Related Research Articles

A pension is a fund into which amounts are paid regularly during the individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be:

A pension fund, also known as a superannuation fund in some countries, is any program, fund, or scheme which provides retirement income.

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed, as opposed to social assistance programs which provide support on the basis of need alone. The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury.

Employee benefits and benefits in kind include various types of non-wage compensation provided to employees in addition to their normal wages or salaries. Instances where an employee exchanges (cash) wages for some other form of benefit is generally referred to as a "salary packaging" or "salary exchange" arrangement. In most countries, most kinds of employee benefits are taxable to at least some degree. Examples of these benefits include: housing furnished or not, with or without free utilities; group insurance ; disability income protection; retirement benefits; daycare; tuition reimbursement; sick leave; vacation ; social security; profit sharing; employer student loan contributions; conveyancing; long service leave; domestic help (servants); and other specialized benefits.

The State Pension is part of the United Kingdom Government's pension arrangements. Benefits vary depending on the age of the individual and their contribution record. Anyone can make a claim, provided they have a minimum number of qualifying years of contributions.

The Employees' Provident Fund Organisation (EPFO) is one of the two main social security organization under the Government of India's Ministry of Labour and Employment and is responsible for regulation and management of provident funds in India, the other being Employees' State Insurance. The EPFO administers the mandatory provident fund, a basic pension scheme and a disability/death insurance scheme. It also manages social security agreements with other countries. International workers are covered under EPFO plans in countries where bilateral agreements have been signed. As of May 2021, 19 such agreements are in place. The EPFO's top decision-making body is the Central Board of Trustees (CBT), a statutory body established by the Employees' Provident Fund and Miscellaneous Provisions (EPF&MP) Act, 1952. As of 2018, more than ₹11 lakh crore are under EPFO management.

Pensions in the United States consist of the Social Security system, public employees retirement systems, as well as various private pension plans offered by employers, insurance companies, and unions.

Kav La'Oved is an Israeli non-profit association, founded in 1991. Its objective is to protect the rights of disadvantaged workers. It provides information, advice, and legal representation for the most deprived workers in Israel – migrant workers, Palestinian workers and Israeli low-wage earners.

Social security in India includes a variety of statutory insurances and social grant schemes bundled into a formerly complex and fragmented system run by the Indian government at the federal and the state level. The Directive Principles of State Policy, enshrined in Part IV of the Indian Constitution reflects that India is a welfare state. Food security to all Indians are guaranteed under the National Food Security Act, 2013 where the government provides highly subsidised food grains or a food security allowance to economically vulnerable people. The system has since been universalised with the passing of The Code on Social Security, 2020. These cover most of the Indian population with social protection in various situations in their lives.

The International Social Security Association (ISSA) is an international organization bringing together national social security administrations and agencies. Founded in 1927, the ISSA has more than 330 member organizations in 158 countries. It has its headquarters in Geneva, Switzerland, in the International Labour Office (ILO).

Social security is divided by the French government into five branches: illness; old age/retirement; family; work accident; and occupational disease. From an institutional point of view, French social security is made up of diverse organismes. The system is divided into three main Regimes: the General Regime, the Farm Regime, and the Self-employed Regime. In addition there are numerous special regimes dating from prior to the creation of the state system in the mid-to-late 1940s.

Welfare in France includes all systems whose purpose is to protect people against the financial consequences of social risks.

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.

The Japanese National Pension is a pension system that all registered residents of Japan, both Japanese and foreign, are required to enroll in. Since January 1, 2010, it has been managed by the Japan Pension Service.

A social pension is a stream of payments from state to an individual that starts when someone retires and continues in payment until death. It is a part of a pension system of most developed countries, specifically the so-called zero or first pillar of the pension system, which is a part of state social security system. The social pension is different from other types of pension since its eligibility criteria do not require former contributions of an individual, but citizenship or residency and age or other criteria set by government.

Luxembourg has an extensive welfare system. It comprises a social security, health, and pension funds. The labour market is highly regulated, and Luxembourg is a corporatist welfare state. Enrollment is mandatory in one of the welfare schemes for any employed person. Luxembourg's social security system is the Centre Commun de la Securite Sociale (CCSS). Both employees and employers make contributions to the fund at a rate of 25% of total salary, which cannot eclipse more than five times the minimum wage. Social spending accounts for 21.8% of GDP.

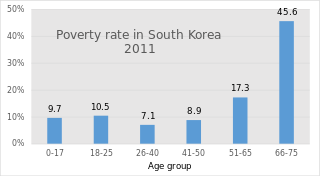

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.

Pensions in Denmark consist of both private and public programs, all managed by the Agency for the Modernisation of Public Administration under the Ministry of Finance. Denmark created a multipillar system, consisting of an unfunded social pension scheme, occupational pensions, and voluntary personal pension plans. Denmark's system is a close resemblance to that encouraged by the World Bank in 1994, emphasizing the international importance of establishing multifaceted pension systems based on public old-age benefit plans to cover the basic needs of the elderly. The Danish system employed a flat-rate benefit funded by the government budget and available to all Danish residents. The employment-based contribution plans are negotiated between employers and employees at the individual firm or profession level, and cover individuals by labor market systems. These plans have emerged as a result of the centralized wage agreements and company policies guaranteeing minimum rates of interest. The last pillar of the Danish pension system is income derived from tax-subsidized personal pension plans, established with life insurance companies and banks. Personal pensions are inspired by tax considerations, desirable to people not covered by the occupational scheme.

Carson and Others v. The United Kingdom [2008] ECHR 1194 was heard by the European Court of Human Rights (ECHR), Fourth Section in Strasbourg on 4 November 2008 appeal from the Appellate Committee of the House of Lords before Lech Garlicki (President); Nicolas Bratza; Giovanni Bonello; Ljiljana Mijović; David Thór Björgvinsson; Ledi Bianku; Mihai Poalelungi.

Carson and Others v. The United Kingdom [2010] ECHR 338 was heard by the European Court of Human Rights (ECHR), in Strasbourg on 16 March 2010 on appeal from the European Court of Rights (ECHR), Fourth Section before Jean-Paul Costa (President), Christos Rozakis, Nicolas Bratza, Peer Lorenzen, Françoise Tulkens, Josep Casadevall, Karel Jungwiert, Nina Vajić, Dean Spielmann, Renate Jaeger, Danutė Jočienė, Ineta Ziemele, Isabelle Berro-Lefèvre, Päivi Hirvelä, Luis López Guerra, Mirjana Lazarova Trajkovska, Zdravka Kalaydjieva.

References

- ↑

- Cruz, Armando (2004). "Portability of benefits rights in response to external and internal labor mobility: the Philippine experience". Paper presented at the International Social Security Association (ISSA), Thirteenth Regional Conference for Asia and the Pacific in Kuwait, March 8–10. Available at http://www.issa.int/pdf/kuwait04/2cruz.pdf.

- ↑ Holzmann, Robert, Johannes Koettl, and Taras Chernetsky (2005). "Portability regimes of pension and health care benefits for international migrants: an analysis of issues and good practices". Social Protection Discussion Paper 0519. Washington, DC: World Bank. Available at http://siteresources.worldbank.org/SOCIALPROTECTION/Resources/SP-Discussion-papers/Pensions-DP/0519.pdf.

- ↑ Avato, J., J. Koettl and R. Sabates-Wheeler. 2010. Social Security Regimes, Global Estimates, and Good Practices: The Status of Social Protection for International Migrants, World Development Vol 38, No. 4: 455-466.