arose from the desire of the Victorian governing landed classes, many of whom sat in the House of Lords, to counter rising public clamour about what was considered the monopoly of land. Karl Marx, who had lived in London since 1849, published Das Kapital in 1867. It influenced European political thought, prompting the British Establishment to extinguish revolutionary sentiment in the United Kingdom.

In English common law, real property, real estate, realty, or immovable property is land which is the property of some person and all structures integrated with or affixed to the land, including crops, buildings, machinery, wells, dams, ponds, mines, canals, and roads, among other things. The term is historic, arising from the now-discontinued form of action, which distinguished between real property disputes and personal property disputes. Personal property was, and continues to be, all property that is not real property.