The World Trade Organization (WTO) is an intergovernmental organization that regulates and facilitates international trade. With effective cooperation in the United Nations System, governments use the organization to establish, revise, and enforce the rules that govern international trade. It officially commenced operations on 1 January 1995, pursuant to the 1994 Marrakesh Agreement, thus replacing the General Agreement on Tariffs and Trade (GATT) that had been established in 1948. The WTO is the world's largest international economic organization, with 164 member states representing over 98% of global trade and global GDP.

Refrigeration is any of various types of cooling of a space, substance, or system to lower and/or maintain its temperature below the ambient one. Refrigeration is an artificial, or human-made, cooling method.

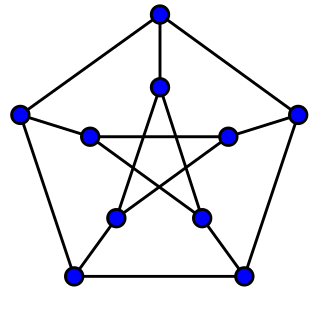

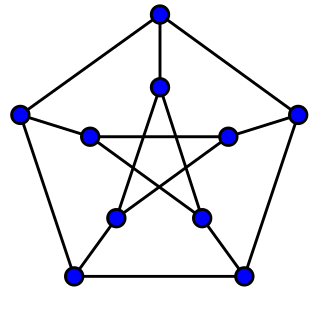

In the mathematical field of graph theory, the Petersen graph is an undirected graph with 10 vertices and 15 edges. It is a small graph that serves as a useful example and counterexample for many problems in graph theory. The Petersen graph is named after Julius Petersen, who in 1898 constructed it to be the smallest bridgeless cubic graph with no three-edge-coloring.

In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price.

The Whanganui River is a major river in the North Island of New Zealand. It is the country's third-longest river, and has special status owing to its importance to the region's Māori people. In March 2017 it became the world's second natural resource to be given its own legal identity, with the rights, duties and liabilities of a legal person. The Whanganui Treaty settlement brought the longest-running litigation in New Zealand history to an end.

In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment into the actual movement of money from one account to another. Clearing houses were formed to facilitate such transactions among banks.

The ex-dividend date is an investment term involving the timing of payment of dividends on stocks of corporations, income trusts, and other financial holdings, both publicly and privately held. The ex-date or ex-dividend date represents the date on or after which a security is traded without a previously declared dividend or distribution. The opening price on the ex-dividend date, in comparison to the previous closing price, can be expected to decrease by the amount of the dividend, although this change may be obscured by other influences on the stock's value.

Settlement is the "final step in the transfer of ownership involving the physical exchange of securities or payment". After settlement, the obligations of all the parties have been discharged and the transaction is considered complete.

A matrix scheme is a business model involving the exchange of money for a certain product with a side bonus of being added to a waiting list for a product of greater value than the amount given. Matrix schemes are also sometimes considered similar to Ponzi or pyramid schemes. They have been called "unsustainable" by the United Kingdom's Office of Fair Trading. A matrix scheme is also an example of an 'exploding queue' in queueing theory.

The Nairobi Securities Exchange (NSE) was established in 1954 as the Nairobi Stock Exchange, based in Nairobi the capital of Kenya. It was a voluntary association of stockbrokers in the European community registered under the Societies Act in British Kenya. The exchange had 66 listed companies in February 2021.

A Mars cycler is a kind of spacecraft trajectory that encounters Earth and Mars regularly. The term Mars cycler may also refer to a spacecraft on a Mars cycler trajectory. The Aldrin cycler is an example of a Mars cycler.

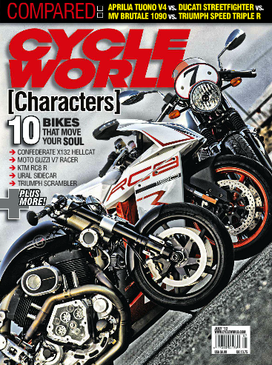

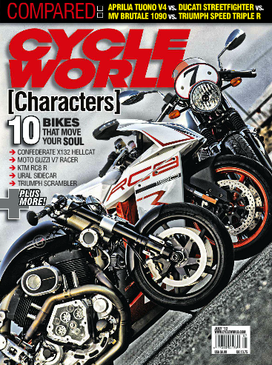

Cycle World is a motorcycling magazine in the United States. It was founded in 1962 by Joe Parkhurst, who was inducted to the Motorcycle Hall of Fame as "the person responsible for bringing a new era of objective journalism" to the US. As of 2001 Cycle World was the largest motorcycling magazine in the world. The magazine is headquartered in Irvine, California. Regular contributors include Peter Egan and Nick Ienatsch. Previous or occasional contributors have included gonzo journalist and author Hunter S. Thompson, journalist and correspondent Henry N. Manney III, and professional riding coach Ken Hill.

In finance, a trade is an exchange of a security for "cash", typically a short-dated promise to pay in the currency of the country where the 'exchange' is located. The price at which a financial instrument is traded, is determined by the supply and demand for that financial instrument.

- Order initiation and execution.

- Risk management and order routing.

- Order matching and conversion into trade.

- Affirmation and confirmation.

- Clearing and Settlement.

Balatonszemes is a village in Somogy county, Hungary. It lies on the southern shore of Lake Balaton, on the northern slopes of the Outer Somogy hills overlooking the lake and on the half-kilometre wide coastal plain. It has a train station on the (Budapest-)Székesfehérvár-Gyékényes railway line.

In financial markets T+2 is a shorthand for trade date plus two days indicating when securities transactions must be settled. The rules or customs in financial markets are for securities transactions to be settled within a commonly understood 'settlement period'. The most common current settlement period for securities transactions is two business days after the day of a transaction, which is widely abbreviated to T+2. On settlement, the seller must produce the security's certificate and executed share transfer form in exchange for payment from the purchaser. Many countries now dispense with the requirement that a physical stock certificate be produced, and have adopted electronic settlement systems.

Events from the year 1611 in Quebec.

Cycling infrastructure is all infrastructure cyclists are allowed to use. Bikeways include bike paths, bike lanes, cycle tracks, rail trails and, where permitted, sidewalks. Roads used by motorists are also cycling infrastructure, except where cyclists are barred such as many freeways/motorways. It includes amenities such as bike racks for parking, shelters, service centers and specialized traffic signs and signals. The more cycling infrastructure, the more people get about by bicycle.

Carlton Cycles was a bicycle manufacturer based in Worksop, Nottinghamshire, England.

The Atlantic slave trade to Brazil occurred during the period of history in which there was a forced migration of Africans to Brazil for the purpose of slavery. It lasted from the mid-sixteenth century until the mid-nineteenth century. During the trade, more than three million Africans were transported across the Atlantic and sold into slavery. It was divided into four phases: The Cycle of Guinea ; the Cycle of Angola which trafficked people from Bakongo, Mbundu, Benguela and Ovambo; Cycle of Costa da Mina, now renamed Cycle of Benin and Dahomey, which trafficked people from Yoruba, Ewe, Minas, Hausa, Nupe and Borno; and the Illegal trafficking period, which was suppressed by the United Kingdom (1815-1851). During this period, to escape the supervision of British ships enforcing an anti-slavery blockade, Brazilian slave traders began to seek alternative routes to the routes of the West African coast, turning to Mozambique.

An automated clearing house (ACH) is a computer-based electronic network for processing transactions, usually domestic low value payments, between participating financial institutions. It may support both credit transfers and direct debits. The ACH system is designed to process batches of payments containing numerous transactions, and it charges fees low enough to encourage its use for low value payments.