A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to collectively fund government spending, public expenditures, or as a way to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation took place in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent.

Marketing is the process of identifying customers and "creating, communicating, delivering, and exchanging" goods and services for the satisfaction and retention of those customers. It is one of the primary components of business management and commerce.

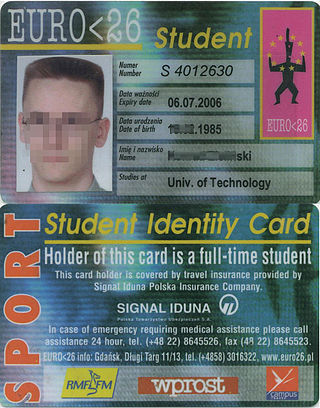

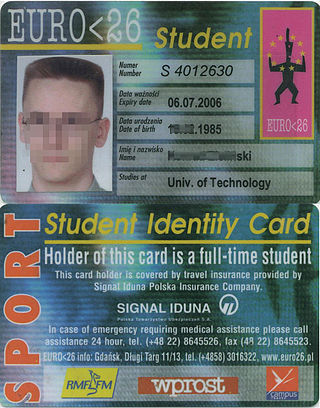

Price discrimination is a microeconomic pricing strategy where identical or largely similar goods or services are sold at different prices by the same provider in different market segments. Price discrimination is distinguished from product differentiation by the more substantial difference in production cost for the differently priced products involved in the latter strategy. Price differentiation essentially relies on the variation in the customers' willingness to pay and in the elasticity of their demand. For price discrimination to succeed, a firm must have market power, such as a dominant market share, product uniqueness, sole pricing power, etc. All prices under price discrimination are higher than the equilibrium price in a perfectly competitive market. However, some prices under price discrimination may be lower than the price charged by a single-price monopolist. Price discrimination is utilised by the monopolist to recapture some deadweight loss. This Pricing strategy enables firms to capture additional consumer surplus and maximize their profits while benefiting some consumers at lower prices. Price discrimination can take many forms and is prevalent in many industries, from education and telecommunications to healthcare.

In finance, a loan is the transfer of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money.

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, revenue is a subsection of the Equity section of the balance statement, since it increases equity. It is often referred to as the "top line" due to its position at the very top of the income statement. This is to be contrasted with the "bottom line" which denotes net income.

The subscription business model is a business model in which a customer must pay a recurring price at regular intervals for access to a product or service. The model was pioneered by publishers of books and periodicals in the 17th century, and is now used by many businesses, websites and even pharmaceutical companies in partnership with the government.

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on:

- The efficient allocation of available resources;

- The distribution of income among citizens; and

- The stability of the economy.

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited.

In financial accounting, a cash flow statement, also known as statement of cash flows, is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 is the International Accounting Standard that deals with cash flow statements.

Variable costs are costs that change as the quantity of the good or service that a business produces changes. Variable costs are the sum of marginal costs over all units produced. They can also be considered normal costs. Fixed costs and variable costs make up the two components of total cost. Direct costs are costs that can easily be associated with a particular cost object. However, not all variable costs are direct costs. For example, variable manufacturing overhead costs are variable costs that are indirect costs, not direct costs. Variable costs are sometimes called unit-level costs as they vary with the number of units produced.

Credit is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately, but promises either to repay or return those resources at a later date. The resources provided by the first party can be either property, fulfillment of promises, or performances. In other words, credit is a method of making reciprocity formal, legally enforceable, and extensible to a large group of unrelated people.

Pay to surf (PTS) is an online business model which gained popularity in the late 1990’s and experienced a significant decline following the dot-com crash. PTS companies advertised their main advantage as sharing the advertising revenue with their user base in a form of rewards for watching promotional content over the web. In order to participate, users would need to install software that tracked their browsing activities and displayed targeted advertisements. Ultimately, users receive financial compensation for their time spent browsing the web.

A matrix scheme is a business model involving the exchange of money for a certain product with a side bonus of being added to a waiting list for a product of greater value than the amount given. Matrix schemes are also sometimes considered similar to Ponzi or pyramid schemes. They have been called "unsustainable" by the United Kingdom's Office of Fair Trading. A matrix scheme is also an example of an 'exploding queue' in queueing theory.

Section 61 of the Internal Revenue Code defines "gross income," the starting point for determining which items of income are taxable for federal income tax purposes in the United States. Section 61 states that "[e]xcept as otherwise provided in this subtitle, gross income means all income from whatever source derived [. .. ]". The United States Supreme Court has interpreted this to mean that Congress intended to express its full power to tax incomes to the extent that such taxation is permitted under Article I, Section 8, Clause 1 of the Constitution of the United States and under the Constitution's Sixteenth Amendment.

A structured settlement factoring transaction means a transfer of structured settlement payment rights made for consideration by means of sale, assignment, pledge, or other form of encumbrance or alienation for consideration. In order for such transfer to be approved, the transfer must comply with Internal Revenue Code section 5891 and any applicable state structured settlement protection law.

In bookkeeping, accounting, and financial accounting, net sales are operating revenues earned by a company for selling its products or rendering its services. Also referred to as revenue, they are reported directly on the income statement as Sales or Net sales.

A revenue stream is a source of revenue of a company, other organization, or regional or national economy.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

A revenue model is a framework for generating financial income. It identifies which revenue source to pursue, what value to offer, how to price the value, and who pays for the value. It is a key component of a company's business model. It primarily identifies what product or service will be created in order to generate revenues and the ways in which the product or service will be sold.

In any technical subject, words commonly used in everyday life acquire very specific technical meanings, and confusion can arise when someone is uncertain of the intended meaning of a word. This article explains the differences in meaning between some technical terms used in economics and the corresponding terms in everyday usage.