The Specie Payment Resumption Act of January 14, 1875 was a law in the United States that restored the nation to the gold standard through the redemption of previously-unbacked United States Notes and reversed inflationary government policies promoted directly after the American Civil War. The decision further contracted the nation's money supply and was seen by critics as an exacerbating factor of the so-called Long Depression, which struck in 1873.

Jay Cooke was an American financier who helped finance the Union war effort during the American Civil War and the postwar development of railroads in the northwestern United States. He is generally acknowledged as the first major investment banker in the United States and creator of the first wire house firm.

The Panic of 1873 was a financial crisis that triggered an economic depression in Europe and North America that lasted from 1873 to 1877 or 1879 in France and in Britain. In Britain, the Panic started two decades of stagnation known as the "Long Depression" that weakened the country's economic leadership. In the United States, the Panic was known as the "Great Depression" until the events of 1929 and the early 1930s set a new standard.

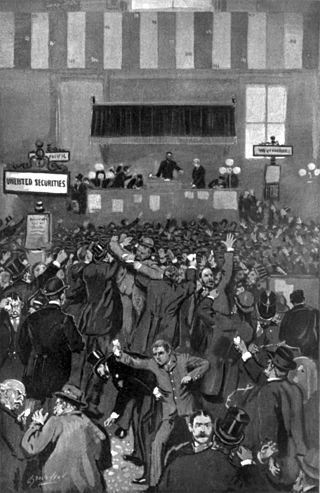

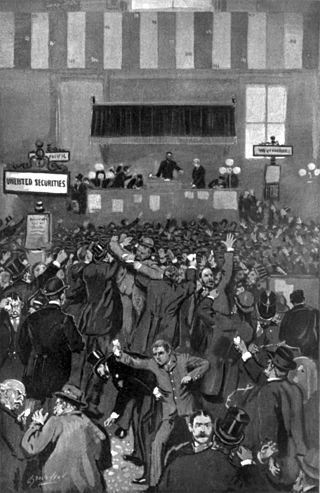

The Black Friday gold panic of September 24, 1869 was caused by a conspiracy between two investors, Jay Gould and his partner James Fisk, and Abel Corbin, a small time speculator who had married Virginia (Jennie) Grant, the younger sister of President Ulysses Grant. They formed the Gold Ring to corner the gold market and force up the price of metal on the New York Gold Exchange. The scandal took place during the Presidency of Ulysses S. Grant, whose policy was to sell Treasury gold at weekly intervals to pay off the national debt, stabilize the dollar, and boost the economy. The country had gone through tremendous upheaval during the Civil War and was not yet fully restored.

The Panic of 1893 was an economic depression in the United States that began in 1893 and ended in 1897. It deeply affected every sector of the economy, and produced political upheaval that led to the political realignment of 1896 and the presidency of William McKinley.

The Greenback Party was an American political party with an anti-monopoly ideology which was active between 1874 and 1889. The party ran candidates in three presidential elections, in 1876, 1880 and 1884, before it faded away.

The Northern Pacific Railway was a transcontinental railroad that operated across the northern tier of the western United States, from Minnesota to the Pacific Northwest. It was approved by Congress in 1864 and given nearly 40 million acres of land grants, which it used to raise money in Europe for construction.

The Long Depression was a worldwide price and economic recession, beginning in 1873 and running either through March 1879, or 1896, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the "Great Depression" at the time, and it held that designation until the Great Depression of the 1930s. Though a period of general deflation and a general contraction, it did not have the severe economic retrogression of the Great Depression.

Junius Spencer Morgan I was an American banker and financier, as well as the father of John Pierpont "J.P." Morgan and patriarch to the Morgan banking house.

The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by Samuel F. Morse in 1844, the Panic of 1857 was the first financial crisis to spread rapidly throughout the United States. The world economy was more interconnected by the 1850s, which made the Panic of 1857 the first worldwide economic crisis. In Britain, the Palmerston government circumvented the requirements of the Bank Charter Act 1844, which required gold and silver reserves to back up the amount of money in circulation. Surfacing news of this circumvention set off the Panic in Britain.

The Lake Superior and Mississippi Railroad is the name of two railroads in Minnesota: a freight and passenger line that operated from 1870 to 1877 and a heritage railroad that has operated since 1981.

The Panic of 1884 was an economic panic during the Depression of 1882–1885. It was unusual in that it struck at the end rather than the beginning of the recession. The panic created a credit shortage that led to a significant economic decline in the United States, turning a recession into a depression.

Dillon, Read & Co. was an investment bank based in New York City. In 1991, it was acquired by Barings Bank and, in 1997, it was acquired by Swiss Bank Corporation, which was in turn acquired by UBS in 1998.

Henry David Cooke was an American financier, journalist, railroad executive, and politician. He was the younger brother of Philadelphia financier Jay Cooke. A member of the Republican political machine in post-Civil War Washington, D.C., Cooke was appointed first territorial governor of the District of Columbia by Ulysses S. Grant.

The Freedman's Saving and Trust Company, known as the Freedman's Savings Bank, was a private savings bank chartered by the U.S. Congress on March 3, 1865, to collect deposits from the newly emancipated communities. The bank opened 37 branches across 17 states and Washington DC within 7 years and collected funds from over 67,000 depositors. At the height of its success, the Freedman's Savings Bank held assets worth more than $3.7 million in 1872 dollars, which translates to approximately $80 million in 2021.

E. W. Clark & Co. was a banking and financial firm founded in Philadelphia, Pennsylvania, in 1837 by Enoch White Clark. Among its partners were American Civil War financier Jay Cooke and West Philadelphia developer Clarence Howard Clark.

Philadelphia financier Jay Cooke established the first modern American investment bank during the Civil War era. However, private banks had been providing investment banking functions since the beginning of the 19th century and many of these evolved into investment banks in the post-bellum era. However, the evolution of firms into investment banks did not follow a single trajectory. For example, some currency brokers such as Prime, Ward & King and John E. Thayer and Brother moved from foreign exchange operations to become private banks, taking on some investment bank functions. Other investment banks evolved from mercantile firms such as Thomas Biddle and Co. and Alexander Brothers.

Samuel Jaudon was a 19th-century American banker and businessman who was best known for his work as cashier and agent of the Bank of the United States from 1832 to 1837. During the Panic of 1837, Jaudon secured large loans for the bank and engaged in commodity speculation, particularly cotton, which failed to secure the bank's own credit and caused it to go bankrupt.

The Grandin Brothers; John Livingston Grandin, William James Grandin and Elijah Bishop Grandin were a sibling trio of American entrepreneurs who were among the first to begin business ventures in commercial oil prospecting in the United States, and who later became involved in banking and Bonanza wheat farming. They eventually became titans of the wheat industry, operating the largest corporate wheat farm in the Dakota Territory in the late 19th century.

Harris Charles Fahnestock was an American investment banker.