Constituents

| Operator | NZX, S&P Dow Jones Indices |

|---|---|

| Exchanges | NZX |

| Constituents | 50 |

| Type | Large capitalisation |

| Website | S&P/NZX 50 Index |

The S&P/NZX 50 Index is the main stock market index in New Zealand. It comprises the 50 biggest stocks by free-float market capitalisation trading on the New Zealand Stock Market (NZSX). The calculation of the free-float capitalisation excludes blocks of shares greater than 20% and blocks between 5% and 20% that are considered strategic. [1]

The index was introduced as the NZSX 50 Index in March 2003 and replaced the NZSE 40 Index as the headline index. It was renamed the NZX 50 Index in late 2005. [1] The NZSE 40 Capital Index replaced the Barclays index in 1992, [2] although the Barclays index is still compiled by the NZX but not made widely available. [3] In 2015, the index was renamed to S&P/NZX 50 Index reflecting a 'strategic partnership' between NZX and S&P Dow Jones Indices (S&P DJI). As part of the partnership, S&P DJI has assumed responsibility for calculating, publishing distributing all NZX indices. [4]

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index.

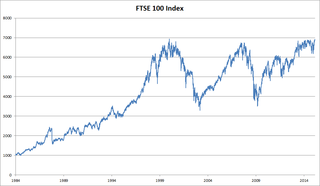

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group.

The Dow Jones Transportation Average is a U.S. stock market index from S&P Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. It is the oldest stock index still in use, even older than its better-known relative, the Dow Jones Industrial Average (DJIA).

New Zealand's Exchange, known commonly as the NZX, is the national stock exchange for New Zealand and a publicly owned company. NZX is the parent company of Smartshares, and Wealth Technologies.

The NIFTY 50 is a benchmark Indian stock market index that represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange. It is one of the two main stock indices used in India, the other being the BSE SENSEX.

BUX is a blue chip stock market index consisting up to 25 major Hungarian companies trading on the Budapest Stock Exchange. Prices are taken from the electronic Xetra trading system. According to the operator Budapest Stock Exchange, the BUX measures the performance of the Equities Prime Market's 12 to 25 largest Hungarian companies in terms of order book volume and market capitalization. It is the equivalent of the Dow Jones Industrial Average and DAX, the index shows the average price changing of the shares with the biggest market value and turnover in the equity section. Hereby this is the most important index number of the exchange trends.

The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange. Initiated in 1992, the index is administered and calculated by Sociedad de Bolsas, a subsidiary of Bolsas y Mercados Españoles (BME), the company which runs Spain's securities markets. It is a market capitalization weighted index comprising the 35 most liquid Spanish stocks traded in the Madrid Stock Exchange General Index and is reviewed twice annually. Trading on options and futures contracts on the IBEX 35 is provided by MEFF, another subsidiary of BME.

The S&P/ASX 50 Index is a stock market index of Australian stocks listed on the Australian Securities Exchange from Standard & Poor's.

The FTSE Bursa Malaysia KLCI, also known as the FBM KLCI, is a capitalisation-weighted stock market index, composed of the 30 largest companies on the Bursa Malaysia by market capitalisation that meet the eligibility requirements of the FTSE Bursa Malaysia Index Ground Rules. The index is jointly operated by FTSE and Bursa Malaysia.

The Dow Jones Global Titans 50 Index is a float-adjusted index of 50 of the largest and best known blue chip companies traded on the New York Stock Exchange, American Stock Exchange, Nasdaq, Euronext, London Stock Exchange, and Tokyo Stock Exchange. The index represents the biggest and most liquid stocks traded in individual countries. It was created by Dow Jones Indexes to reflect the globalization of international blue chip securities in the wake of mergers and the creation of megacorporations.

Carter Holt Harvey Limited is a privately-owned New Zealand-based company controlled by Rank Group Limited, the corporate vehicle of the country's richest man, Graeme Hart. Based in Auckland, New Zealand, the company has three main divisions: Woodproducts New Zealand and Woodproducts Australia, which are both major Australasian manufacturers of wood-based building products; and Carters, a New Zealand chain of trade-focused building supply stores.

The S&P/ASX 20 index is a stock market index of stocks listed on the Australian Securities Exchange from Standard & Poor's. While the "ASX 20" often simply refers to the 20 largest companies by market capitalisation, the S&P/ASX 20 Index is calculated by using the S&P Dow Jones Indices market capitalization weighted and float-adjusted methodologies. All 20 companies also feature in the S&P/ASX 50.

The S&P/ASX 300, or simply, ASX 300, is a stock market index of Australian stocks listed on the Australian Securities Exchange (ASX). The index is market-capitalisation weighted, meaning each company included is in proportion to the indexes total market value, and float-adjusted, meaning the index only considers shares available to public investors.

S&P Dow Jones Indices LLC is a joint venture between S&P Global, the CME Group, and News Corp that was announced in 2011 and later launched in 2012. It produces, maintains, licenses, and markets stock market indices as benchmarks and as the basis of investable products, such as exchange-traded funds (ETFs), mutual funds, and structured products. The company currently has employees in 15 cities worldwide, including New York, London, Frankfurt, Singapore, Hong Kong, Sydney, Beijing, and Dubai.

The Dow Jones Sustainability Indices (DJSI) launched in 1999, are a family of indices evaluating the sustainability performance of thousands of companies trading publicly, operated under a strategic partnership between S&P Dow Jones Indices and RobecoSAM of the S&P Dow Jones Indices. They are the longest-running global sustainability benchmarks worldwide and have become the key reference point in sustainability investing for investors and companies alike. In 2012, S&P Dow Jones Indices was formed via the merger of S&P Indices and Dow Jones Indexes.

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance.

Bremworth Limited is a New Zealand company specializing in the manufacture of broadloom wool carpet. Floated in 1984, the company was once included in the NZX 50 share index, as one of New Zealand's 50 largest public companies. It left the NZX50 due to a low market capitalisation in January 2013.

The S&P BSE 500 Shariah Index is a stock market index established on 27 December 2010 on Bombay Stock Exchange, in collaboration with the Taqwaa Advisory and Shariah Investment Solutions (TASIS) has launched an Islamic index in a bid to attract more investors from India and overseas. On 19 February 2013, S&P Dow Jones Indices and the Bombay Stock Exchange ("BSE") announced their strategic partnership to calculate, disseminate, and license the widely followed BSE suite of indices. One of the first indices created by the partnership was the S&P BSE 500 SHARIAH. This index was designed to represent all Shariah compliant companies of the broad-based S&P BSE 500 index. The index joins the family of S&P Shariah indices with the S&P 500 Shariah, S&P Europe 350 Shariah, and S&P Pan Asia Shariah among others. The S&P BSE 500 consists of 500 of the largest, most liquid Indian stocks trading at the BSE. The index represents nearly 93% of the total market capitalization on the exchange. It covers all 20 major industries of the economy. In line with other S&P BSE indices, on 16 August 2005 the calculation methodology was changed to the free-float methodology.