This disambiguation page contains the primary topic and one other topic for the ambiguous title. Please expand it by adding additional topics to which the title refers, being sure to follow MOS guidelines.(November 2023) |

SIBOR may refer to:

This disambiguation page contains the primary topic and one other topic for the ambiguous title. Please expand it by adding additional topics to which the title refers, being sure to follow MOS guidelines.(November 2023) |

SIBOR may refer to:

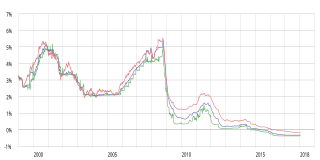

The London Inter-Bank Offered Rate is an interest rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. It is the primary benchmark, along with the Euribor, for short-term interest rates around the world. Libor was phased out at the end of 2021, and market participants are being encouraged to transition to risk-free interest rates such as SOFR and SARON.

A reference rate is a rate that determines pay-offs in a financial contract and that is outside the control of the parties to the contract. It is often some form of LIBOR rate, but it can take many forms, such as a consumer price index, a house price index or an unemployment rate. Parties to the contract choose a reference rate that neither party has power to manipulate.

A variable-rate mortgage, adjustable-rate mortgage (ARM), or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based on an index which reflects the cost to the lender of borrowing on the credit markets. The loan may be offered at the lender's standard variable rate/base rate. There may be a direct and legally defined link to the underlying index, but where the lender offers no specific link to the underlying market or index, the rate can be changed at the lender's discretion. The term "variable-rate mortgage" is most common outside the United States, whilst in the United States, "adjustable-rate mortgage" is most common, and implies a mortgage regulated by the Federal government, with caps on charges. In many countries, adjustable rate mortgages are the norm, and in such places, may simply be referred to as mortgages.

The Euro Interbank Offered Rate (Euribor) is a daily reference rate, published by the European Money Markets Institute, based on the averaged interest rates at which Eurozone banks borrow unsecured funds from counterparties in the euro wholesale money market. Prior to 2015, the rate was published by the European Banking Federation.

Eonia is computed as a weighted average of all overnight unsecured lending transactions in the interbank market, undertaken in the European Union and European Free Trade Association (EFTA) countries by the Panel Banks. It is reported on an ACT/360 day count convention and is displayed to three decimal places. "Overnight" means from one TARGET day to the next. The panel of reporting banks is the same as for Euribor, and a list is provided by the overseers of the publication of the index. There is no clear definition of 'interbank market' leading to the potential of subjective assessment of what is an 'interbank loan', albeit all panel banks are subject to the Eonia Code of Conduct.

SIBOR stands for Singapore Interbank Offered Rate and is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Singapore wholesale money market. It is similar to the widely used LIBOR, and Euribor. Using SIBOR is more common in the Asian region and set by the Association of Banks in Singapore (ABS).

Pribor may refer to:

An interbank network, also known as an ATM consortium or ATM network, is a computer network that enables ATM cards issued by a financial institution that is a member of the network to be used to perform ATM transactions through ATMs that belong to another member of the network.

TIBOR stands for the Tokyo Interbank Offered Rate and is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Japan wholesale money market. TIBOR is published daily by the JBA TIBOR Administration.

The overnight rate is generally the interest rate that large banks use to borrow and lend from one another in the overnight market. In some countries, the overnight rate may be the rate targeted by the central bank to influence monetary policy. In most countries, the central bank is also a participant on the overnight lending market, and will lend or borrow money to some group of banks.

Stockholm Interbank Offered Rate is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Swedish wholesale money market. STIBOR is the average of the interest rates listed at 11 a.m.

Kyiv Interbank Offer Rate (KIBOR) is a daily indicative rate based on the interest rates at which banks offer to lend unsecured funds to other banks on the Ukrainian money market. KIBOR is the opposite of the Kyiv Interbank Bid Rate (KIBID).

The interbank lending market is a market in which banks lend funds to one another for a specified term. Most interbank loans are for maturities of one week or less, the majority being overnight. Such loans are made at the interbank rate. A sharp decline in transaction volume in this market was a major contributing factor to the collapse of several financial institutions during the financial crisis of 2007–2008.

Romanian Interbank Bid Rate (ROBID) is the reference rate calculated by the Proxy as the arithmetical average of the last rates quoted by the each Participant in the Fixing for the RON deposits offered within 15 minutes before the Fixing after rejecting extreme rates. This is the rate at which banks offer to lend unsecured funds to other banks in the Romanian wholesale money market. It is similar to the widely used LIBOR, and Euribor. The rate quoted by each Participant in the Fixing represents the rate at which the RON deposits are offered to the other Participant for 15 minutes from the publication of ROBID and ROBOR rates by the Proxy.

RIGIBOR stands for the Riga Interbank Offered Rate and is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Latvia wholesale money market. RIGIBOR is published daily by the National Bank of Latvia together with RIGIBID.

Libor is the London interbank offered rate.

Singapore Dollar Swap Offer Rate (SOR) is an implied interest rate, determined by examining the spot and forward foreign exchange rate between the US dollar (USD) and Singapore dollar (SGD) and the appropriate US dollar interest rate for the term of the forward.

Kibor is a surname of Kenyan origin that may refer to:

The Saudi Arabian Interbank Offered Rate (SAIBOR) is a daily reference rate, published by the Saudi Central Bank, based on the averaged interest rates at which Saudi banks offer to lend unsecured funds to other banks in the Saudi Riyal wholesale money market.

The Karachi Interbank Offered Rate, commonly known as KIBOR, is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Karachi wholesale money market. The banks used it as a benchmark in their lending to corporate sector.