The reference dates of the United States' business cycles are determined by the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER), which looks at various coincident indicators such as real GDP, real personal income, employment, and sales to make informative judgments on when to set the historical dates of the peaks and troughs of past business cycles. The NBER was founded in 1920, and the first business cycle dates published in 1929.

The Economic Cycle Research Institute (ECRI), founded by Geoffrey H. Moore, who created the first index of leading economic indicators (LEI) in 1967, also determines historical international business cycle dates comparable to the NBER’s U.S. business cycle chronology.

In economics, a recession is a business cycle contraction that occurs when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster.

An economic depression is a period of carried long-term economic downturn that is the result of lowered economic activity in one major or more national economies. Economic depression maybe related to one specific country where there is some economic crisis that has worsened but most often reflexes historically the American Great Depression and similar economic status that may be recognized as existing at some country, several countries or even in many countries. It is often understood in economics that economic crisis and the following recession that maybe named economic depression are part of economic cycles where the slowdown of the economy follows the economic growth and vice versa. It is a result of more severe economic problems or a downturn than the recession itself, which is a slowdown in economic activity over the course of the normal business cycle of growing economy.

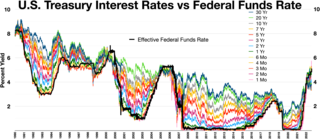

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate, housing starts, consumer price index, Inverted yield curve, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet penetration, retail sales, price index, and changes in credit conditions.

Business cycles are intervals of general expansion followed by recession in economic performance. The changes in economic activity that characterize business cycles have important implications for the welfare of the general population, government institutions, and private sector firms. There are numerous specific definitions of what constitutes a business cycle. The simplest and most naïve characterization comes from regarding recessions as 2 consecutive quarters of negative GDP growth. More satisfactory classifications are provided by, first including more economic indicators and second by looking for more informative data patterns than the ad hoc 2 quarter definition.

Simon Smith Kuznets was an American economist and statistician who received the 1971 Nobel Memorial Prize in Economic Sciences "for his empirically founded interpretation of economic growth which has led to new and deepened insight into the economic and social structure and process of development."

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic community". The NBER is known for proposing start and end dates for recessions in the United States.

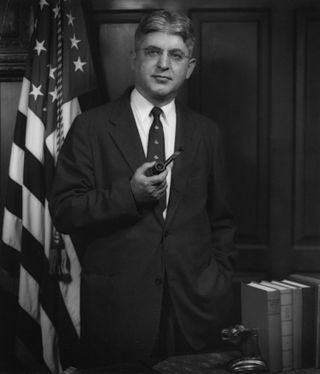

Arthur Frank Burns was an American economist and diplomat who served as the 10th chairman of the Federal Reserve from 1970 to 1978. He previously chaired the Council of Economic Advisers under President Dwight D. Eisenhower from 1953 to 1956, and served as the first Counselor to the President under Richard Nixon from January to November 1969. He also taught and researched at Rutgers University, Columbia University, and the National Bureau of Economic Research.

The early 2000s recession was a decline in economic activity which mainly occurred in developed countries. The recession affected the European Union during 2000 and 2001 and the United States from March to November 2001. The UK, Canada and Australia avoided the recession, while Russia, a nation that did not experience prosperity during the 1990s, began to recover from it. Japan's 1990s recession continued.

Robert Ernest "Bob" Hall is an American economist who serves as a professor of economics at Stanford University, and as the Robert and Carole McNeil Senior Fellow at the Hoover Institution. He is generally considered a macroeconomist, but he describes himself as an applied economist.

Victor Zarnowitz was a leading scholar on business cycles, indicators, and forecast evaluation. Zarnowitz was Senior Fellow and Economic Counselor to The Conference Board. He was professor emeritus of Economics and Finance, Graduate School of Business, The University of Chicago, and Research Associate, National Bureau of Economic Research (NBER).

The Survey of Professional Forecasters (SPF) is a quarterly survey of macroeconomic forecasts for the economy of the United States issued by the Federal Reserve Bank of Philadelphia. It is the oldest such survey in the United States.

A global recession is recession that affects many countries around the world—that is, a period of global economic slowdown or declining economic output.

Christina Duckworth Romer is the Class of 1957 Garff B. Wilson Professor of Economics at the University of California, Berkeley and a former chair of the Council of Economic Advisers in the Obama administration. She resigned from her role on the Council of Economic Advisers on September 3, 2010.

The recession of 1949 was a downturn in the United States lasting for 11 months. According to the National Bureau of Economic Research, the recession began in November 1948 and lasted until October 1949.

The Depression of 1882–1885, or Recession of 1882–1885, was an economic contraction in the United States that lasted from March 1882 to May 1885, according to the National Bureau of Economic Research. Lasting 38 months, it was the third-longest recession in the NBER's chronology of business cycles since 1854. Only the Great Depression (1929-1941) and the Long Depression (1873–1879) were longer.

The Economic Cycle Research Institute (ECRI) based in New York City, is an independent institute formed in 1996 by Geoffrey H. Moore, Anirvan Banerji, and Lakshman Achuthan. It provides economic modeling, financial databases, economic forecasting, and market cycles services to investment managers, business executives, and government policymakers.

Geoffrey Hoyt Moore, whom The Wall Street Journal called "the father of leading indicators", spent several decades working on business cycles at the National Bureau of Economic Research, where he helped build on the work of his mentors, Wesley Clair Mitchell and Arthur F. Burns. Moore also served as commissioner of the Bureau of Labor Statistics from March 1969 to January 1973.

In macroeconomics, the Sahm rule, or Sahm rule recession indicator, is a heuristic measure by the United States' Federal Reserve for determining when an economy has entered a recession. It is useful in real-time evaluation of the business cycle and relies on monthly unemployment data from the Bureau of Labor Statistics (BLS). It is named after economist Claudia Sahm, formerly of the Federal Reserve and Council of Economic Advisors.