In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster.

An economic depression is a period of carried long-term economical downturn that is result of lowered economic activity in one major or more national economies. Economic depression maybe related to one specific country were there is some economic crisis that has worsened but most often reflexes historically the American Great Depression and similar economic status that may be recognized as existing at some country, several countries or even in many countries. It is often understood in economics that economic crisis and the following recession that maybe named economic depression are part of economic cycles where slowdown of economy follows the economic growth and vice versa. It is a result of more severe economic problems or a downturn than the recession itself, which is a slowdown in economic activity over the course of the normal business cycle of growing economy.

Nouriel Roubini is a Turkish-born Iranian-American economist. He is Professor Emeritus (2021–present) and was Professor of Economics (1995–2021) at the Stern School of Business, New York University, and also chairman of Roubini Macro Associates LLC, an economic consultancy firm.

The Japanese asset price bubble was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble burst and Japan's economy stagnated. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity, as well as an uncontrolled money supply and credit expansion. More specifically, over-confidence and speculation regarding asset and stock prices were closely associated with excessive monetary easing policy at the time. Through the creation of economic policies that cultivated the marketability of assets, eased the access to credit, and encouraged speculation, the Japanese government started a prolonged and exacerbated Japanese asset price bubble.

The early 1980s recession was a severe economic recession that affected much of the world between approximately the start of 1980 and 1983. It is widely considered to have been the most severe recession since World War II. A key event leading to the recession was the 1979 energy crisis, mostly caused by the Iranian Revolution which caused a disruption to the global oil supply, which saw oil prices rising sharply in 1979 and early 1980. The sharp rise in oil prices pushed the already high rates of inflation in several major advanced countries to new double-digit highs, with countries such as the United States, Canada, West Germany, Italy, the United Kingdom and Japan tightening their monetary policies by increasing interest rates in order to control the inflation. These G7 countries each, in fact, had "double-dip" recessions involving short declines in economic output in parts of 1980 followed by a short period of expansion, in turn, followed by a steeper, longer period of economic contraction starting sometime in 1981 and ending in the last half of 1982 or in early 1983. Most of these countries experienced stagflation, a situation of both high inflation rates and high unemployment rates.

Gingival recession, also known as receding gums, is the exposure in the roots of the teeth caused by a loss of gum tissue and/or retraction of the gingival margin from the crown of the teeth. Gum recession is a common problem in adults over the age of 40, but it may also occur starting in adolescence, or around the age of 10. It may exist with or without concomitant decrease in crown-to-root ratio.

The recession index is an informal index created by The Economist which counts how many stories in The Washington Post and The New York Times use the word “recession” in a quarter.

A sudden stop in capital flows is defined as a sudden slowdown in private capital inflows into emerging market economies, and a corresponding sharp reversal from large current account deficits into smaller deficits or small surpluses. Sudden stops are usually followed by a sharp decrease in output, private spending and credit to the private sector, and real exchange rate depreciation. The term “sudden stop” was inspired by a banker’s comment on a paper by Rüdiger Dornbusch and Alejandro Werner about Mexico, that “it is not speed that kills, it is the sudden stop”.

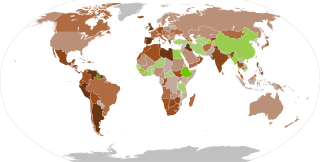

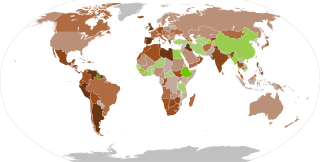

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations.

The Second Great Depression may refer to:

A global recession is recession that affects many countries around the world—that is, a period of global economic slowdown or declining economic output.

The European recession is part of the Great Recession that began in mid-2007. The crisis spread rapidly and affected much of the region with several countries already in recession as of February 2009, and most others suffering marked economic setbacks. The global recession was first seen in Europe, as Ireland was the first country to fall into recession from Q2-Q3 2007 – followed by temporary growth in Q4 2007 – and then a two-year-long recession.

North America was one of the focal points of the global, Great Recession. While Canada has managed to return its economy nearly to the levels it enjoyed prior to the recession, the United States and Mexico are still under the influence of the worldwide economic slowdown. The cost of staple items dropped dramatically in the United States as a result of the recession.

The Great Recession in Oceania was the great recession of the late 2000s and early 2010s in Oceania. The Oceanic countries suffered minimal impact during this time, in comparison with the impact that North America and Europe felt.

The Great Recession in South America, as it mainly consists of commodity exporters, was not directly affected by the financial turmoil, even if the bond markets of Brazil, Argentina, Colombia and Venezuela have been hit.

The United States entered recession in 1990, which lasted 8 months through March 1991. Although the recession was mild relative to other post-war recessions, it was characterized by a sluggish employment recovery, most commonly referred to as a jobless recovery. Unemployment continued to rise through June 1992, even though a positive economic growth rate had returned the previous year.

An economic recovery is the phase of the business cycle following a recession. The overall business outlook for an industry looks optimistic during the economic recovery phase.

A rolling recession, or rolling adjustment recession, occurs when the recession only affects certain sectors of the economy at a time. As one sector enters recovery, the slowdown will ‘roll’ into another part of the economy. On a whole, rolling recessions occurs regardless of nationwide or statewide economic recession and the effects may not be in the national economic measures e.g. gross domestic product (GDP). The recession of 1960–61 in the United States is an example of a rolling-adjustment recession.

Gingival grafting, also called gum grafting or periodontal plastic surgery, is a generic term for the performance of any of a number of periodontal surgical procedures in which the gum tissue is grafted. The aim may be to cover exposed root surfaces or merely to augment the band of keratinized tissue.

The COVID-19 recession, also referred to as the Great Lockdown, is a global economic recession caused by the COVID-19 pandemic. The recession began in most countries in February 2020.