In probability theory, the expected value is a generalization of the weighted average. Informally, the expected value is the mean of the possible values a random variable can take, weighted by the probability of those outcomes. Since it is obtained through arithmetic, the expected value sometimes may not even be included in the sample data set; it is not the value you would "expect" to get in reality.

Roulette is a casino game which was likely developed from the Italian game Biribi. In the game, a player may choose to place a bet on a single number, various groupings of numbers, the color red or black, whether the number is odd or even, or if the number is high or low.

The Pareto distribution, named after the Italian civil engineer, economist, and sociologist Vilfredo Pareto, is a power-law probability distribution that is used in description of social, quality control, scientific, geophysical, actuarial, and many other types of observable phenomena; the principle originally applied to describing the distribution of wealth in a society, fitting the trend that a large portion of wealth is held by a small fraction of the population. The Pareto principle or "80-20 rule" stating that 80% of outcomes are due to 20% of causes was named in honour of Pareto, but the concepts are distinct, and only Pareto distributions with shape value of log45 ≈ 1.16 precisely reflect it. Empirical observation has shown that this 80-20 distribution fits a wide range of cases, including natural phenomena and human activities.

Fixed-odds betting is a form of gambling where individuals place bets on the outcome of an event, such as sports matches or horse races, at predetermined odds. In fixed-odds betting, the odds are fixed and determined at the time of placing the bet. These odds reflect the likelihood of a particular outcome occurring. If the bettor's prediction is correct, they receive a payout based on the fixed odds. This means that the potential winnings are known at the time of placing the bet, regardless of any changes in the odds leading up to the event.

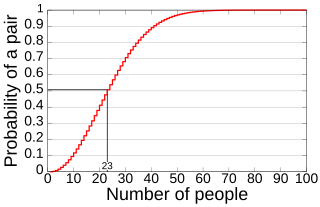

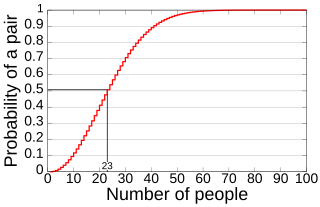

In probability theory, the birthday problem asks for the probability that, in a set of n randomly chosen people, at least two will share a birthday. The birthday paradox refers to the counterintuitive fact that only 23 people are needed for that probability to exceed 50%.

In probability theory, odds provide a measure of the probability of a particular outcome. Odds are commonly used in gambling and statistics. For example for an event that is 40% probable, one could say that the odds are "2 in 5","2 to 3 in favor", or "3 to 2 against".

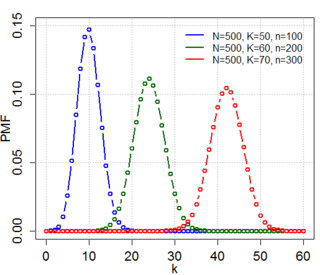

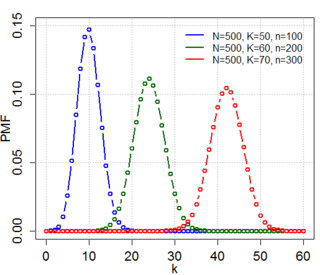

In probability theory and statistics, the hypergeometric distribution is a discrete probability distribution that describes the probability of successes in draws, without replacement, from a finite population of size that contains exactly objects with that feature, wherein each draw is either a success or a failure. In contrast, the binomial distribution describes the probability of successes in draws with replacement.

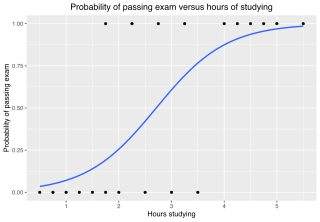

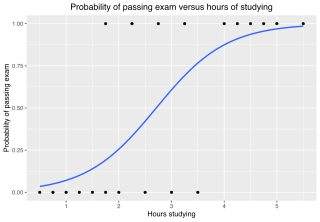

In statistics, the logistic model is a statistical model that models the log-odds of an event as a linear combination of one or more independent variables. In regression analysis, logistic regression estimates the parameters of a logistic model. In binary logistic regression there is a single binary dependent variable, coded by an indicator variable, where the two values are labeled "0" and "1", while the independent variables can each be a binary variable or a continuous variable. The corresponding probability of the value labeled "1" can vary between 0 and 1, hence the labeling; the function that converts log-odds to probability is the logistic function, hence the name. The unit of measurement for the log-odds scale is called a logit, from logistic unit, hence the alternative names. See § Background and § Definition for formal mathematics, and § Example for a worked example.

A martingale is a class of betting strategies that originated from and were popular in 18th-century France. The simplest of these strategies was designed for a game in which the gambler wins the stake if a coin comes up heads and loses if it comes up tails. The strategy had the gambler double the bet after every loss, so that the first win would recover all previous losses plus win a profit equal to the original stake. Thus the strategy is an instantiation of the St. Petersburg paradox.

In statistics, gambler's ruin is the fact that a gambler playing a game with negative expected value will eventually go bankrupt, regardless of their betting system.

The St. Petersburg paradox or St. Petersburg lottery is a paradox involving the game of flipping a coin where the expected payoff of the lottery game is infinite but nevertheless seems to be worth only a very small amount to the participants. The St. Petersburg paradox is a situation where a naïve decision criterion that takes only the expected value into account predicts a course of action that presumably no actual person would be willing to take. Several resolutions to the paradox have been proposed, including the impossible amount of money a casino would need to continue the game indefinitely.

Vigorish is the fee charged by a bookmaker for accepting a gambler's wager. In American English, it can also refer to the interest owed a loanshark in consideration for credit. The term came to English usage via Yiddish slang which was itself a loanword from Russian.

In decision theory, economics, and probability theory, the Dutch book arguments are a set of results showing that agents must satisfy the axioms of rational choice to avoid a kind of self-contradiction called a Dutch book. A Dutch book or money pump is a set of bets that ensures a guaranteed loss, i.e. the gambler will lose money no matter what happens. A set of beliefs and preferences is called coherent if it cannot result in a Dutch book.

Fan-Tan, or fantan is a gambling game long played in China. It is a game of pure chance.

The two envelopes problem, also known as the exchange paradox, is a paradox in probability theory. It is of special interest in decision theory and for the Bayesian interpretation of probability theory. It is a variant of an older problem known as the necktie paradox. The problem is typically introduced by formulating a hypothetical challenge like the following example:

Imagine you are given two identical envelopes, each containing money. One contains twice as much as the other. You may pick one envelope and keep the money it contains. Having chosen an envelope at will, but before inspecting it, you are given the chance to switch envelopes. Should you switch?

In probability theory, the Kelly criterion is a formula for sizing a sequence of bets by maximizing the long-term expected value of the logarithm of wealth, which is equivalent to maximizing the long-term expected geometric growth rate. John Larry Kelly Jr., a researcher at Bell Labs, described the criterion in 1956.

A parlay, accumulator, combo bet, or multi is a single bet that links together two or more individual wagers, usually seen in sports betting. Winning the parlay is dependent on all of those wagers winning together. If any of the bets in the parlay lose, the entire parlay loses. If any of the plays in the parlay ties, or "pushes", the parlay reverts to a lower number of wagers with the payout odds reducing accordingly. Parlay bets are high-risk, high-reward; linking the possibilities drastically reduces the chance of the bet paying off overall. The benefit of the parlay is that there are much higher pay-offs, although as usual, casinos and bookkeepers offering parlays often exploit the poor calculation of gamblers by not increasing the pay-out as much as the odds truly demand, with the effect of the house edge increasing in parlays.

In gambling, Dutching is sharing the risk of losing across a number of runners by backing more than one selection in a race or event. One needs to calculate the correct stake to place on each selection so that the return is the same if any of them wins. Although not foolproof, because handicapping is still involved, there have been successful bettors throughout history who have applied this system. This is not to be confused with what constitutes a Dutch book which is when a bookmaker goes overbroke.

The mathematics of gambling is a collection of probability applications encountered in games of chance and can get included in game theory. From a mathematical point of view, the games of chance are experiments generating various types of aleatory events, and it is possible to calculate by using the properties of probability on a finite space of possibilities.

Ergodicity economics is a research programme aimed at reworking the theoretical foundations of economics around the concept of ergodicity. The programme's main goal is to understand how traditional economic theory, framed in terms of the expectation values, changes when replacing expectation value with time averages. In particular, the programme is interested in understanding the effect of non-ergodic processes in economics, that is processes where the expectation value of an observable does not equal its time average.