The Department of the Treasury (USDT) is an executive department and the treasury of the United States federal government. Established by an Act of Congress in 1789 to manage government revenue, the Treasury prints all paper currency and mints all coins in circulation through the Bureau of Engraving and Printing and the United States Mint, respectively; collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy.

Banking in the United States began in the late 1790s along with the country's founding and has developed into highly influential and complex system of banking and financial services. Anchored by New York City and Wall Street, it is centered on various financial services namely private banking, asset management, and deposit security.

Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the integrity of the financial system. This may be handled by either a government or non-government organization. Financial regulation has also influenced the structure of banking sectors by increasing the variety of financial products available. Financial regulation forms one of three legal categories which constitutes the content of financial law, the other two being market practices, case law.

A comptroller is a management-level position responsible for supervising the quality of accounting and financial reporting of an organization. A financial comptroller is a senior-level executive who acts as the head of accounting, and oversees the preparation of financial reports, such as balance sheets and income statements.

The Office of the Comptroller of the Currency (OCC) is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863 and serves to charter, regulate, and supervise all national banks and thrift institutions and the federally licensed branches and agencies of foreign banks in the United States. The Comptroller of the Currency is Joseph Otting.

Community development bank (CDB) or Community Development Financial Institution (CDFI) is a development bank or credit union that focus on to serving people who have been locked out of the traditional financial systems such as the unbanked or underbanked in deprived local communities. They emphasis the long term development of communities and provide loans such as micro-finance or venture capital.

The Office of Thrift Supervision (OTS) was a United States federal agency under the Department of the Treasury that chartered, supervised, and regulated all federally chartered and state-chartered savings banks and savings and loans associations. It was created in 1989 as a renamed version of another federal agency. Like other U.S. federal bank regulators, it was paid by the banks it regulated. The OTS was initially seen as an aggressive regulator, but was later lax. Declining revenues and staff led the OTS to market itself to companies as a lax regulator in order to get revenue.

Federal savings associations, in the United States, are institutions chartered by the Office of Thrift Supervision which is now administered by Office of the Comptroller of the Currency after the agencies merged. Institutions chartered by the OTS are still regulated according to the rules and regulations of Federal Savings Banks. Mortgages issued by Federal Savings Banks are pursuant to the provisions of the Home Owners' Loan Act, a U.S. federal statute. Although the activities of federal thrifts were once confined primarily to taking deposits from consumers and making residential mortgage loans, federal thrifts are now authorized to offer a wide range of financial products and services.

The Federal Reserve Bank of St. Louis is one of 12 regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the United States' central bank. Missouri is the only state to have two main branches of Federal Reserve Banks.. Located in downtown St. Louis, the St. Louis Fed is the headquarters of the Eighth Federal Reserve District, which includes the state of Arkansas and portions of Illinois, Indiana, Kentucky, Mississippi, the eastern half of Missouri and West Tennessee. It has branches in Little Rock, Louisville and Memphis. Its building, at 411 Locust Street, was designed by St. Louis firm Mauran, Russell & Crowell in 1924. The Eighth District serves as a center for local, national and global economic research, and provides the following services: supervisory and regulatory services to state-member banks and bank holding companies; cash and coin-handling for the District and beyond; economic education; and community development resources.

John C. Dugan was the 29th Comptroller of the Currency for the United States Department of the Treasury, sworn in August 2005. He completed his term on August 14, 2010. Dugan was born in Washington, D.C. He currently serves as chairman of Citigroup.

The Federal Financial Institutions Examination Council (FFIEC) is a formal U.S. government interagency body composed of five banking regulators that is "empowered to prescribe uniform principles, standards, and report forms to promote uniformity in the supervision of financial institutions". It also oversees real estate appraisal in the United States. Its regulations are contained in title 12 of the Code of Federal Regulations.

The Senate Banking Subcommittee on Financial Institutions is one of five subcommittees within the Senate Committee on Banking, Housing, and Urban Affairs.

The Freedman's Saving and Trust Company, popularly known as the Freedman's Savings Bank, was a private corporation chartered by the U.S. government to encourage and guide the economic development of the newly emancipated African-American communities in the post-Civil War period. Although functioning only between 1865 and 1874, the company achieved notable successes as a leading financial institution of African-Americans. However, its failure was devastating to the newly emancipated black community. Its archives are valuable as an exhaustive collection of information regarding the African American community and its socio-economic life in the immediate aftermath of emancipation.

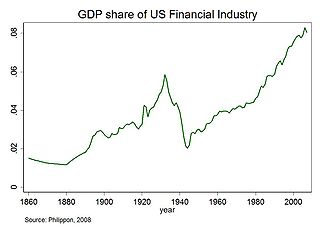

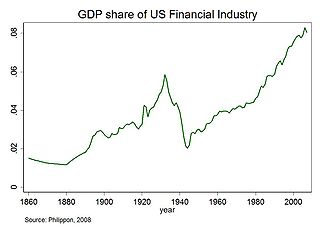

Financialization is a term sometimes used to describe the development of financial capitalism during the period from 1980 until 2010, in which debt-to-equity ratios increased and financial services accounted for an increasing share of national income relative to other sectors.

The Consumer Bankers Association (CBA) is a U.S. trade organization representing financial institutions offering retail lending products and services. It was originally founded in 1919 as the National Morris Plan Bankers Association and changed its name to the Consumer Bankers Association in 1947.

The financial position of the United States includes assets of at least $269.6 trillion and debts of $145.8 trillion to produce a net worth of at least $123.8 trillion as of Q1 2014.

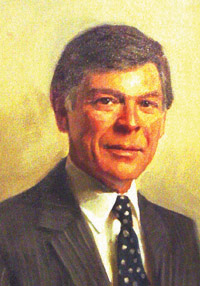

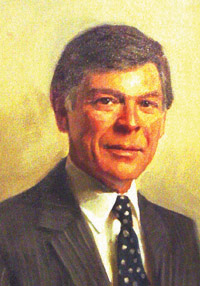

John G. Heimann was Comptroller of the Currency from 1977 to 1981 having been appointed by President Jimmy Carter and confirmed by the Senate.

Charles Edwin Lord II also known as Charles E. Lord. was an investment banker and appointed Vice-Chairman of the Export-Import Bank of the United States of the United States by President Reagan. He also worked in the Office of the Comptroller of the Currency for the United States government, and became the acting Comptroller in 1981. After leaving the Office of the Comptroller Charles worked in the private sector becoming chairman and chief executive of the Prudential Bank and Trust Company. Concurrently he was a senior adviser with Dillon Read & Company. Later he was Vice Chairman of the Madison Financial Group. He had been a principal of Lord & Associates beginning in 1989.

Joseph M. Otting is an American businessman and government official. He was sworn in as the 31st Comptroller of the Currency on November 27, 2017.

Keith A. Noreika is an American lawyer who specializes in the regulation of financial institutions. He served as Acting Comptroller of the Currency from May 5, 2017, to November 27, 2017, following the 30th Comptroller of the Currency, Thomas J. Curry, and preceding the 31st Comptroller of the Currency, Joseph Otting. Mr. Noreika rejoined the law firm of Simpson Thacher on January 8, 2018.