Related Research Articles

The DAX is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a total return index. Prices are taken from the Xetra trading venue. According to Deutsche Börse, the operator of Xetra, DAX measures the performance of the Prime Standard's 40 largest German companies in terms of order book volume and market capitalization. DAX is the equivalent of the UK FTSE 100 and the US Dow Jones Industrial Average, and because of its small company selection it does not necessarily represent the vitality of the German economy as a whole.

The Taiwan Stock Exchange Capitalization Weighted Stock Index, TWSE Capitalization Weighted Stock Index, or TAIEX is a stock market index for companies traded on the Taiwan Stock Exchange (TWSE). TAIEX covers all of the listed stocks excluding preferred stocks, full-delivery stocks and newly listed stocks, which are listed for less than one calendar month. It was first published in 1967 by TWSE with 1966 being the base year with a value of 100.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

The SSE Composite Index also known as SSE Index is a stock market index of all stocks that are traded at the Shanghai Stock Exchange.

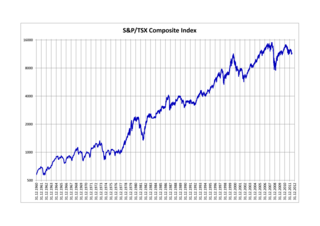

The S&P/TSX Composite Index is the benchmark Canadian stock market index representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX). Having replaced the TSE 300 Composite Index on May 1, 2002, as of September 20, 2021 the S&P/TSX Composite Index comprises 237 of the 3,451 companies listed on the TSX. The index reached an all-time closing high of 22,185.25 on April 1, 2024, and an intraday record high of 22,220.91 on March 28, 2024.

The S&P Asia 50 Index is a stock index of Asian stocks that is a part of the S&P Global 1200. The index includes companies listed on the stock exchanges in Hong Kong, South Korea, Singapore, and Taiwan. This index has an exchange-traded fund (ETF) in the United States and in Australia.

The S&P/TSX 60 Index is a stock market index of 60 large companies listed on the Toronto Stock Exchange. Launched on December 30, 1998 by the Canadian S&P Index Committee, a unit of S&P Dow Jones Indices, the index has components across nine sectors of the Canadian economy. The index forms the S&P/TSX Composite Index alongside the S&P/TSX Completion Index, as well as being the Canadian component of the S&P Global 1200.

The S&P Latin America 40 is a stock market index from Standard & Poor's. It tracks Latin American stocks.

The EURO STOXX 50 is a stock index of Eurozone stocks designed by STOXX, an index provider owned by Deutsche Börse Group. The index is composed of 50 stocks from 11 countries in the Eurozone.

The S&P/ASX 200 (XJO) index is a market-capitalisation weighted and float-adjusted stock market index of stocks listed on the Australian Securities Exchange. The index is maintained by Standard & Poor's and is considered the benchmark for Australian equity performance. It is based on the 200 largest ASX listed stocks, which together account for about 82% of Australia's share market capitalisation.

The Santiago Stock Exchange (SSE), founded on November 27, 1893, is Chile's dominant stock exchange, and the third largest stock exchange in Latin America, behind Brazil's BM&F Bovespa, and the Bolsa Mexicana de Valores in Mexico. On December 5, 2014, the Santiago Stock Exchange announced it was joining the United Nations Sustainable Stock Exchanges (SSE) initiative, becoming the 17th Partner Exchange of the initiative.

The Lima Stock Exchange is the stock exchange of Peru, located in the capital Lima. It has several indices. The S&P/BVL Peru General Index is a value-weighted index that tracks the performance of the largest and most frequently traded stocks on the Lima Exchange.

The SET50 and SET100 Indices are the primary stock indices of Thailand. The constituents of both lists are companies listed on the Stock Exchange of Thailand (SET) in Bangkok.

The Indice de Precio Selectivo de Acciones is a Chilean stock market index composed of the 30 stocks with the highest average annual trading volume in the Santiago Stock Exchange. On the last trading day of the year, the index is re-based back to 1000. The index has been calculated since 1977 and is revised on a quarterly basis.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

Índice Bursátil de Capitalización (IBC), also known as the General Index, is the main and most important index of Caracas Stock Exchange. It lists the 11 largest companies by capitalization and liquidity of the Venezuelan Stock Market.

Graña y Montero is a company based in Latin America. It originated as a real estate and construction company, now the oldest and largest in Peru. Its many business interests include the construction of buildings and infrastructure, the energy and mining industries, and sanitation and highway services. In November 2020 changed its name to AENZA.

The PSI-20 is a benchmark stock market index of companies that trade on Euronext Lisbon, the main stock exchange of Portugal. The index tracks the prices of the twenty listings with the largest market capitalisation and share turnover in the PSI Geral, the general stock market of the Lisbon exchange. It is one of the main national indices of the pan-European stock exchange group Euronext alongside Brussels' BEL20, Paris's CAC 40 and Amsterdam's AEX.

The Mercado Integrado Latinoamericano, more commonly known as MILA, is a program that integrates the stock exchange markets of Chile, Colombia, Mexico, and Peru. The three founding members are the Lima Stock Exchange, the Santiago Stock Exchange, and the Colombia Stock Exchange. The integration aims to develop the capital market through the integration of the four countries, to give investors a greater supply of securities, issuers and also larger sources of funding.

References

- ↑ S&P Dow Jones Indices and the Lima Stock Exchange Launch S&P/BVL Peru Select Index. PR Newswire. December 16, 2014. Retrieved May 5, 2017.

- 1 2 S&P/BVL Peru Indices Methodology. S&P Indices. Retrieved June 28, 2017.