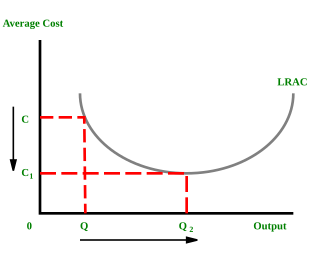

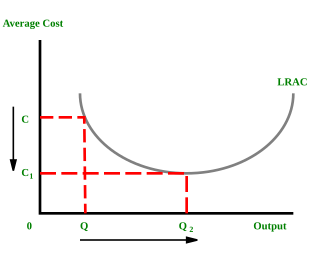

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, with cost per unit of output decreasing with increasing scale. At the basis of economies of scale there may be technical, statistical, organizational or related factors to the degree of market control.

Physical capital represents in economics one of the three primary factors of production. Physical capital is the apparatus used to produce a good and services. Physical capital represents the tangible man-made goods that help and support the production inventory, cash, equipment or real estate are all examples of physical capital

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input, and output levels that lead to the highest profit. Neoclassical economics, currently the mainstream approach to microeconomics, usually models the firm as maximizing profit.

The following outline is provided as an overview of and topical guide to industrial organization:

In economics, marginal cost is the change in the total cost that arises when the quantity produced is incremented by one unit; that is, it is the cost of producing one more unit of a good. Intuitively, marginal cost at each level of production includes the cost of any additional inputs required to produce the next unit. At each level of production and time period being considered, marginal costs include all costs that vary with the level of production, whereas other costs that do not vary with production are fixed and thus have no marginal cost. For example, the marginal cost of producing an automobile will generally include the costs of labor and parts needed for the additional automobile but not the fixed costs of the factory that have already been incurred. In practice, marginal analysis is segregated into short and long-run cases, so that, over the long run, all costs become marginal. Where there are economies of scale, prices set at marginal cost will fail to cover total costs, thus requiring a subsidy. Marginal cost pricing is not a matter of merely lowering the general level of prices with the aid of a subsidy; with or without subsidy it calls for a drastic restructuring of pricing practices, with opportunities for very substantial improvements in efficiency at critical points.

A production–possibility frontier (PPF), production possibility curve (PPC), or production possibility boundary (PPB), or Transformation curve/boundary/frontier is a curve which shows various combinations of the amounts of two goods which can be produced within the given resources and technology/a graphical representation showing all the possible options of output for two products that can be produced using all factors of production, where the given resources are fully and efficiently utilized per unit time. A PPF illustrates several economic concepts, such as allocative efficiency, economies of scale, opportunity cost, productive efficiency, and scarcity of resources.

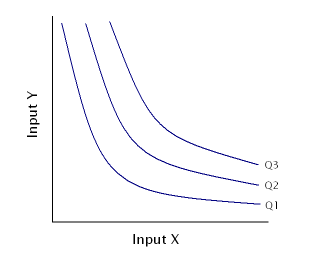

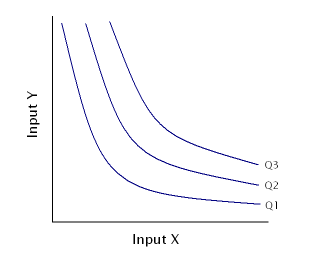

In economics, a production function gives the technological relation between quantities of physical inputs and quantities of output of goods. The production function is one of the key concepts of mainstream neoclassical theories, used to define marginal product and to distinguish allocative efficiency, a key focus of economics. One important purpose of the production function is to address allocative efficiency in the use of factor inputs in production and the resulting distribution of income to those factors, while abstracting away from the technological problems of achieving technical efficiency, as an engineer or professional manager might understand it.

In economics, average cost or unit cost is equal to total cost (TC) divided by the number of units of a good produced :

In economics and in particular neoclassical economics, the marginal product or marginal physical productivity of an input is the change in output resulting from employing one more unit of a particular input, assuming that the quantities of other inputs are kept constant.

In economics, diminishing returns is the decrease in the marginal (incremental) output a production process as the amount of a single factor of production is incrementally increased, while the amounts of all other factors of production stay constant.

An isoquant, in microeconomics, is a contour line drawn through the set of points at which the same quantity of output is produced while changing the quantities of two or more inputs. While an indifference curve mapping helps to solve the utility-maximizing problem of consumers, the isoquant mapping deals with the cost-minimization problem of producers. Isoquants are typically drawn along with isocost curves in capital-labor graphs, showing the technological tradeoff between capital and labor in the production function, and the decreasing marginal returns of both inputs. Adding one input while holding the other constant eventually leads to decreasing marginal output, and this is reflected in the shape of the isoquant. A family of isoquants can be represented by an isoquant map, a graph combining a number of isoquants, each representing a different quantity of output. Isoquants are also called equal product curves.

In economics, returns to scale describe what happens to long run returns as the scale of production increases, when all input levels including physical capital usage are variable. The concept of returns to scale arises in the context of a firm's production function. It explains the long run linkage of the rate of increase in output (production) relative to associated increases in the inputs. In the long run, all factors of production are variable and subject to change in response to a given increase in production scale. While economies of scale show the effect of an increased output level on unit costs, returns to scale focus only on the relation between input and output quantities.

In the theory of dynamical systems and control theory, a linear time-invariant system is marginally stable if it is neither asymptotically stable nor unstable. Roughly speaking, a system is stable if it always returns to and stays near a particular state, and is unstable if it goes farther and farther away from any state, without being bounded. A marginal system, sometimes referred to as having neutral stability, is between these two types: when displaced, it does not return to near a common steady state, nor does it go away from where it started without limit.

In economics, a cost curve is a graph of the costs of production as a function of total quantity produced. In a free market economy, productively efficient firms optimize their production process by minimizing cost consistent with each possible level of production, and the result is a cost curve. Profit-maximizing firms use cost curves to decide output quantities. There are various types of cost curves, all related to each other, including total and average cost curves; marginal cost curves, which are equal to the differential of the total cost curves; and variable cost curves. Some are applicable to the short run, others to the long run.

In economics, total cost (TC) is the cost function that produces the minimum amount of costs associated with producing a vector of outputs (y=y1...yn). This happens when the firm also faces a set of exogenous input prices. is the total economic cost of production and is made up of variable cost, which varies according to the quantity of a good produced and includes inputs such as labor and raw materials, plus fixed cost, which is independent of the quantity of a good produced and includes inputs that cannot be varied in the short term: fixed costs such as buildings and machinery, including sunk costs if any.

In economics the long run is a theoretical concept in which all markets are in equilibrium, and all prices and quantities have fully adjusted and are in equilibrium. The long run contrasts with the short run, in which there are some constraints and markets are not fully in equilibrium.

In economics, supply is the amount of a resource that firms, producers, labourers, providers of financial assets, or other economic agents are willing and able to provide to the marketplace or directly to another agent in the marketplace. Supply can be in currency, time, raw materials, or any other scarce or valuable object that can be provided to another agent. This is often fairly abstract. For example in the case of time, supply is not transferred to one agent from another, but one agent may offer some other resource in exchange for the first spending time doing something. Supply is often plotted graphically as a supply curve, with the quantity provided plotted horizontally and the price plotted vertically.

In economics, the marginal product of capital (MPK) is the additional production that a firm experiences when it adds an extra unit of capital. It is a feature of the production function, alongside the labour input.

The marginal efficiency of capital (MEC) is that rate of discount which would equate the price of a fixed capital asset with its present discounted value of expected income.

In economics, the marginal product of labor (MPL) is the change in output that results from employing an added unit of labor. It is a feature of the production function, and depends on the amounts of physical capital and labor already in use.