Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world.

JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City. JPMorgan Chase is ranked by S&P Global as the largest bank in the United States and the sixth largest bank in the world by total assets, with total assets of US$2.687 trillion. It is also the world's most valuable bank by market capitalization. JPMorgan Chase is incorporated in Delaware.

The Emergency Banking Act, Public Law 73-1, 48 Stat. 1, was an act passed by the United States Congress in March 1933 in an attempt to stabilize the banking system. Beginning on February 14, 1933, Michigan, an industrial state that had been hit particularly hard by the Great Depression in the United States, declared an eight-day bank holiday. Fears of other bank closures spread from state to state as people rushed to withdraw their deposits while they still could do so. Within weeks, all other states held their own bank holidays in an attempt to stem the bank runs. Following his inauguration on March 4, 1933, President Franklin Roosevelt set out to rebuild confidence in the nation's banking system. On March 6 he declared a four-day national banking holiday that kept all banks shut until Congress could act. A draft law, prepared by the Treasury staff during Herbert Hoover's administration, was passed on March 9, 1933. The new law allowed the twelve Federal Reserve Banks to issue additional currency on good assets so that banks that reopened would be able to meet every legitimate call.

The Panic of 1907 – also known as the 1907 Bankers' Panic or Knickerbocker Crisis – was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% from its peak the previous year. Panic occurred, as this was during a time of economic recession, and there were numerous runs on banks and trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. Primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops. The panic was triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company. When this bid failed, banks that had lent money to the cornering scheme suffered runs that later spread to affiliated banks and trusts, leading a week later to the downfall of the Knickerbocker Trust Company—New York City's third-largest trust. The collapse of the Knickerbocker spread fear throughout the city's trusts as regional banks withdrew reserves from New York City banks. Panic extended across the nation as vast numbers of people withdrew deposits from their regional banks.

The National Bank of Detroit (NBD), later renamed NBD Bank, was a bank that operated mostly in the Midwestern United States. Following its merger with First National Bank of Chicago, the bank was ultimately acquired and merged into Bank One, at which point the NBD name was discontinued. Today, what was once NBD is owned by JPMorgan Chase & Co.

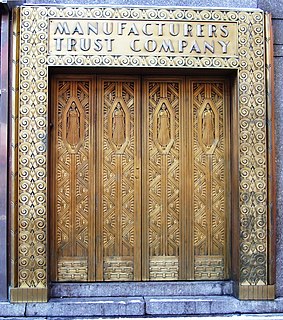

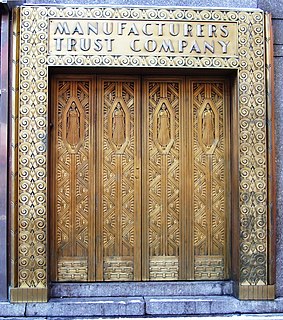

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufacturers Hanover Corporation. Charles J. Stewart was the company's first president and chairman.

Northern Trust Corporation is a financial services company headquartered in Chicago, Illinois that caters to corporations, institutional investors, and ultra high net worth individuals. It is one of the largest banks in the United States and one of the oldest banks in continuous operation. As of December 31, 2018, it had $1.07 trillion in assets under management and $10.13 trillion in assets under custody. Northern Trust Corporation is incorporated in Delaware.

Firstar Corporation was a Milwaukee, Wisconsin-based regional bank holding company that later became U.S. Bancorp, a nationwide bank corporation in the United States. In 2001, Firstar acquired U.S. Bancorp and assumed its name, moving its headquarters to Minneapolis.

First Chicago Bank was a Chicago-based retail and commercial bank tracing its roots back to 1863. Over the years, the bank operated under several names including The First National Bank of Chicago and First Chicago NBD. In 1998, First Chicago NBD merged with Banc One Corporation to form Bank One Corporation, today a part of Chase.

Charles Wyman Morse was an American businessman and speculator who committed frauds and engaged in corrupt business practices. At one time he controlled 13 banks. Known as the "Ice King" early in his career out of New York City, through Tammany Hall corruption he established a monopoly in New York's ice business, before buying several shipping companies and moving into high finance. His attempt to manipulate the price of copper-shares set off a wave of selling that developed into the Panic of 1907. Jailed for violating federal banking laws, he faked serious illness and was released. Later he was indicted for war profiteering and fraud.

Bank of America Private Bank was founded in 1853 as the United States Trust Company of New York. It operated independently until 2000, when it was acquired by Charles Schwab, and Co. and subsequently sold to, and became a subsidiary of, Bank of America in 2007. U.S. Trust provides investment management, wealth structuring, and credit and lending services to clients.

W.O.S. Thorne, more generally known as Oakleigh Thorne, was an American businessperson, a publisher of tax guides, a banker, and a philanthropist. Among his early ventures were the consolidation of brickyards on the Hudson River, and later he was president of the National Switch and Signal Company and Westinghouse Electric's vice president. In 1900 he came to New York City as vice president of the International Banking and Trust Company, becoming president. That company became the Trust Company of America, of which Thorne was serving as president. He helped the company survive a bank run during the Panic of 1907, securing the backing of J. Pierpont Morgan and European sources. He served as a director of Wells Fargo & Company from 1902 to 1918. In addition to his connection with Commerce Clearing House, Wells Fargo, and the Trust Company of America, Thorne was a director of the Corporation Trust Company and of the Bank of Millbrook. After purchasing Briarcliff Farms in 1918, he became a breeder of champion Angus cattle. He was inducted into the Angus Heritage Foundation Hall of Fame in 1934.

Walter E. Heller (1891–1969) was a US financier and philanthropist, who founded Walter E. Heller and Company, Inc., Chicago, Illinois with money borrowed from his father in 1919. He originally started the company to do "automobile financing" as autos became more popular in the 1920s. The firm developed into a highly successful, multi-faceted international financial company that was a leader in various fields of finance, particularly in factoring.

Morris Plan Banks were part of a historic banking system in the United States created to assist the middle class in obtaining loans that were often difficult to obtain at traditional banks. They were established by Arthur J. Morris (1881–1973), a lawyer in Norfolk, Virginia, who noticed the difficulty his working clients had in getting loans. The first was started in 1910 in Norfolk, and the second in Atlanta in 1911.

The Chatham Phenix National Bank and Trust Company was a bank in New York City connected with the Chatham Phenix Corporation. Its predecessor Chatham and Phenix National Bank was formed in 1911 when Chatham National Bank paid $1,880,000 to absorb the asset of the Phenix National Bank. The bank grew significantly as it absorbed smaller banking institutions, such as Mutual Alliance Trust Company and Century Bank in 1915, at which point Chatham and Phenix National Bank became the "first national bank to operate branches in the same city with the main bank."

The Trust Company of America was a large company in New York City. Founded on May 23, 1899 in Albany, New York, its founding president was Ashbel P. Fitch and it was initially located in the Singer Building in Manhattan's Financial District. In 1907 the company absorbed the Colonial Trust Company, a commercial bank. During the Panic of 1907 it was the target of a bank run starting on October 23, 1907, which it survived with the backing of J. Pierpont Morgan and an infusion of gold from the Bank of England and other European sources. The company ultimately represented a consolidation of the North American Trust Company, the former Trust Company of America, the City Trust Company and the Colonial Trust Company. The Trust Company of America was absorbed by the Equitable Trust Company in the spring of 1912.

The North American Trust Company was a trust company based in New York City. It was organized in early 1896. At the start of 1898, the company was located in the American Surety Building at 100 Broadway. On April 3, 1900, the directors of the International Banking and Trust Company and the North American Trust Company unanimously voted to merge the two organizations under the new name the North American Trust Company. Around either other organizations were acquired in 1901, and in 1905 the City Trust, the North American Trust, and the Trust Company of America merged in what the Times called "the most important trust company consolidation of recent years." The new company was named the Trust Company of America.

The Continental Bank and Trust Company of New York was a financial institution based in New York City, New York, United States. It was established in 1870 as the German-American Bank, which became the Continental Bank of New York. Originally in the Equitable Building at 120 Broadway, the bank was later headquartered at 50 Wall Street, 25 Broad Street, and starting in 1932 the Continental Bank Building It became known as the “brokers bank” for its collaboration with Wall Street brokers and investment banking interests. The institution was renamed the Continental Bank and Trust Company of New York around 1929, at which point it was involved in extending its business with acquisitions of commercial banking and fiduciary operations. Acquired banks included the Fidelity Trust Company in 1929, International Trust Company and Straus National Bank and Trust Company in 1931, and Industrial National Bank later that year. In 1947, the bank earned $804,000 in net profits. As of December 31, 1947, Continental had total resources of $202,000,000, and deposits of $188,000,000. It merged with the Chemical Bank and Trust Company in 1948.

The Straus National Bank and Trust Company was a financial institution based in New York. Founded in In 1928, in 1931 it merged with the Continental Bank and Trust Company in New York.