Chapter 7 of the Title 11 of the United States Code governs the process of liquidation under the bankruptcy laws of the United States. Chapter 7 is the most common form of bankruptcy in the United States.

The Freedom of Information Act (FOIA), 5 U.S.C. § 552, is a federal freedom of information law that requires the full or partial disclosure of previously unreleased information and documents controlled by the United States government upon request. The Act defines agency records subject to disclosure, outlines mandatory disclosure procedures, and defines nine exemptions to the statute. President Lyndon B. Johnson, despite his misgivings, signed the Freedom of Information Act into law on July 4, 1966, and it went into effect the following year.

The Clean Water Act (CWA) is the primary federal law in the United States governing water pollution. Its objective is to restore and maintain the chemical, physical, and biological integrity of the nation's waters; recognizing the responsibilities of the states in addressing pollution and providing assistance to states to do so, including funding for publicly owned treatment works for the improvement of wastewater treatment; and maintaining the integrity of wetlands. It is one of the United States' first and most influential modern environmental laws. As with many other major U.S. federal environmental statutes, it is administered by the U.S. Environmental Protection Agency (EPA), in coordination with state governments. Its implementing regulations are codified at 40 C.F.R. Subchapters D, N, and O.

Tax exemption is a monetary exemption which reduces taxable income. Tax exempt status can provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

In the United States, bankruptcy is governed by federal law, commonly referred to as the "Bankruptcy Code" ("Code"). The United States Constitution authorizes Congress to enact "uniform Laws on the subject of Bankruptcies throughout the United States". Congress has exercised this authority several times since 1801, including through adoption of the Bankruptcy Reform Act of 1978, as amended, codified in Title 11 of the United States Code and the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. Its implementing agency is the Internal Revenue Service.

A 501(c) organization is a nonprofit organization in the federal law of the United States according to 26 U.S.C. § 501 and is one of 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for attaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

Title 28 is the portion of the United States Code that governs the federal judicial system.

A controlled substance is generally a drug or chemical whose manufacture, possession, or use is regulated by a government, such as illicitly used drugs or prescription medications that are designated by law. Some treaties, notably the Single Convention on Narcotic Drugs, the Convention on Psychotropic Substances, and the United Nations Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances provide internationally agreed upon "schedules" of controlled substances, which have been incorporated into national laws, however national laws usually significantly expand on these international convention.

Income taxes in the United States are imposed by the federal, most state, and many local governments. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels.

Title 18 of the United States Code is the main criminal code of the federal government of the United States. The Title deals with federal crimes and criminal procedure. In its coverage, Title 18 is similar to most U.S. state criminal codes, which typically are referred to by such names as Penal Code, Criminal Code, or Crimes Code. Typical of state criminal codes is the California Penal Code. Many U.S. state criminal codes, unlike the federal Title 18, are based on the Model Penal Code promulgated by the American Law Institute.

Title 4 of the United States Code outlines the role of flag of the United States, Great Seal of the United States, Washington, DC, and the states in the United States Code.

Title 44 of the United States Code outlines the role of public printing and documents in the United States Code.

The business and occupation tax is a type of tax levied by the U.S. states of Washington, West Virginia, and, as of 2010, Ohio, and by municipal governments in West Virginia and Kentucky.

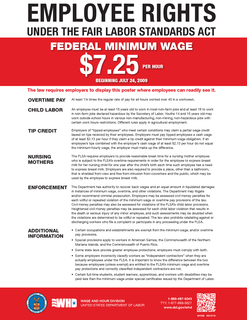

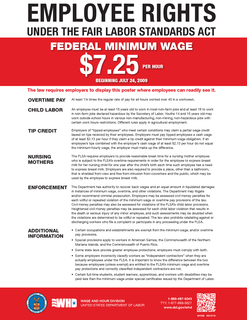

The Fair Labor Standards Act of 1938 29 U.S.C. § 203 (FLSA) is a United States labor law that creates the right to a minimum wage, and "time-and-a-half" overtime pay when people work over forty hours a week. It also prohibits most employment of minors in "oppressive child labor". It applies to employees engaged in interstate commerce or employed by an enterprise engaged in commerce or in the production of goods for commerce, unless the employer can claim an exemption from coverage.

Regan v. Taxation with Representation of Washington, 461 U.S. 540 (1983), was a case before the United States Supreme Court.

The International Organizations Immunities Act is a United States federal law enacted in 1945. It "established a special group of foreign or international organizations whose members could work in the U.S. and enjoy certain exemptions from US taxes and search and seizure laws". These advantages are usually given to diplomatic bodies.

Title 51 of the United States Code, entitled National and Commercial Space Programs, is the compilation of the general laws regarding space programs. It was promulgated by U.S. President Barack Obama on December 18, 2010 when he signed PL 111-314 into law.

Travel Act or International Travel Act of 1961, 18 U.S.C. § 1952, is a Federal criminal statute which forbids the use of the U.S. mail, or interstate or foreign travel, for the purpose of engaging in certain specified criminal acts.

Bankruptcy in Florida is made under title 11 of the United States Code, which is referred to as the Bankruptcy Code. Although bankruptcy is a federal procedure, in certain regards, it looks to state law, such as to exemptions and to define property rights. The Bankruptcy Code provides that each state has the choice whether to "opt in" and use the federal exemptions or to "opt out" and to apply the state law exemptions. Florida is an "opt out" state in regard to exemptions. Bankruptcy in the United States is provided for under federal law as provided in the United States Constitution. Under the federal constitution, there are no state bankruptcy courts. The bankruptcy laws are primarily contained in 11 U.S.C. 101, et seq. The Bankruptcy Code underwent a substantial amendment in 2005 with the "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005", often referred to as "BAPCPA". The Bankruptcy Code provides for a set of federal bankruptcy exemptions, but each states is allowed is choose whether it will "opt in" or "opt out" of the federal exemptions. In the event that a state opts out of the federal exemptions, the exemptions are provided for the particular exemption laws of the state with the application with certain federal exemptions.