In finance, a bond is an instrument of indebtedness of the bond issuer to the holders. The most common types of bonds include municipal bonds and corporate bonds.

Debt is when something, usually money, is owed by one party, the borrower or debtor, to a second party, the lender or creditor. Debt is a deferred payment, or series of payments, that is owed in the future, which is what differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. The term can also be used metaphorically to cover moral obligations and other interactions not based on economic value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person.

Off-budget enterprises are a type of government in the United States, the UK and the EU. OBEs use public funds to further public or private interests. Regulated by various state and federal laws, they operate outside the regulations for general-purpose government and public scrutiny, although many states have created oversight authorities of one form or another. They achieve self-funding by usually having taxation authority or fund themselves through fees for services rendered. Some have the ability to raise revenue bonds. The fastest-growing OBE is the industrial development agency which issues tax-exempt industrial revenue bonds to finance private business ventures mainly to revitalize economically depressed areas. Many are formed to deal with special local situations. The most common OBE is the School district.

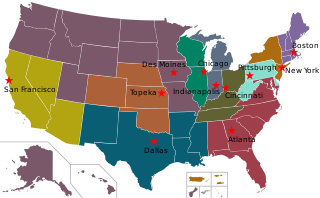

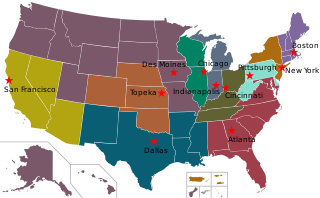

A municipal bond, commonly known as a Muni Bond, is a bond issued by a local government or territory, or one of their agencies. It is generally used to finance public projects such as roads, schools, airports and seaports, and infrastructure-related repairs. The term municipal bond is commonly used in the United States, which has the largest market of such trade-able securities in the world. As of 2011, the municipal bond market was valued at $3.7 trillion. Potential issuers of municipal bonds include states, cities, counties, redevelopment agencies, special-purpose districts, school districts, public utility districts, publicly owned airports and seaports, and other governmental entities at or below the state level having more than a de minimis amount of one of the three sovereign powers: the power of taxation, the power of eminent domain or the police power.

A bearer bond is a bond or debt security issued by a business entity such as a corporation, or a government. As a bearer instrument, it differs from the more common types of investment securities in that it is unregistered—no records are kept of the owner, or the transactions involving ownership. Whoever physically holds the paper on which the bond is issued is the presumptive owner of the instrument. This is useful for investors who wish to retain anonymity. Recovery of the value of a bearer bond in the event of its loss, theft, or destruction is usually impossible. Some relief is possible in the case of United States public debt.

A mortgage-backed security (MBS) is a type of asset-backed security which is secured by a mortgage or collection of mortgages. The mortgages are sold to a group of individuals that securitizes, or packages, the loans together into a security that investors can buy. The mortgages of a MBS may be residential or commercial, depending on whether it is an Agency MBS or a Non-Agency MBS; in the United States they may be issued by structures set up by government-sponsored enterprises like Fannie Mae or Freddie Mac, or they can be "private-label", issued by structures set up by investment banks. The structure of the MBS may be known as "pass-through", where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs. Other types of MBS include collateralized mortgage obligations and collateralized debt obligations (CDOs).

Tax increment financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in many countries, including the United States. Similar or related value capture strategies are used around the world.

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide reliable liquidity to member financial institutions to support housing finance and community investment. With their members, the FHLBanks represents the largest collective source of home mortgage and community credit in the United States.

The Jones–Shafroth Act —also known as the Jones Act of Puerto Rico, Jones Law of Puerto Rico, or as the Puerto Rican Federal Relations Act of 1917— was an Act of the United States Congress, signed by President Woodrow Wilson on March 2, 1917. The act superseded the Foraker Act and granted U.S. citizenship to anyone born in Puerto Rico on or after April 25, 1898. It also created the Senate of Puerto Rico, established a bill of rights, and authorized the election of a Resident Commissioner to a four-year term. The act also exempted Puerto Rican bonds from federal, state, and local taxes regardless of where the bond holder resides.

The bond market is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on.

In general, a private activity bond is a bond issued by or on behalf of local or state government for the purpose of financing the project of a private user.

The Toledo–Lucas County Port Authority is a port authority financing and/or operating air, rail, trucking, and port facilities, as well as supporting and funding economic development activities in Lucas County, located in northwest Ohio and bordering on southeast Michigan.

The 2007 Texas Constitutional Amendment Election took place 6 November 2007.

Build America Bonds are taxable municipal bonds that carry special tax credits and federal subsidies for either the bond issuer or the bondholder. Build America Bonds were created under Section 1531 of Title I of Division B of the American Recovery and Reinvestment Act that U.S. President Barack Obama signed into law on February 17, 2009. The program expired December 31, 2010.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

Taxation may involve payments to a minimum of two different levels of government: central government through SARS or to local government. Prior to 2001 the South African tax system was "source-based", wherein income is taxed in the country where it originates. Since January 2001, the tax system was changed to "residence-based" wherein taxpayers residing in South Africa are taxed on their income irrespective of its source. Non residents are only subject to domestic taxes.

Fiscal policy refers to the "measures employed by governments to stabilize the economy, specifically by manipulating the levels and allocations of taxes and government expenditures. Fiscal measures are frequently used in tandem with monetary policy to achieve certain goals." In the Philippines, this is characterized by continuous and increasing levels of debt and budget deficits, though there have been improvements in the last few years.

The Puerto Rican government-debt crisis is a financial crisis affecting the government of Puerto Rico. The crisis traces back its history to 1973 when the government began to spend more than what it collected. To cover that imbalance, the government issued bonds rather than adjust its budget. That practice continued for four decades until 2014 when three major credit agencies downgraded several bonds issues by Puerto Rico to "junk status" after the government was unable to demonstrate that it would be able to pay its debt. The downgrading, in turn, prevented the government from selling more bonds in the open market. Unable to obtain the funding to cover its budget imbalance, the government began using its savings to pay its debt while warning that those savings would eventually exhaust and that it would thus eventually be unable to pay its debt. To prevent such scenario, the United States Congress enacted a law known as PROMESA, which appointed an oversight board with ultimate control over the commonwealth's budget. As the PROMESA board began to exert that control, the government sought to increase revenues and reduce its expenses by increasing taxes while curtailing public services and reducing worker's benefits. Those measures further compounded the crisis by provoking social distrust and unpleasantness in the general population.