Taxation in Georgia may refer to:

Taxation in Georgia may refer to:

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to collectively fund government spending, public expenditures, or as a way to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent.

A land value tax (LVT) is a levy on the value of land without regard to buildings, personal property and other improvements. It is also known as a location value tax, a point valuation tax, a site valuation tax, split rate tax, or a site-value rating.

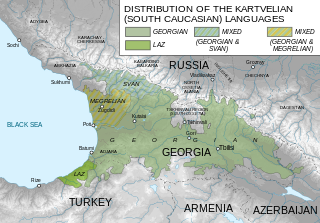

Georgian is the most widely spoken Kartvelian language; it also serves as the literary language or lingua franca for speakers of related languages. It is the official language of Georgia and the native or primary language of 87.6% of its population. Its speakers today amount to approximately four million. Georgian is written in its own unique alphabet.

A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. A dividend tax is in addition to any tax imposed directly on the corporation on its profits. Some jurisdictions do not tax dividends.

"No taxation without representation" is a political slogan that originated in the American Revolution and which expressed one of the primary grievances of the American colonists for Great Britain. In short, many colonists believed that as they were not represented in the distant British parliament, any taxes it imposed on the colonists were unconstitutional and were a denial of the colonists' rights as Englishmen.

In addition to federal income tax collected by the United States, most individual U.S. states collect a state income tax. Some local governments also impose an income tax, often based on state income tax calculations. Forty-two states and many localities in the United States impose an income tax on individuals. Eight states impose no state income tax, and a ninth, New Hampshire, imposes an individual income tax on dividends and interest income but not other forms of income. Forty-seven states and many localities impose a tax on the income of corporations.

The Constitution of the State of Georgia is the governing document of the U.S. State of Georgia. The constitution outlines the three branches of government in Georgia. The legislative branch is embodied in the bicameral General Assembly. The executive branch is headed by the Governor. The judicial branch is headed by the Supreme Court. Besides providing for the organization of these branches, the Constitution carefully outlines which powers each branch may exercise.

International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries, or the international aspects of an individual country's tax laws as the case may be. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residence-based, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more.

Rate or rates may refer to:

James Mark Wilcox was a U.S. Representative from Florida. He is remembered as the author of the Wilcox Municipal Bankruptcy Act, which became law in 1934, a bill which initially allowed a city in his district, West Palm Beach, to adjust its bonded indebtedness and avoid bankruptcy. It was later invoked to help New York City avoid bankruptcy in 1972.

The Urban-Brookings Tax Policy Center, typically shortened to the Tax Policy Center (TPC), is a nonpartisan think tank based in Washington D.C., United States. A joint venture of the Urban Institute and the Brookings Institution, it aims to provide independent analyses of current and longer-term tax issues, and to communicate its analyses to the public and to policymakers. TPC combines national specialists in tax, expenditure, budget policy, and microsimulation modeling to concentrate on five overarching areas of tax policy: fair, simple and efficient taxation, social policy in the tax code, business tax reform, long-term implications of tax and budget choices, and state tax issues.

Iran and Georgia have had relations for millennia, although official diplomatic relations between the two nations in the 20th century were established on May 15, 1992. Georgia is represented by its embassy in Tehran, while Iran has its representative embassy in Tbilisi. Iran is an important trade partner of Georgia.

Georgia most commonly refers to:

Alaska Aces may refer to:

Department of Revenue can refer to agencies of various governments:

The New Departure refers to the political strategy used by the US Democratic Party after 1865 to distance itself from its pro-slavery and Copperhead history in an effort to broaden its political base and to focus on issues on which it had more of an advantage, especially economic ones. The New Departure theory also argued that the Fourteenth Amendment and the Fifteenth Amendment had already given women suffrage, but that argument was rejected in state and federal courts.

Taxation in Pakistan is a system of compulsory contributions to state revenue, levied by the government on individuals or businesses, based on ability to pay, as a means of making individuals or organizations contribute towards the costs of public services. The country’s tax system includes direct and indirect taxes that are levied by the federal and provincial governments. The tax system in Pakistan is administered by the Federal Board of Revenue (FBR).

Taxes in Germany are levied by the federal government, the states (Länder) as well as the municipalities (Städte/Gemeinden). Many direct and indirect taxes exist in Germany; income tax and VAT are the most significant.

Taxes in Georgia are collected on both national and local levels. The most important taxes are collected on national level, these taxes include an income tax, corporate taxes and value added tax. On local level property taxes as well as various fees are collected. There are 6 flat tax rates in Georgia - Corporate Profit Tax, Value Added Tax, Excise Tax, Personal Income Tax, Import Tax and Property Tax.