In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor. The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure.

The Incoterms or International Commercial Terms are a series of pre-defined commercial terms published by the International Chamber of Commerce (ICC) relating to international commercial law. Incoterms define the responsibilities of exporters and importers in the arrangement of shipments and the transfer of liability involved at various stages of the transaction. They are widely used in international commercial transactions or procurement processes and their use is encouraged by trade councils, courts and international lawyers. A series of three-letter trade terms related to common contractual sales practices, the Incoterms rules are intended primarily to clearly communicate the tasks, costs, and risks associated with the global or international transportation and delivery of goods. Incoterms inform sales contracts defining respective obligations, costs, and risks involved in the delivery of goods from the seller to the buyer, but they do not themselves conclude a contract, determine the price payable, currency or credit terms, govern contract law or define where title to goods transfers.

In business or commerce, an order is a stated intention, either spoken or written, to engage in a commercial transaction for specific products or services. From a buyer's point of view it expresses the intention to buy and is called a purchase order. From a seller's point of view it expresses the intention to sell and is referred to as a sales order. When the purchase order of the buyer and the sales order of the seller agree, the orders become a contract between the buyer and seller.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable to a third party at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their receivables to a forfaiter. Factoring is commonly referred to as accounts receivable factoring, invoice factoring, and sometimes accounts receivable financing. Accounts receivable financing is a term more accurately used to describe a form of asset based lending against accounts receivable. The Commercial Finance Association is the leading trade association of the asset-based lending and factoring industries.

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities can be contrasted with equity securities that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not: in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing.

A purchase order, often abbreviated to PO, is a commercial document issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services required. It is used to control the purchasing of products and services from external suppliers. Purchase orders can be an essential part of enterprise resource planning system orders.

An invoice, bill or tab is a commercial document issued by a seller to a buyer relating to a sale transaction and indicating the products, quantities, and agreed-upon prices for products or services the seller had provided the buyer.

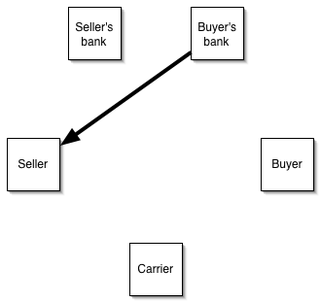

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.

Debtor finance is a process to fund a business using its accounts receivable ledger as collateral. Generally, companies that have low working capital reserves can get into cash flow problems because invoices are paid on net 30 terms. Debtor finance solutions fund slow-paying invoices, which improves the cash flow of the company and puts it in a better position to pay operating expenses.

In trade finance, forfaiting is a service providing medium-term financial support for export/import of capital goods. The third party providing the support is termed the forfaiter. The forfaiter provides medium-term finance to, and will commonly also take on certain risks from, the importer; and takes on all risk from the exporter, in return for a margin. Payment may be by negotiable instrument, enabling the forfaiter to lay off some risks. Like factoring, forfaiting involves sale of financial assets from the seller's receivables. Key differences are that forfait supports the buyer (importer) as well as the seller (exporter), and is available only for export/import transactions and in relation to capital goods. The word forfaiting is derived from the French word forfait, meaning to relinquish the right.

An air waybill (AWB) or air consignment note is a receipt issued by an international airline for goods and an evidence of the contract of carriage. It is not a document of title to the goods. The air waybill is non-negotiable.

A banker's acceptance is a commitment by a bank to make a requested future payment. The request will typically specify the payee, the amount, and the date on which it is eligible for payment. After acceptance, the request becomes an unconditional liability of the bank. Banker's acceptances are distinguished from ordinary time drafts in that ownership is transferable prior to maturity, allowing them to be traded in the secondary market.

Buyer credit is a term credit available to an importer (buyer) from overseas lenders such as banks and other financial institution for goods they are importing. In simple words it is the credit that is given by a bank to a foreign buyer where funds are paid directly to the buyer through a lending bank. The overseas banks usually lend the importer (buyer) based on the letter of comfort issued by the importer's bank. For this service the importer's bank or buyer's credit consultant charges a fee called an arrangement fee.

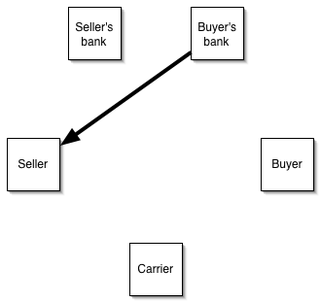

A documentary collection is a process in which a seller instructs their bank to forward documents related to the export of goods to a buyer's bank with a request to present these documents to the buyer for payment, indicating when and on what conditions these documents can be released to the buyer.

An asset swap refers to an exchange of tangible for intangible assets, in accountancy, or, in finance, to the exchange of the flow of payments from a given security for a different set of cash flows.

Trade finance is a phrase used to describe different strategies that are employed to make international trade easier. It signifies financing for trade, and it concerns both domestic and international trade transactions. A trade transaction requires a seller of goods and services as well as a buyer. Various intermediaries such as banks and financial institutions can facilitate these transactions by financing the trade. Trade finance manifest itself in the form of letters of credit (LOC), guarantees or insurance and is usually provided by intermediaries.

Pre-shipment inspection is a part of supply chain management and an important quality control method for checking the quality of goods clients buy from suppliers.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

Supply chain financing is a form of financial transaction wherein a third party facilitates an exchange by financing the supplier on the customer's behalf. The term also refers to the techniques and practices used by banks and other financial institutions to manage the capital invested into the supply chain and reduce risk for the parties involved.

Financial law is the law and regulation of the commercial banking, capital markets, insurance, derivatives and investment management sectors. Understanding financial law is crucial to appreciating the creation and formation of banking and financial regulation, as well as the legal framework for finance generally. Financial law forms a substantial portion of commercial law, and notably a substantial proportion of the global economy, and legal billables are dependent on sound and clear legal policy pertaining to financial transactions. Therefore financial law as the law for financial industries involves public and private law matters. Understanding the legal implications of transactions and structures such as an indemnity, or overdraft is crucial to appreciating their effect in financial transactions. This is the core of financial law. Thus, financial law draws a narrower distinction than commercial or corporate law by focusing primarily on financial transactions, the financial market, and its participants; for example, the sale of goods may be part of commercial law but is not financial law. Financial law may be understood as being formed of three overarching methods, or pillars of law formation and categorised into five transaction silos which form the various financial positions prevalent in finance.