Vista Bank may refer to:

- Vista Bank (Dallas), a bank in the United States

- Vista Bank (Africa), a multinational banking group

- Vista Bank (Romania) , a bank in Romania

Vista Bank may refer to:

Up or UP may refer to:

Bala may refer to:

Romanian may refer to:

BT or Bt may refer to:

Isla Vista is an unincorporated community in Santa Barbara County, California, in the United States. As of 2020 census, the community had a population of 15,500. For statistical purposes, the United States Census Bureau has defined the community as a census-designated place (CDP). The majority of residents are college students at the University of California, Santa Barbara, or Santa Barbara City College. The beachside community of Isla Vista lies on a flat plateau about 30 feet (9 m) in elevation, separated from the beach by a bluff.

Marcus, Markus, Márkus or Mărcuș may refer to:

Boz, BoZ or BOZ may refer to:

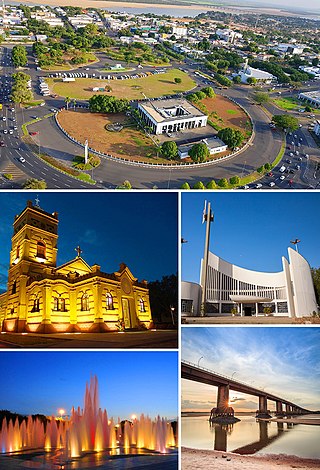

Boa Vista is the capital of the Brazilian state of Roraima. Situated on the western bank of the Branco River, the city lies 220 km (140 mi) from Brazil's border with Venezuela. It is the only Brazilian state capital located entirely north of the equator.

Constantia may refer to:

Geoagiu is a town in Hunedoara County, in the historical region of Transylvania, Romania. It administers ten villages: Aurel Vlaicu, Băcâia (Bakonya), Bozeș (Bózes), Cigmău (Csigmó), Gelmar (Gyalmár), Geoagiu-Băi (Feredőgyógy), Homorod (Homoród), Mermezeu-Văleni (Nyírmező), Renghet (Renget), and Văleni (Valény).

Santana may refer to:

Boa Vista or Boavista may refer to:

Windows Vista is a major release of the Windows NT operating system developed by Microsoft. It was the direct successor to Windows XP, released five years earlier, which was then the longest time span between successive releases of Microsoft Windows. It was released to manufacturing on November 8, 2006, and over the following two months, it was released in stages to business customers, original equipment manufacturers (OEMs), and retail channels. On January 30, 2007, it was released internationally and was made available for purchase and download from the Windows Marketplace; it is the first release of Windows to be made available through a digital distribution platform.

Reconstruction may refer to:

RAC or Rac may refer to:

BVB or bvb may refer to:

BRD may refer to:

The 2014 Algarve Cup was the 21st edition of the Algarve Cup, an invitational women's football tournament held annually in Portugal. It took place between 5–12 March 2014.

Raiffeisenbank or Raiffeisen Bank refers to cooperative banks in Europe that are rooted in the early credit unions of Friedrich Wilhelm Raiffeisen. The name is found in: