In trade, barter is a system of exchange in which participants in a transaction directly exchange goods or services for other goods or services without using a medium of exchange, such as money. Economists usually distinguish barter from gift economies in many ways; barter, for example, features immediate reciprocal exchange, not one delayed in time. Barter usually takes place on a bilateral basis, but may be multilateral. In most developed countries, barter usually exists parallel to monetary systems only to a very limited extent. Market actors use barter as a replacement for money as the method of exchange in times of monetary crisis, such as when currency becomes unstable or simply unavailable for conducting commerce.

Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business and other organizations. It involves preparing source documents for all transactions, operations, and other events of a business. Transactions include purchases, sales, receipts and payments by an individual person, organization or corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems. While these may be viewed as "real" bookkeeping, any process for recording financial transactions is a bookkeeping process.

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. Debit cards are similar to a credit card, but the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

In computer science, ACID is a set of properties of database transactions intended to guarantee data validity despite errors, power failures, and other mishaps. In the context of databases, a sequence of database operations that satisfies the ACID properties is called a transaction. For example, a transfer of funds from one bank account to another, even involving multiple changes such as debiting one account and crediting another, is a single transaction.

In information technology and computer science, especially in the fields of computer programming, operating systems, multiprocessors, and databases, concurrency control ensures that correct results for concurrent operations are generated, while getting those results as quickly as possible.

A database transaction symbolizes a unit of work, performed within a database management system against a database, that is treated in a coherent and reliable way independent of other transactions. A transaction generally represents any change in a database. Transactions in a database environment have two main purposes:

- To provide reliable units of work that allow correct recovery from failures and keep a database consistent even in cases of system failure. For example: when execution prematurely and unexpectedly stops in which case many operations upon a database remain uncompleted, with unclear status.

- To provide isolation between programs accessing a database concurrently. If this isolation is not provided, the programs' outcomes are possibly erroneous.

Savant syndrome is a phenomenon where someone demonstrates exceptional aptitude in one domain, such as art or mathematics, despite significant social or intellectual impairment.

Visa Debit is a major brand of debit card issued by Visa in many countries around the world. Numerous banks and financial institutions issue Visa Debit cards to their customers for access to their bank accounts. In many countries the Visa Debit functionality is often incorporated on the same plastic card that allows access to ATM and any domestic networks like EFTPOS or Interac.

Business-to-business is a situation where one business makes a commercial transaction with another. This typically occurs when:

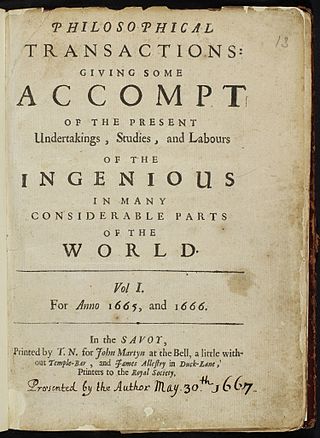

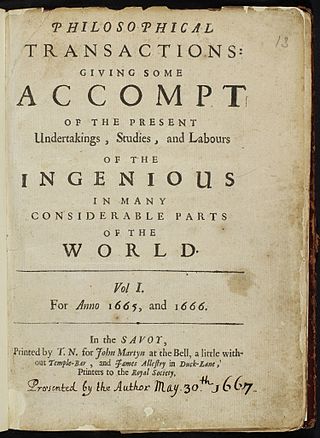

Philosophical Transactions of the Royal Society is a scientific journal published by the Royal Society. In its earliest days, it was a private venture of the Royal Society's secretary. It was established in 1665, making it the second journal in the world exclusively devoted to science, after the Journal des sçavans, and therefore also the world's longest-running scientific journal. It became an official society publication in 1752. The use of the word philosophical in the title refers to natural philosophy, which was the equivalent of what would now be generally called science.

The Journal of the Chemical Society was a scientific journal established by the Chemical Society in 1849 as the Quarterly Journal of the Chemical Society. The first editor was Edmund Ronalds. The journal underwent several renamings, splits, and mergers throughout its history. In 1980, the Chemical Society merged with several other organizations into the Royal Society of Chemistry. The journal's continuity is found in Chemical Communications, Dalton Transactions, Faraday Transactions, and Perkin Transactions, all of which are published by the Royal Society of Chemistry.

A ledger is a book or collection of accounts in which accounting transactions are recorded. Each account has:

The Financial Transactions and Reports Analysis Centre of Canada is the national financial intelligence agency of Canada. FINTRAC was established in 2000 under the Proceeds of Crime Act to facilitate detection and investigation of money laundering, FINTRAC's mandate was expanded in December 2001 following amendments to the Proceeds of Crime Act to also disclose financial intelligence to other Canadian intelligence and law enforcement agencies with respect to suspected terrorist financing. FINTRAC's mandate was further expanded in 2006 under Bill C-25 to enhance the client identification, record-keeping and reporting measures, established a registration regime for money services businesses and foreign exchange dealers, and created new offences for not registering.

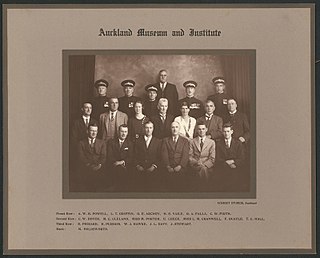

Arthur William Baden Powell was a New Zealand malacologist, naturalist and palaeontologist, a major influence in the study and classification of New Zealand molluscs through much of the 20th century. He was known to his friends and family by his third name, "Baden".

American Family Radio (AFR), also known as American Family News (AFN), is a network of more than 180 radio stations broadcasting Christian right-oriented programming to over 30 states. AFR streams its programming on its website and on the AFR mobile app.

Philosophical Transactions of the Royal Society B: Biological Sciences is a biweekly peer-reviewed scientific journal published by the Royal Society. The editor-in-chief is Richard Dixon (UNT).

National Electronic Funds Transfer (NEFT) is an electronic funds transfer system maintained by the Reserve Bank of India (RBI). Started in November 2005, the setup was established and maintained by Institute for Development and Research in Banking Technology. NEFT enables bank customers in India to transfer funds between any two NEFT-enabled bank accounts on a one-to-one basis. It is done via electronic messages.

Double-spending is the unauthorized production and spending of money, either digital or conventional. It represents a monetary design problem: a good money is verifiably scarce, and where a unit of value can be spent more than once, the monetary property of scarcity is challenged. As with counterfeit money, such double-spending leads to inflation by creating a new amount of copied currency that did not previously exist. Like all increasingly abundant resources, this devalues the currency relative to other monetary units or goods and diminishes user trust as well as the circulation and retention of the currency.

Bitcoin is the first decentralized cryptocurrency. Nodes in the peer-to-peer bitcoin network verify transactions through cryptography and record them in a public distributed ledger, called a blockchain, without central oversight. Consensus between nodes is achieved using a computationally intensive process based on proof of work, called mining, that secures the bitcoin blockchain. Mining consumes large quantities of electricity and has been criticized for its environmental impact.

A blockchain is a distributed ledger with growing lists of records (blocks) that are securely linked together via cryptographic hashes. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Since each block contains information about the previous block, they effectively form a chain, with each additional block linking to the ones before it. Consequently, blockchain transactions are irreversible in that, once they are recorded, the data in any given block cannot be altered retroactively without altering all subsequent blocks.