In materials science

- Stress–strain curve — physical relationship between the stress and strain of a particular material

Yield curve or Yield-curve spread usually refers to the relationships among bond yields of different maturities.

Yield curve or Yield-curve spread may also refer to:

In economics and finance, arbitrage is the practice of taking advantage of a difference in prices in two or more markets – striking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which the unit is traded. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price.

In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor. The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure.

In engineering, deformation may be elastic or plastic. If the deformation is negligible, the object is said to be rigid.

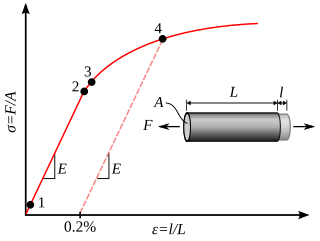

In engineering and materials science, a stress–strain curve for a material gives the relationship between stress and strain. It is obtained by gradually applying load to a test coupon and measuring the deformation, from which the stress and strain can be determined. These curves reveal many of the properties of a material, such as the Young's modulus, the yield strength and the ultimate tensile strength.

In finance, a spot contract, spot transaction, or simply spot, is a contract of buying or selling a commodity, security or currency for immediate settlement on the spot date, which is normally two business days after the trade date. The settlement price is called spot price. A spot contract is in contrast with a forward contract or futures contract where contract terms are agreed now but delivery and payment will occur at a future date.

In finance, the yield on a security is a measure of the ex-ante return to a holder of the security. It is one component of return on an investment, the other component being the change in the market price of the security. It is a measure applied to fixed income securities, common stocks, preferred stocks, convertible stocks and bonds, annuities and real estate investments.

Stress–strain analysis is an engineering discipline that uses many methods to determine the stresses and strains in materials and structures subjected to forces. In continuum mechanics, stress is a physical quantity that expresses the internal forces that neighboring particles of a continuous material exert on each other, while strain is the measure of the deformation of the material.

In finance, the yield curve is a graph which depicts how the yields on debt instruments – such as bonds – vary as a function of their years remaining to maturity. Typically, the graph's horizontal or x-axis is a time line of months or years remaining to maturity, with the shortest maturity on the left and progressively longer time periods on the right. The vertical or y-axis depicts the annualized yield to maturity.

An interest rate future is a futures contract with an interest-bearing instrument as the underlying asset. It is a particular type of interest rate derivative. Examples include Treasury-bill futures, Treasury-bond futures and Eurodollar futures.

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, mergers & acquisitions, or to expand business. It is a longer-term debt instrument indicating that a corporation has borrowed a certain amount of money and promises to repay it in the future under specific terms. Corporate debt instruments with maturity shorter than one year are referred to as commercial paper.

Fixed-income arbitrage is a group of market-neutral-investment strategies that are designed to take advantage of differences in interest rates between varying fixed-income securities or contracts. Arbitrage in terms of investment strategy, involves buying securities on one market for immediate resale on another market in order to profit from a price discrepancy.

In finance, the yield spread or credit spread is the difference between the quoted rates of return on two different investments, usually of different credit qualities but similar maturities. It is often an indication of the risk premium for one investment product over another. The phrase is a compound of yield and spread.

In materials science and engineering, the yield point is the point on a stress–strain curve that indicates the limit of elastic behavior and the beginning of plastic behavior. Below the yield point, a material will deform elastically and will return to its original shape when the applied stress is removed. Once the yield point is passed, some fraction of the deformation will be permanent and non-reversible and is known as plastic deformation.

In materials science, hardness is a measure of the resistance to localized plastic deformation, such as an indentation or a scratch (linear), induced mechanically either by pressing or abrasion. In general, different materials differ in their hardness; for example hard metals such as titanium and beryllium are harder than soft metals such as sodium and metallic tin, or wood and common plastics. Macroscopic hardness is generally characterized by strong intermolecular bonds, but the behavior of solid materials under force is complex; therefore, hardness can be measured in different ways, such as scratch hardness, indentation hardness, and rebound hardness. Hardness is dependent on ductility, elastic stiffness, plasticity, strain, strength, toughness, viscoelasticity, and viscosity. Common examples of hard matter are ceramics, concrete, certain metals, and superhard materials, which can be contrasted with soft matter.

For interest rate swaps, the Swap rate is the fixed rate that the swap "receiver" demands in exchange for the uncertainty of having to pay a short-term (floating) rate, e.g. 3 months LIBOR over time. Analogous to YTM for bonds, the swap rate is then the market's quoted price for entering the swap in question.

The Interpolated Spread, I-spread or ISPRD of a bond is the difference between its yield to maturity and the linearly interpolated yield for the same maturity on an appropriate reference yield curve. The reference curve may refer to government debt securities or interest rate swaps or other benchmark instruments, and should always be explicitly specified. If the bond is expected to repay some principal before its final maturity, then the interpolation may be based on the weighted-average life, rather than the maturity.

The Z-spread, ZSPRD, zero-volatility spread, or yield curve spread of a bond is the parallel shift or spread over the zero-coupon Treasury yield curve required for discounting a predetermined cash flow schedule to arrive at its present market price. The Z-spread is also widely used in the credit default swap (CDS) market as a measure of credit spread that is relatively insensitive to the particulars of specific corporate or government bonds.

Thermomechanical analysis (TMA) is a technique used in thermal analysis, a branch of materials science which studies the properties of materials as they change with temperature.

Fixed-income attribution is the process of measuring returns generated by various sources of risk in a fixed income portfolio, particularly when multiple sources of return are active at the same time.

Option-adjusted spread (OAS) is the yield spread which has to be added to a benchmark yield curve to discount a security's payments to match its market price, using a dynamic pricing model that accounts for embedded options. OAS is hence model-dependent. This concept can be applied to a mortgage-backed security (MBS), or another bond with embedded options, or any other interest rate derivative or option. More loosely, the OAS of a security can be interpreted as its "expected outperformance" versus the benchmarks, if the cash flows and the yield curve behave consistently with the valuation model.