Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world.

Truist Financial Corporation is an American bank holding company headquartered in Charlotte, North Carolina. The company was formed in December 2019 as the result of the merger of BB&T and SunTrust Banks. Its bank operates 2,049 branches in 15 states and Washington, D.C., and offers consumer and commercial banking, securities brokerage, asset management, mortgage, and insurance products and services. It is on the list of largest banks in the United States by assets. Its subsidiary, McGriff Insurance Services, was one of the largest insurance brokers in the world. In its history, it has made 106 mergers and acquisitions. Since it took over Southern National Bank in 1995, it has made 43 deals.

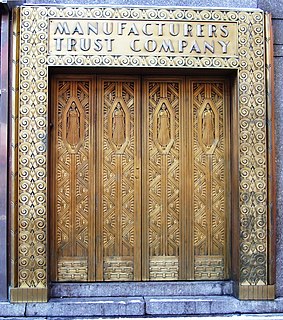

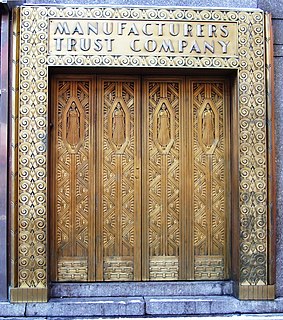

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufacturers Hanover Corporation. Charles J. Stewart was the company's first president and chairman.

The Corn Exchange Bank was a retail bank founded in 1853 in New York state. Over the years, the company acquired many community banks.

The Bank of United States, founded by Joseph S. Marcus in 1913 at 77 Delancey Street in New York City, was a New York City bank that failed in 1931. The bank run on its Bronx branch is said to have started the collapse of banking during the Great Depression.

The Manhattan Company was a New York bank and holding company established on September 1, 1799. The company merged with Chase National Bank in 1955 to form the Chase Manhattan Bank. It is the oldest of the predecessor institutions that eventually formed the current JPMorgan Chase & Co.

Bank of America Private Bank was founded in 1853 as the United States Trust Company of New York. It operated independently until 2000, when it was acquired by Charles Schwab, and Co. and subsequently sold to, and became a subsidiary of, Bank of America in 2007. U.S. Trust provides investment management, wealth structuring, and credit and lending services to clients.

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets. Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California. Wachovia provided global services through more than 40 offices around the world.

The New York Trust Company was a large trust and wholesale-banking business that specialized in servicing large industrial accounts. It merged with the Chemical Corn Exchange Bank and eventually the merged entity became Chemical Bank.

Girard Bank was a Philadelphia based bank founded by Stephen Girard in 1811. The bank was acquired by Mellon Bank in 1983 and then, two decades later, by Citizens Bank.

American Fletcher National Bank was an Indianapolis-based bank founded in 1839 that was eventually absorbed by Bank One and later Chase Bank. Since the merger of the Fletcher Trust Company with the American National Bank to form the American Fletcher National Bank and Trust Company at the end of 1954, it had been the largest or the second largest bank in the state of Indiana, often changing places with its Indianapolis-based rival Indiana National Bank for the top spot. From the mid-1950s through the late 1980s, American Fletcher National Bank and Trust, along with Indiana National Bank and Merchants National Bank, was one of the top three largest banks within Indianapolis and its holding company, American Fletcher Corporation, was one of the top three largest bank holding companies within the state, along with INB Financial Corporation and Merchants National Corporation.

Valley National Bank of Arizona was a bank based in Phoenix, Arizona, founded in 1900 and acquired by Bank One in 1992. The bank was one of Arizona's leading financial institutions during the 20th century and the last major independent bank in Arizona at the time of its acquisition.

Consolidated National Bank of New York was a bank operating in New York City. Also referred to in the press as Consolidated National Bank, the institution was organized on July 1, 1902 with capital of $1 million. Wrote The New York Times, the bank was "founded with the idea of cornering the business of the Consolidated Exchange and its brokers." The bank opened for business at 57 Broadway on September 22, 1902, and a year later the bank took out a five-year lease at the Exchange Court Building. In 1906, the Consolidated Stock Exchange withdrew its deposits with the Consolidated National Bank. In 1909, the bank voted to acquire the assets of Oriental Bank and merge them with Consolidated, creating the National Reserve Bank. The Consolidated name was operative for a short time afterwards.

The National Reserve Bank of the City of New York was a bank in New York City that was formed from a merger of Consolidated National Bank and Oriental Bank in 1909. Deposits of the National Bank Reserve Bank were about $4,352,561 on January 13, 1914 and the bank had "a large number of country bank accounts, chiefly in the West and Southwest," handling a large degree of cotton exchange business. On January 27, 1914, the National Reserve Bank was taken over by the Mutual Alliance Trust Company, operating for a time as the Reserve Branch of the trust company.

The Mutual Alliance Trust Company was a trust company formed in New York City in 1902, with founders such as Cornelius Vanderbilt and William Rockefeller.

The Chatham Phenix National Bank and Trust Company was a bank in New York City connected with the Chatham Phenix Corporation. Its predecessor Chatham and Phenix National Bank was formed in 1911 when Chatham National Bank paid $1,880,000 to absorb the asset of the Phenix National Bank. The bank grew significantly as it absorbed smaller banking institutions, such as Mutual Alliance Trust Company and Century Bank in 1915, at which point Chatham and Phenix National Bank became the "first national bank to operate branches in the same city with the main bank."

The Trust Company of America was a large company in New York City. Founded on May 23, 1899 in Albany, New York, its founding president was Ashbel P. Fitch and it was initially located in the Singer Building in Manhattan's Financial District. In 1907 the company absorbed the Colonial Trust Company, a commercial bank. During the Panic of 1907 it was the target of a bank run starting on October 23, 1907, which it survived with the backing of J. Pierpont Morgan and an infusion of gold from the Bank of England and other European sources. The company ultimately represented a consolidation of the North American Trust Company, the former Trust Company of America, the City Trust Company and the Colonial Trust Company. The Trust Company of America was absorbed by the Equitable Trust Company in the spring of 1912.

The Straus National Bank and Trust Company was a financial institution based in Chicago, Illinois. It was founded in 1928 out of the Straus Trust Company. In 1933 the bank changed its name from the Straus National Bank and Trust Company to the American National Bank and Trust Company. In 1973, the Walter E. Heller International Corporation acquired the American National Bank and Trust Company of Chicago. As the fifth largest bank in Chicago at the time, American National had assets of $1.3 billion. In 1984 First Chicago Corporation acquired American National Corporation, the bank's holding company, for around $275 million.

The Straus National Bank and Trust Company was a financial institution based in New York. Founded in In 1928, in 1931 it merged with the Continental Bank and Trust Company in New York.

The Astor Trust Company was a historic American banking organization. The firm merged with Bankers Trust in 1917.