The economy of Eritrea has undergone extreme changes after the War of Independence. It experienced considerable growth in recent years, indicated by an improvement in gross domestic product in 2011 of 8.7 percent and in 2012 of 7.5% over 2011, and has a total of $8.090 billion as of 2020. However, worker remittances from abroad are estimated to account for 32 percent of gross domestic product.

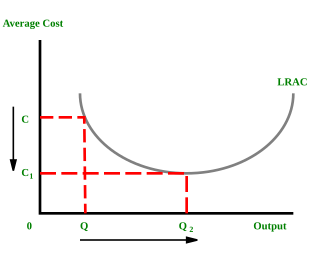

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables an increase in scale that is, increased production with lowered cost. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of market control.

The economy of Honduras is based mostly on agriculture, which accounts for 14% of its gross domestic product (GDP) in 2013. The country's leading export is coffee (US$340 million), which accounted for 22% of the total Honduran export revenues. Bananas, formerly the country's second-largest export until being virtually wiped out by 1998's Hurricane Mitch, recovered in 2000 to 57% of pre-Mitch levels. Cultivated shrimp is another important export sector. Since the late 1970s, towns in the north began industrial production through maquiladoras, especially in San Pedro Sula and Puerto Cortés.

The economy of Libya depends primarily on revenues from the petroleum sector, which represents over 95% of export earnings and 60% of GDP. These oil revenues and a small population have given Libya one of the highest nominal per capita GDP in Africa.

The economy of Nicaragua is focused primarily on the agricultural sector. Nicaragua itself is the least developed country in Central America, and the second poorest in the Americas by nominal GDP. In recent years, under the administrations of Daniel Ortega, the Nicaraguan economy has expanded somewhat, following the Great Recession, when the country's economy actually contracted by 1.5%, due to decreased export demand in the American and Central American markets, lower commodity prices for key agricultural exports, and low remittance growth. The economy saw 4.5% growth in 2010 thanks to a recovery in export demand and growth in its tourism industry. Nicaragua's economy continues to post growth, with preliminary indicators showing the Nicaraguan economy growing an additional 5% in 2011. Consumer Price inflation have also curtailed since 2008, when Nicaragua's inflation rate hovered at 19.82%. In 2009 and 2010, the country posted lower inflation rates, 3.68% and 5.45%, respectively. Remittances are a major source of income, equivalent to 15% of the country's GDP, which originate primarily from Costa Rica, the United States, and European Union member states. Approximately one million Nicaraguans contribute to the remittance sector of the economy.

The economy of Paraguay is a market economy that is highly dependent on agriculture products. In recent years, Paraguay's economy has grown as a result of increased agricultural exports, especially soybeans. Paraguay has the economic advantages of a young population and vast hydroelectric power. Its disadvantages include the few available mineral resources, and political instability. The government welcomes foreign investment.

The economy of Eswatini is fairly diversified. Agriculture, forestry and mining account for about 13 percent of Eswatini's GDP whereas manufacturing represent 37 percent of GDP. Services – with government services in the lead – constitute the other 50 percent of GDP.

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate of increase in the real and nominal gross domestic product (GDP).

Import substitution industrialization (ISI) is a trade and economic policy that advocates replacing foreign imports with domestic production. It is based on the premise that a country should attempt to reduce its foreign dependency through the local production of industrialized products. The term primarily refers to 20th-century development economics policies, but it has been advocated since the 18th century by economists such as Friedrich List and Alexander Hamilton.

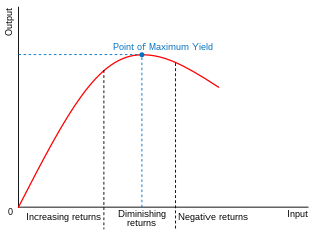

In economics, diminishing returns are the decrease in marginal (incremental) output of a production process as the amount of a single factor of production is incrementally increased, holding all other factors of production equal. The law of diminishing returns states that in productive processes, increasing a factor of production by one unit, while holding all other production factors constant, will at some point return a lower unit of output per incremental unit of input. The law of diminishing returns does not cause a decrease in overall production capabilities, rather it defines a point on a production curve whereby producing an additional unit of output will result in a loss and is known as negative returns. Under diminishing returns, output remains positive, but productivity and efficiency decrease.

Verdoorn's law is named after Dutch economist Petrus Johannes Verdoorn (1949). It states that in the long run productivity generally grows proportionally to the square root of output. In economics, this law pertains to the relationship between the growth of output and the growth of productivity. According to the law, faster growth in output increases productivity due to increasing returns. Verdoorn argued that "in the long run a change in the volume of production, say about 10 per cent, tends to be associated with an average increase in labor productivity of 4.5 per cent." The Verdoorn coefficient close to 0.5 (0.484) is also found in subsequent estimations of the law.

The Dual Sector model, or the Lewis model, is a model in developmental economics that explains the growth of a developing economy in terms of a labour transition between two sectors, the subsistence or traditional agricultural sector and the capitalist or modern industrial sector.

Industry is 39.4% of China's gross domestic product (GDP) in 2022. In 2007, industry contributed 46.7 percent of GDP in 2010 and occupied 27 percent of the workforce. In 2015, the manufacturing industrial sectors contributed to 40% of China's GDP. The manufacturing sector produced 44.1 percent of GDP in 2004 and accounted for 11.3 percent of total employment in 2006.

The United Kingdom, where the Industrial Revolution began in the late 18th century, has a long history of manufacturing, which contributed to Britain's early economic growth. During the second half of the 20th century, there was a steady decline in the importance of manufacturing and the economy of the United Kingdom shifted toward services. Manufacturing, however, remains important for overseas trade and accounted for 44% of goods exports in 2014. In June 2010, manufacturing in the United Kingdom accounted for 8.2% of the workforce and 12% of the country's national output. The East Midlands and West Midlands were the regions with the highest proportion of employees in manufacturing. London had the lowest at 2.8%.

Manufacturing is a vital economic sector in the United States of America. The United States is the world's second-largest manufacturer after the People's Republic of China with a record high real output in 2021 of $2.5 trillion.

The balanced growth theory is an economic theory pioneered by the economist Ragnar Nurkse (1907–1959). The theory hypothesises that the government of any underdeveloped country needs to make large investments in a number of industries simultaneously. This will enlarge the market size, increase productivity, and provide an incentive for the private sector to invest.

Unbalanced growth is a natural path of economic development. Situations that countries are in at any one point in time reflect their previous investment decisions and development. Accordingly, at any point in time desirable investment programs that are not balanced investment packages may still advance welfare. Unbalanced investment can complement or correct existing imbalances. Once such an investment is made, a new imbalance is likely to appear, requiring further compensating investments. Therefore, growth need not take place in a balanced way. Supporters of the unbalanced growth doctrine include Albert O. Hirschman, Hans Singer, Paul Streeten, Marcus Fleming, Prof. Rostov and J. Sheehan.

The Fei–Ranis model of economic growth is a dualism model in developmental economics or welfare economics that has been developed by John C. H. Fei and Gustav Ranis and can be understood as an extension of the Lewis model. It is also known as the Surplus Labor model. It recognizes the presence of a dual economy comprising both the modern and the primitive sector and takes the economic situation of unemployment and underemployment of resources into account, unlike many other growth models that consider underdeveloped countries to be homogenous in nature. According to this theory, the primitive sector consists of the existing agricultural sector in the economy, and the modern sector is the rapidly emerging but small industrial sector. Both the sectors co-exist in the economy, wherein lies the crux of the development problem. Development can be brought about only by a complete shift in the focal point of progress from the agricultural to the industrial economy, such that there is augmentation of industrial output. This is done by transfer of labor from the agricultural sector to the industrial one, showing that underdeveloped countries do not suffer from constraints of labor supply. At the same time, growth in the agricultural sector must not be negligible and its output should be sufficient to support the whole economy with food and raw materials. Like in the Harrod–Domar model, saving and investment become the driving forces when it comes to economic development of underdeveloped countries.

Transformation in economics refers to a long-term change in dominant economic activity in terms of prevailing relative engagement or employment of able individuals.

The economic de-industrialisation of India refers to a period of supposed reduction in industrial based activities within the Indian economy from 1757 to 1947.