An investment bank is a financial services company or corporate division that engages in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, and FICC services. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

An offshore bank is a bank regulated under international banking license, which usually prohibits the bank from establishing any business activities in the jurisdiction of establishment. Due to less regulation and transparency, accounts with offshore banks were often used to hide undeclared income. Since the 1980s, jurisdictions that provide financial services to nonresidents on a big scale, can be referred to as offshore financial centres. Since OFCs often also levy little or no tax corporate and/or personal income and offer, they are often referred to as tax havens.

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of failure or bankruptcy.

Dexia N.V./S.A., also referred to as the Dexia Group, was a Franco-Belgian financial institution active in public finance, providing retail and commercial banking services to individuals and SMEs, asset management, and insurance; with headquarters in Saint-Josse-ten-Noode, Brussels. The company had about 35,200 members of staff and a core shareholders' equity of €19.2 billion, as of 31 December 2010, and provided governments and local public finance operators with banking and other financial services. Asset Management and Services provided asset management, investor and insurance services, in particular to clients of the two other business lines.

Vikram Shankar Pandit is an Indian-American banker and investor who was the chief executive officer of Citigroup from December 2007 to 16 October 2012 and is the current chairman and chief executive officer of The Orogen Group.

The Capital Requirements Directives (CRD) for the financial services industry have introduced a supervisory framework in the European Union which reflects the Basel II and Basel III rules on capital measurement and capital standards.

Office of Fair Trading v Abbey National plc and Others[2009] UKSC 6is a judicial decision of the United Kingdom Supreme Court relating to bank charges in the United Kingdom, with reference to the situation where a bank account holder goes into unplanned overdraft.

Executive compensation or executive pay is composed of the financial compensation and other non-financial benefits received by an executive from their firm for their service to the organization. It is typically a mixture of salary, bonuses, shares of or call options on the company stock, benefits, and perquisites, ideally configured to take into account government regulations, tax law, the desires of the organization and the executive, and rewards for performance.

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George W. Bush on October 3, 2008. It was a component of the government's measures in 2008 to address the subprime mortgage crisis.

United Kingdom banking law refers to banking law in the United Kingdom, to control the activities of banks.

Directive 2011/61/EU is a legal act of the European Union on the financial regulation of hedge funds, private equity, real estate funds, and other "Alternative Investment Fund Managers" (AIFMs) in the European Union. The Directive requires all covered AIFMs to obtain authorisation, and make various disclosures as a condition of operation. It followed the global financial crisis. Before, the alternative investment industry had not been regulated at EU level.

The European Stability Mechanism (ESM) is an intergovernmental organization located in Luxembourg City, which operates under public international law for all eurozone Member States having ratified a special ESM intergovernmental treaty. It was established on 27 September 2012 as a permanent firewall for the eurozone, to safeguard and provide instant access to financial assistance programmes for member states of the eurozone in financial difficulty, with a maximum lending capacity of €500 billion.

The Liikanen Report or "Report of the European Commission’s High-level Expert Group on Bank Structural Reform" is a set of recommendations published in October 2012 by a group of experts led by Erkki Liikanen, governor of the Bank of Finland and ECB council member. On 3 July 2013, by large majority the European Parliament adopted an own initiative report called "Reforming the structure of the EU banking sector" that welcomes structural reform measures at Union level to tackle concerns on Too big to fail banks, that led to the publication of a proposal of Regulation on structural measures improving the resilience of EU credit institutions on January 2014. This proposal was withdrawn in July 2018.

Commerzbank AG v Keen [2006] EWCA Civ 1536 is a UK labour law case, concerning the construction of terms in a contract of employment.

The Office for administration and payment of individual entitlements, also known as the Paymaster's Office or PMO is a central office of the European Commission.

Carsten Schneider is a German social democratic politician, who has been a member of the German Parliament since 1998. Since 2017, he has been serving as First Secretary of his party's parliamentary group, in this position assisting the group's chairmonster Andrea Nahles.

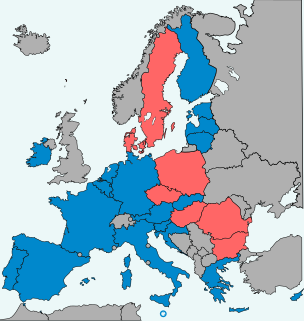

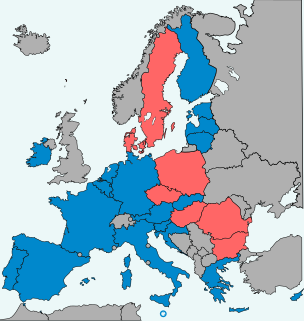

The banking union of the European Union is the transfer of responsibility for banking policy from the national to the EU level in several countries of the European Union, initiated in 2012 as a response to the Eurozone crisis. The motivation for banking union was the fragility of numerous banks in the Eurozone, and the identification of vicious circle between credit conditions for these banks and the sovereign credit of their respective home countries. In several countries, private debts arising from a property bubble were transferred to sovereign debt as a result of banking system bailouts and government responses to slowing economies post-bubble. Conversely, weakness in sovereign credit resulted in deterioration of the balance sheet position of the banking sector, not least because of high domestic sovereign exposures of the banks.

The Capital Requirements Regulation(EU) No. 575/2013 is an EU law that aims to decrease the likelihood that banks go insolvent. With the Credit Institutions Directive 2013 the Capital Requirements Regulation 2013 reflects Basel III rules on capital measurement and capital standards.

Andrea Orcel is an Italian investment banker who most recently served as the president of UBS Investment Bank from November 2014 to September 2018. He was slated to succeed José Antonio Alvarez as chief executive of Spanish bank Banco Santander from September 2018 to January 2019. Since early 2020, Orcel has been linked to taking over as CEO at a variety of financial institutions including starting his own boutique investment bank.

Emilios Avgouleas is a Greek professor and researcher specialising in international financial markets and blockchain technology. He holds the chair in international banking law and finance at the University of Edinburgh. He is a member of the stakeholder group of the European Banking Authority as a 'top-ranking' academic.