The Nasdaq Stock Market is an American stock exchange. It is the second-largest stock exchange in the world by market capitalization, behind only the New York Stock Exchange located in the same city. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic and Nasdaq Baltic stock market network and several U.S. stock and options exchanges

The S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE, NASDAQ, or the Cboe BZX Exchange.

The Chicago Board Options Exchange, located at 400 South LaSalle Street in Chicago, is the largest U.S. options exchange with annual trading volume that hovered around 1.27 billion contracts at the end of 2014. CBOE offers options on over 2,200 companies, 22 stock indices, and 140 exchange-traded funds (ETFs).

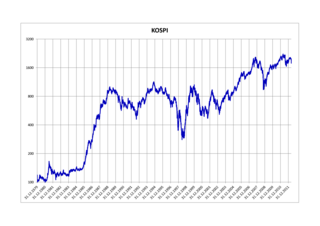

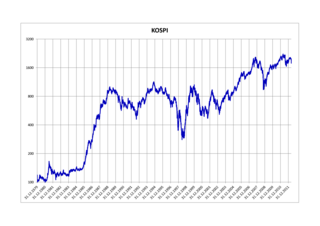

The Korea Composite Stock Price Index or KOSPI (코스피지수) is the index of all common stocks traded on the Stock Market Division—previously, Korea Stock Exchange—of the Korea Exchange. It is the representative stock market index of South Korea, like the S&P 500 in the United States.

The IDX Composite is an index of all stocks listed on the Indonesia Stock Exchange, IDX.

The Shanghai Stock Exchange (SSE) is a stock exchange that is based in the city of Shanghai, China. It is one of the two stock exchanges operating independently in the People's Republic of China, the other being the Shenzhen Stock Exchange. Shanghai Stock Exchange is the world's 4th largest stock market by market capitalization at US$5.5 trillion as of April 2018. Unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is still not entirely open to foreign investors and often manipulated by the decisions of the central government. This is due to tight capital account controls exercised by the Chinese mainland authorities.

The SSE Composite Index also known as SSE Index is a stock market index of all stocks that are traded at the Shanghai Stock Exchange.

Jakarta Stock Exchange (JSX) or in Indonesian Bursa Efek Jakarta (BEJ) was a stock exchange based in Jakarta, Indonesia, before it merged with the Surabaya Stock Exchange to form the Indonesian Stock Exchange.

The Philippine Stock Exchange, Inc. is the national stock exchange of the Philippines. The exchange was created in 1992 from the merger of the Manila Stock Exchange and the Makati Stock Exchange. Including previous forms, the exchange has been in operation since 1927.

The PSE Composite Index, commonly known previously as the PHISIX and presently as the PSEi, is a stock market index of the Philippine Stock Exchange consisting of 30 companies.

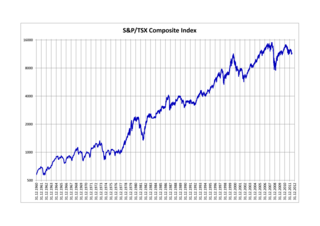

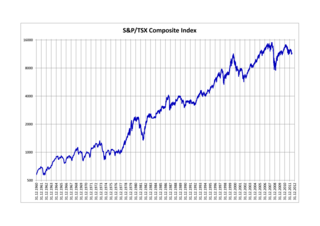

The S&P/TSX Composite Index is the benchmark Canadian index, representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX) with about 250 companies included in it. The Toronto Stock Exchange is made up of over 1,500 companies. On January 4, 2018, the S&P/TSX Composite Index reached an all-time high of 16,412.94. It replaces the earlier TSE 300 index.

The Athens Exchange is "the operator of the regulated markets, the multilateral trading facilities (MTFs) and carbon market as well as the over the counter market (OTC) in Greece". There are five markets operating in ATHEX: regulated securities market, regulated derivatives market, Alternative market, carbon market and OTC market. In the regulated securities market investors can trade in stocks, bonds, ETFs and other related securities. The term Athens Stock Exchange (ASE) is unofficially used for the stock exchange in ATHEX; this term was used in the past more extensively, a fact that was reflected in the address of the former corresponding website of the exchange.

The S&P/TSX 60 Index is a stock market index of 60 large companies listed on the Toronto Stock Exchange. Maintained by the Canadian S&P Index Committee, a unit of Standard & Poor's, it exposes the investor to ten industry sectors.

The Casablanca Stock Exchange is a stock exchange in Casablanca, Morocco. The Casablanca Stock Exchange (CSE), which achieves one of the best performances in the region of the Middle East and North Africa (MENA), is Africa's third largest Bourse after Johannesburg Stock Exchange and Nigerian Stock Exchange in Lagos. It was established in 1929 and currently has 19 members and 81 listed securities with a total market capitalisation of $71.1 billion in 2018.

Indonesia Stock Exchange is a stock exchange based in Jakarta, Indonesia. It was previously known as the Jakarta Stock Exchange (JSX) before its name changed in 2007 after merging with the Surabaya Stock Exchange (SSX). As of the end of 2017, the Indonesia Stock Exchange had 566 listed companies with a combined market capitalisation of IDR 7,052.39 trillion. In December 2017, based on Single Identification Number there were 628,346 domestic investors, of which 51.33% were foreign investors and 48.67% domestic investors. As of December 29, 2017 total daily transactions averaged more than 312,000, with an average value of Rp 7,603 billion/day.

Canadian Securities Exchange (CSE), formerly the Canadian National Stock Exchange (CNSX), is an alternative stock exchange in Canada. It was the first full stock market to be approved by the Ontario Securities Commission in the past 70 years. The CSE offers simplified reporting requirements and reduced barriers to listing. It is an alternative for micro cap and emerging companies. It had been known as CNQ until the organization re-branded itself in November 2008. It is fully automated, rather than using the traditional "open outcry" physical trading floor system.

The Russian Trading System (RTS) was a stock market established in 1995 in Moscow, consolidating various regional trading floors into one exchange. Originally RTS was modeled on NASDAQ's trading and settlement software; in 1998 the exchange went on line with its own in-house system. Initially created as a non-profit organisation, it was transformed into a joint-stock company.

The Value Line Composite Index was launched on the Kansas City Board of Trade(KCBT) in 1982, pioneering the first market index to trade futures market, ushering in a ground-breaking approach to risk management. KCBOT dropped the Value Line indices effective 30th Aug 2013 and shifted the exchange distribution to NYSE’s Global Index Feed.

The SZSE Component Index is an index of 500 stocks that are traded at the Shenzhen Stock Exchange (SZSE). It is the main stock market index of SZSE.