Related Research Articles

The Kyoto Protocol (Japanese: 京都議定書, Hepburn: Kyōto Giteisho) was an international treaty which extended the 1992 United Nations Framework Convention on Climate Change (UNFCCC) that commits state parties to reduce greenhouse gas emissions, based on the scientific consensus that global warming is occurring and that human-made CO2 emissions are driving it. The Kyoto Protocol was adopted in Kyoto, Japan, on 11 December 1997 and entered into force on 16 February 2005. There were 192 parties (Canada withdrew from the protocol, effective December 2012) to the Protocol in 2020.

Environmental finance is a field within finance that employs market-based environmental policy instruments to improve the ecological impact of investment strategies. The primary objective of environmental finance is to regress the negative impacts of climate change through pricing and trading schemes. The field of environmental finance was established in response to the poor management of economic crises by government bodies globally. Environmental finance aims to reallocate a businesses resources to improve the sustainability of investments whilst also retaining profit margins.

The Clean Development Mechanism (CDM) is a United Nations-run carbon offset scheme allowing countries to fund greenhouse gas emissions-reducing projects in other countries and claim the saved emissions as part of their own efforts to meet international emissions targets. It is one of the three Flexible Mechanisms defined in the Kyoto Protocol. The CDM, defined in Article 12 of the Protocol, was intended to assist non-Annex I countries achieve sustainable development and reduce their carbon footprints, and to assist Annex I countries achieve compliance with greenhouse gas emissions reduction commitments.

Carbon offsetting is a carbon trading mechanism that enables entities to compensate for offset greenhouse gas emissions by investing in projects that reduce, avoid, or remove emissions elsewhere. When an entity invests in a carbon offsetting program, it receives carbon credit or offset credit, which account for the net climate benefits that one entity brings to another. After certification by a government or independent certification body, credits can be traded between entities. One carbon credit represents a reduction, avoidance or removal of one metric tonne of carbon dioxide or its carbon dioxide-equivalent (CO2e).

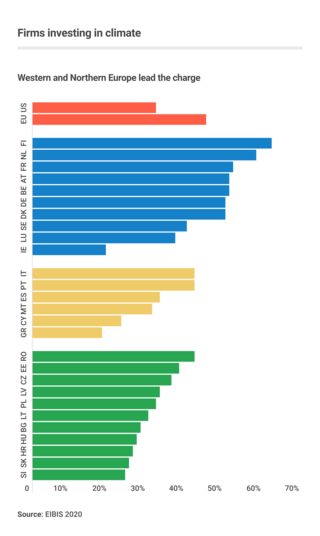

Business action on climate change is a topic which since 2000 includes a range of activities relating to climate change, and to influencing political decisions on climate change-related regulation, such as the Kyoto Protocol. Major multinationals have played and to some extent continue to play a significant role in the politics of climate change, especially in the United States, through lobbying of government and funding of climate change deniers. Business also plays a key role in the mitigation of climate change, through decisions to invest in researching and implementing new energy technologies and energy efficiency measures.

Flexible mechanisms, also sometimes known as Flexibility Mechanisms or Kyoto Mechanisms, refers to emissions trading, the Clean Development Mechanism and Joint Implementation. These are mechanisms defined under the Kyoto Protocol intended to lower the overall costs of achieving its emissions targets. These mechanisms enable Parties to achieve emission reductions or to remove carbon from the atmosphere cost-effectively in other countries. While the cost of limiting emissions varies considerably from region to region, the benefit for the atmosphere is in principle the same, wherever the action is taken.

Joint Implementation (JI) is one of three flexibility mechanisms set out in the Kyoto Protocol to help countries with binding greenhouse gas emissions targets meet their treaty obligations. Under Article 6, any Annex I country can invest in a project to reduce greenhouse gas emissions in any other Annex I country as an alternative to reducing emissions domestically. In this way countries can lower the costs of complying with their Kyoto targets by investing in projects where reducing emissions may be cheaper and applying the resulting Emission Reduction Units (ERUs) towards their commitment goal.

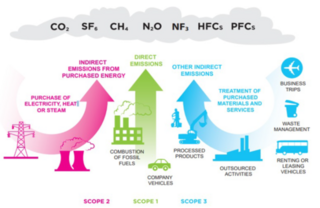

Carbon accounting is a framework of methods to measure and track how much greenhouse gas (GHG) an organization emits. It can also be used to track projects or actions to reduce emissions in sectors such as forestry or renewable energy. Corporations, cities and other groups use these techniques to help limit climate change. Organizations will often set an emissions baseline, create targets for reducing emissions, and track progress towards them. The accounting methods enable them to do this in a more consistent and transparent manner.

A mobile emission reduction credit (MERC) is an emission reduction credit generated within the transportation sector. The term “mobile sources” refers to motor vehicles, engines, and equipment that move, or can be moved, from place to place. Mobile sources include vehicles that operate on roads and highways ("on-road" or "highway" vehicles), as well as nonroad vehicles, engines, and equipment. Examples of mobile sources are passenger cars, light trucks, large trucks, buses, motorcycles, earth-moving equipment, nonroad recreational vehicles (such as dirt bikes and snowmobiles), farm and construction equipment, cranes, lawn and garden power tools, marine engines, ships, railroad locomotives, and airplanes. In California, mobile sources account for about 60 percent of all ozone forming emissions and for over 90 percent of all carbon monoxide (CO) emissions from all sources.

"Supplementarity", also referred to as "the supplementary principle", is one of the main principles of the Kyoto Protocol. The concept is that internal abatement of emissions should take precedence before external participation in flexible mechanisms. These mechanisms include emissions trading, Clean Development Mechanism (CDM), and Joint Implementation (JI).

Certified emission reductions (CERs) originally designed a type of emissions unit issued by the Clean Development Mechanism (CDM) Executive Board for emission reductions achieved by CDM projects and verified by a DOE under the rules of the Kyoto Protocol.

The carboNZero programme and CEMARS programme are the world’s first internationally accredited greenhouse gas (GHG) certification schemes under ISO 14065. They provide tools for organisations, products, services and events to measure and reduce their greenhouse gas emissions, and optionally offset it. The programmes are owned and operated by Toitū Envirocare - Enviro-Mark Solutions Limited, a wholly owned subsidiary of Landcare Research.

ClimateCare is a profit for purpose environmental and social impact company known for its role providing carbon offset services, with a particular focus on using carbon and other results based finance to support its 'Climate+Care Projects'. It also provides businesses and governments with sustainable development programmes, environmental and social impact measurement and project development.

Carbon emission trading (also called carbon market, emission trading scheme (ETS) or cap and trade) is a type of emissions trading scheme designed for carbon dioxide (CO2) and other greenhouse gases (GHGs). A form of carbon pricing, its purpose is to limit climate change by creating a market with limited allowances for emissions. Carbon emissions trading is a common method that countries use to attempt to meet their pledges under the Paris Agreement, with schemes operational in China, the European Union, and other countries.

ecosecurities is a company specialized in carbon markets and greenhouse gas (GHG) mitigation projects worldwide. ecosecurities specializes in sourcing, developing and financing projects on renewable energy, energy efficiency, forestry and waste management with a positive environmental impact.

Emissions reduction currency systems (ERCS) are schemes that provide a positive economic and or social reward for reductions in greenhouse gas emissions, either through distribution or redistribution of national currency or through the publishing of coupons, reward points, local currency, or complementary currency.

The credit channel mechanism of monetary policy describes the theory that a central bank's policy changes affect the amount of credit that banks issue to firms and consumers for purchases, which in turn affects the real economy.

Pedro Moura Costa is an entrepreneur involved in environmental finance with a focus on the international efforts for greenhouse gas (GHG) emission reductions. Of particular relevance, he was the founder and President of EcoSecurities Group Plc., one of the leading project developers for the international carbon markets, and has written widely about the policy and science of climate change mitigation, including contributions to the Intergovernmental Panel on Climate Change (IPCC) reports.

The Verified Carbon Standard (VCS), formerly the Voluntary Carbon Standard, is a standard for certifying carbon credits to offset emissions. VCS is administered by Verra, a 501(c)(3) organization. Verra is a certifier of voluntary carbon offsets. As of 2024, more than 2,300 projects were registered under the Verified Carbon Standard (VCS), spanning various sectors such as AFOLU, energy, transport, waste, manufacturing industries, and others. These projects have collectively issued over 1.3 billion credits, with more than 776 million credits retired to date.

Mayanna Berrin v. Delta Air Lines Inc. is an ongoing civil action lawsuit brought by the law firm Haderlein and Kouyoumdjian LLP against Delta Air Lines. In their complaint, the plaintiffs argue that Delta Air Lines' advertising claim of carbon neutrality is false and misleading, in violation of California state advertising statutes.

References

A good article that discusses the weighted average cost of carbon has been published by KyotoPlanet, view the eBook at pages 98 –100