Related Research Articles

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation.

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after the stock market crash of 1929. It is an integral part of United States securities regulation. It is legislated pursuant to the Interstate Commerce Clause of the Constitution.

EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, performs automated collection, validation, indexing, acceptance, and forwarding of submissions by companies and others who are required by law to file forms with the U.S. Securities and Exchange Commission. The database contains a wealth of information about the Commission and the securities industry which is freely available to the public via the Internet.

The Securities Exchange Act of 1934 is a law governing the secondary trading of securities in the United States of America. A landmark of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law.

The SEC filing is a financial statement or other formal document submitted to the U.S. Securities and Exchange Commission (SEC). Public companies, certain insiders, and broker-dealers are required to make regular SEC filings. Investors and financial professionals rely on these filings for information about companies they are evaluating for investment purposes. Many, but not all SEC filings are available online through the SEC's EDGAR database.

In corporate finance, a tender offer is a type of public takeover bid. The tender offer is a public, open offer or invitation by a prospective acquirer to all stockholders of a publicly traded corporation to tender their stock for sale at a specified price during a specified time, subject to the tendering of a minimum and maximum number of shares. In a tender offer, the bidder contacts shareholders directly; the directors of the company may or may not have endorsed the tender offer proposal.

A Form 10-K is an annual report required by the U.S. Securities and Exchange Commission (SEC), that gives a comprehensive summary of a company's financial performance. Although similarly named, the annual report on Form 10-K is distinct from the often glossy "annual report to shareholders," which a company must send to its shareholders when it holds an annual meeting to elect directors. The 10-K includes information such as company history, organizational structure, executive compensation, equity, subsidiaries, and audited financial statements, among other information.

A reverse takeover (RTO), reverse merger, or reverse IPO is the acquisition of a private company by an existing public company so that the private company can bypass the lengthy and complex process of going public. Sometimes, conversely, the public company is bought by the private company through an asset swap and share issue. The transaction typically requires reorganization of capitalization of the acquiring company.

Pennsylvania Real Estate Investment Trust is a publicly traded real estate investment trust that invests in shopping centers mostly in the Mid-Atlantic states.

Securities regulation in the United States is the field of U.S. law that covers transactions and other dealings with securities. The term is usually understood to include both federal and state-level regulation by governmental regulatory agencies, but sometimes may also encompass listing requirements of exchanges like the New York Stock Exchange and rules of self-regulatory organizations like the Financial Industry Regulatory Authority (FINRA).

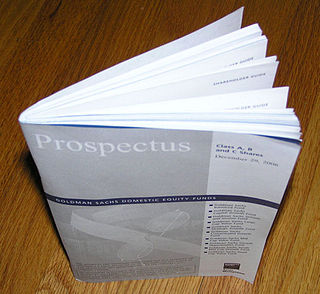

A prospectus, in finance, is a disclosure document that describes a financial security for potential buyers. It commonly provides investors with material information about mutual funds, stocks, bonds and other investments, such as a description of the company's business, financial statements, biographies of officers and directors, detailed information about their compensation, any litigation that is taking place, a list of material properties and any other material information. In the context of an individual securities offering, such as an initial public offering, a prospectus is distributed by underwriters or brokerages to potential investors. Today, prospectuses are most widely distributed through websites such as EDGAR and its equivalents in other countries.

A special purpose acquisition company, also known as a "blank check company", is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thus making it public without going through the traditional initial public offering process. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a merger or acquisition opportunity within a set timeframe. The opportunities usually have yet to be identified.

Evercore Inc., formerly known as Evercore Partners, is a global independent investment banking advisory firm founded in 1995 by Roger Altman, David Offensend, and Austin Beutner. The firm has advised on over $4.7 trillion of merger, acquisition, and restructuring transactions since its founding.

Form 8-K is a very broad form used to notify investors in United States public companies of specified events that may be important to shareholders or the United States Securities and Exchange Commission. This is one of the most common types of forms filed with the SEC. After a significant event like bankruptcy or departure of a CEO, a public company generally must file a Current Report on Form 8-K within four business days to provide an update to previously filed quarterly reports on Form 10-Q and/or Annual Reports on Form 10-K. Form 8-K is required to be filed by public companies with the SEC pursuant to the Securities Exchange Act of 1934, as amended.

Form 4 is a United States SEC filing that relates to insider trading. Every director, officer and owner of more than 10% of a class of equity securities registered under Section 12 of the Securities Exchange Act of 1934 must file with the United States Securities and Exchange Commission a statement of ownership regarding such security. The initial filing is on Form 3 and changes are reported on Form 4. The annual statement of beneficial ownership of securities is on Form 5. The forms contain information on the reporting person's relationship to the company and on purchases and sales of such equity securities.

Form 144, required under Rule 144, is filed by a person who intends to sell either restricted securities or control securities (i.e., securities held by affiliates. Form 144 is notification to the SEC of this intention to sell and must take place at the time the sell order is placed with the broker-dealer. The securities may be sold within the 90-day period after Form 144 is filed.

A venture round is a type of funding round used for venture capital financing, by which startup companies obtain investment, generally from venture capitalists and other institutional investors. The availability of venture funding is among the primary stimuli for the development of new companies and technologies.

Regulation S-K is a prescribed regulation under the US Securities Act of 1933 that lays out reporting requirements for various SEC filings used by public companies. Companies are also often called issuers, filers or registrants.

Regulation S-X is a prescribed regulation in the United States of America that lays out the specific form and content of financial reports, specifically the financial statements of public companies. It is cited as 17 C.F.R. Part 210; the name of the part is "Form and Content of and Requirements for Financial Statements, Securities Act of 1933, Securities Exchange Act of 1934, Public Utility Holding Company Act of 1935, Investment Company Act of 1940, Investment Advisers Act of 1940, and Energy Policy and Conservation Act of 1975".

Paul Alec Bilzerian is an American businessman and corporate takeover specialist.