Related Research Articles

An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory.

A Dutch auction is one of several similar types of auctions for buying or selling goods. Most commonly, it means an auction in which the auctioneer begins with a high asking price in the case of selling, and lowers it until some participant accepts the price, or it reaches a predetermined reserve price. This type of price auction is most commonly used for goods that are required to be sold quickly such as flowers, fresh produce, or tobacco. A Dutch auction has also been called a clock auction or open-outcry descending-price auction. This type of auction shows the advantage of speed since a sale never requires more than one bid. It is strategically similar to a first-price sealed-bid auction.

An online auction is an auction held over the internet and accessed by internet connected devices. Similar to in-person auctions, online auctions come in a variety of types, with different bidding and selling rules.

A Vickrey auction or sealed-bid second-price auction (SBSPA) is a type of sealed-bid auction. Bidders submit written bids without knowing the bid of the other people in the auction. The highest bidder wins but the price paid is the second-highest bid. This type of auction is strategically similar to an English auction and gives bidders an incentive to bid their true value. The auction was first described academically by Columbia University professor William Vickrey in 1961 though it had been used by stamp collectors since 1893. In 1797 Johann Wolfgang von Goethe sold a manuscript using a sealed-bid, second-price auction.

An English auction is an open-outcry ascending dynamic auction. It proceeds as follows.

Offer and acceptance are generally recognised as essential requirements for the formation of a contract, and analysis of their operation is a traditional approach in contract law. The offer and acceptance formula, developed in the 19th century, identifies a moment of formation when the parties are of one mind. This classical approach to contract formation has been modified by developments in the law of estoppel, misleading conduct, misrepresentation, unjust enrichment, and power of acceptance.

In economics, a reservationprice is a limit on the price of a good or a service. On the demand side, it is the highest price that a buyer is willing to pay; on the supply side, it is the lowest price a seller is willing to accept for a good or service.

A Japanese auction is a dynamic auction format. It proceeds in the following way.

Auction sniping is the practice, in a timed online auction, of placing a bid likely to exceed the current highest bid as late as possible—usually seconds before the end of the auction—giving other bidders no time to outbid the sniper. This can be done either manually or by software on the bidder's computer, or by an online sniping service.

A double auction is a process of buying and selling goods with multiple sellers and multiple buyers. Potential buyers submit their bids and potential sellers submit their ask prices to the market institution, and then the market institution chooses some price p that clears the market: all the sellers who asked less than p sell and all buyers who bid more than p buy at this price p. Buyers and sellers that bid or ask for exactly p are also included. A common example of a double auction is stock exchange.

Auction theory is an applied branch of economics which deals with how bidders act in auction markets and researches how the features of auction markets incentivise predictable outcomes. Auction theory is a tool used to inform the design of real-world auctions. Sellers use auction theory to raise higher revenues while allowing buyers to procure at a lower cost. The conference of the price between the buyer and seller is an economic equilibrium. Auction theorists design rules for auctions to address issues which can lead to market failure. The design of these rulesets encourages optimal bidding strategies among a variety of informational settings. The 2020 Nobel Prize for Economics was awarded to Paul R. Milgrom and Robert B. Wilson “for improvements to auction theory and inventions of new auction formats.”

A first-price sealed-bid auction (FPSBA) is a common type of auction. It is also known as blind auction. In this type of auction, all bidders simultaneously submit sealed bids so that no bidder knows the bid of any other participant. The highest bidder pays the price that was submitted.

Bidding is an offer to set a price tag by an individual or business for a product or service or a demand that something be done. Bidding is used to determine the cost or value of something.

The Sale of Goods Act 1979 is an Act of the Parliament of the United Kingdom which regulated English contract law and UK commercial law in respect of goods that are sold and bought. The Act consolidated the original Sale of Goods Act 1893 and subsequent legislation, which in turn had codified and consolidated the law. Since 1979, there have been numerous minor statutory amendments and additions to the 1979 Act. It was replaced for some aspects of consumer contracts from 1 October 2015 by the Consumer Rights Act 2015 but remains the primary legislation underpinning business-to-business transactions involving selling or buying goods.

A mock auction is a scam usually operated in a street market, disposal sale or similar environment, where cheap and low quality goods are sold at high prices by a team of confidence tricksters.

An invitation to treat is a concept within contract law which comes from the Latin phrase invitatio ad offerendum, meaning "inviting an offer". According to Professor Andrew Burrows, an invitation to treat is

an expression of willingness to negotiate. A person making an invitation to treat does not intend to be bound as soon as it is accepted by the person to whom the statement is addressed.

Payne v Cave (1789) 3 TR 148 is an old English contract law case, which stands for the proposition that an auctioneer's request for bids is not an offer but an invitation to treat. The bidders make the offers which can be accepted by the auctioneer.

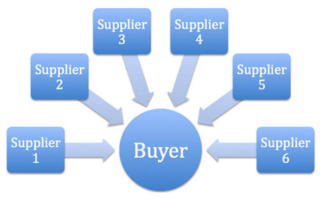

A reverse auction is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction also known as a forward auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.

The South African law of sale is an area of the legal system in that country that describes rules applicable to a contract of sale, generally described as a contract whereby one person agrees to deliver to another the free possession of a thing in return for a price in money.

A government auction or a public auction is an auction held on behalf of a government in which the property to be auctioned is either property owned by the government or property which is sold under the authority of a court of law or a government agency with similar authority. In the case of government procurement, goods and services are bought using a reverse auction.