Farrar, Straus and Giroux (FSG) is an American book publishing company, founded in 1946 by Roger W. Straus, Jr. and John C. Farrar. FSG is known for publishing literary books, and its authors have won numerous awards, including Pulitzer Prizes, National Book Awards, and Nobel Peace Prizes. The publisher is currently a division of Macmillan, whose parent company is the German publishing conglomerate Holtzbrinck Publishing Group.

The Panic of 1907 – also known as the 1907 Bankers' Panic or Knickerbocker Crisis – was a United States financial crisis that took place over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% from its peak the previous year. Panic occurred, as this was during a time of economic recession, and there were numerous runs on banks and trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. Primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops.

The panic was triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company. When this bid failed, banks that had lent money to the cornering scheme suffered runs that later spread to affiliated banks and trusts, leading a week later to the downfall of the Knickerbocker Trust Company—New York City's third-largest trust. The collapse of the Knickerbocker spread fear throughout the city's trusts as regional banks withdrew reserves from New York City banks. Panic extended across the nation as vast numbers of people withdrew deposits from their regional banks.

ICICI Bank Limited is an Indian multinational banking and financial services company headquartered in Mumbai, Maharashtra with its registered office in Vadodara, Gujarat. As of 2018, ICICI Bank is the second largest bank in India in terms of assets and market capitalisation. It offers a wide range of banking products and financial services for corporate and retail customers through a variety of delivery channels and specialised subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management. The bank currently has a network of 4867 branches and 14367 ATMs across India and has a presence in 17 countries including India.

The Canadian Western Bank is a bank that is based in Edmonton, and which operates primarily in western Canada. The bank serves personal and commercial clients in Western Canada.

The Canada Deposit Insurance Corporation is a Canadian federal Crown Corporation created by Parliament in 1967 to provide deposit insurance to depositors in Canadian commercial banks and savings institutions. CDIC insures Canadians' deposits held at Canadian banks up to C$100,000 in case of a bank failure. CDIC automatically insures many types of savings against the failure of a financial institution. However, the bank must be a CDIC member and not all savings are insured. CDIC is also Canada's resolution authority for banks, federally regulated credit unions, trust and loan companies as well as associations governed by the Cooperative Credit Associations Act that take deposits.

SunTrust Banks, Inc. is an American bank holding company. The largest subsidiary is SunTrust Bank. It had US$199 billion in assets as of March 31, 2018. SunTrust Bank's most direct corporate parent was established in 1891 in Atlanta, where its headquarters remain. On February 7, 2019, it was announced that SunTrust Banks would be bought by BB&T for $28 billion in an all-stock deal, creating the sixth largest U.S. lender in the biggest bank deal since the 2007-2009 financial crisis.

Isidor Straus was a German-born, Jewish, American businessman, politician, and co-owner of Macy's department store, along with his brother Nathan. He also served for just over a year as a member of the United States House of Representatives. He died with his wife, Ida, in the sinking of the passenger ship RMS Titanic.

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons before being acquired by Deutsche Bank in 1999.

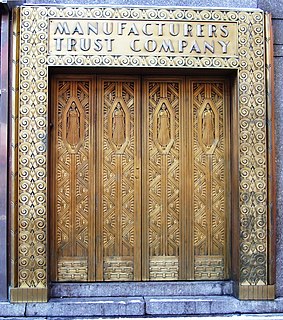

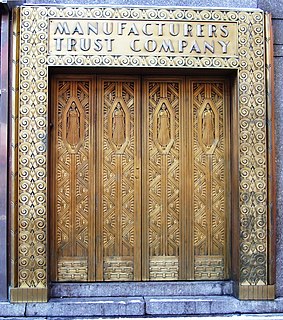

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufacturers Hanover Corporation. Charles J. Stewart was the company's first president and chairman.

Wilmington Trust is one of the top 10 largest US institutions by fiduciary assets. Wilmington Trust is currently a provider of international corporate and institutional services, investment management, and private banking, and is renowned for its prestigious brand and services. The firm was founded on July 8, 1903, as a banking, trust, and safe deposit company by DuPont president T. Coleman du Pont. In 2010, it became a subsidiary of M&T Bank.

Minebea Mitsumi, Inc. or NMB is a Japanese multinational corporation and a major producer of machinery components and electronics devices. International Asian business accounts for 80% of Minebea's production and 50% of its sales.

The Metropolitan Tower, owned by Metropolitan Properties of Chicago, is a skyscraper located at 310 S. Michigan Avenue in Chicago's East Chicago Landmark Historic Michigan Boulevard District in the Loop community area in Cook County, Illinois, United States and has been renovated as a condominium complex with 242 units. Residences range in size from 1,200 square feet (110 m2) to 4,000 square feet (370 m2). Penthouses feature 360 degree city views and private elevators. Prices run from $300,000 for a 762 square feet (70.8 m2) one-bedroom unit to $1.365 million for a 1,932 square feet (179.5 m2) three-bedroom. The Metropolitan Tower is also home for a branch of Chase Bank.

The Freedman's Saving and Trust Company, popularly known as the Freedman's Savings Bank, was a private corporation chartered by the U.S. government to encourage and guide the economic development of the newly emancipated African-American communities in the post-Civil War period. Although functioning only between 1865 and 1874, the company achieved notable successes as a leading financial institution of African-Americans. However, its failure was devastating to the newly emancipated black community. Its archives are valuable as an exhaustive collection of information regarding the African American community and its socio-economic life in the immediate aftermath of emancipation.

Jesse Isidor Straus served as the American ambassador to France from 1933 to 1936.

American Fletcher National Bank was an Indianapolis-based bank founded in 1839 that was eventually absorbed by Bank One and later Chase Bank. Since the merger of the Fletcher Trust Company with the American National Bank to form the American Fletcher National Bank and Trust Company at the end of 1954, it had been the largest or the second largest bank in the state of Indiana, often changing places with its Indianapolis-based rival Indiana National Bank for the top spot. From the mid-1950s through the late 1980s, American Fletcher National Bank and Trust, along with Indiana National Bank and Merchants National Bank, was one of the top three largest banks within Indianapolis and its holding company, American Fletcher Corporation, was one of the top three largest bank holding companies within the state, along with INB Financial Corporation and Merchants National Corporation.

The Mutual Alliance Trust Company was a trust company formed in New York City in 1902, with founders such as Cornelius Vanderbilt and William Rockefeller.

The Continental Bank and Trust Company of New York was a financial institution based in New York City, New York, United States. It was established in 1870 as the German-American Bank, which became the Continental Bank of New York. Originally in the Equitable Building at 120 Broadway, the bank was later headquartered at 50 Wall Street, 25 Broad Street, and starting in 1932 the Continental Bank Building It became known as the “brokers bank” for its collaboration with Wall Street brokers and investment banking interests. The institution was renamed the Continental Bank and Trust Company of New York around 1929, at which point it was involved in extending its business with acquisitions of commercial banking and fiduciary operations. Acquired banks included the Fidelity Trust Company in 1929, International Trust Company and Straus National Bank and Trust Company in 1931, and Industrial National Bank later that year. In 1947, the bank earned $804,000 in net profits. As of December 31, 1947, Continental had total resources of $202,000,000, and deposits of $188,000,000. It merged with the Chemical Bank and Trust Company in 1948.