A societas Europaea is a public company registered in accordance with the corporate law of the European Union (EU), introduced in 2004 with the Council Regulation on the Statute for a European Company. Such a company may more easily transfer to or merge with companies in other member states.

In the European Union, competition law promotes the maintenance of competition within the European Single Market by regulating anti-competitive conduct by companies to ensure that they do not create cartels and monopolies that would damage the interests of society.

Predatory pricing is a commercial pricing strategy which involves the use of large scale undercutting to eliminate competition. This is where an industry dominant firm with sizable market power will deliberately reduce the prices of a product or service to loss-making levels to attract all consumers and create a monopoly. For a period of time, the prices are set unrealistically low to ensure competitors are unable to effectively compete with the dominant firm without making substantial loss. The aim is to force existing or potential competitors within the industry to abandon the market so that the dominant firm may establish a stronger market position and create further barriers to entry. Once competition has been driven from the market, consumers are forced into a monopolistic market where the dominant firm can safely increase prices to recoup its losses.

LexisNexis is an American data analytics company headquartered in New York, New York. Its products are various databases that are accessed through online portals, including portals for computer-assisted legal research (CALR), newspaper search, and consumer information. During the 1970s, LexisNexis began to make legal and journalistic documents more accessible electronically. As of 2006, the company had the world's largest electronic database for legal and public-records–related information. The company is a subsidiary of RELX.

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust law, anti-monopoly law, and trade practices law; the act of pushing for antitrust measures or attacking monopolistic companies is commonly known as trust busting.

A law dictionary is a dictionary that is designed and compiled to give information about terms used in the field of law.

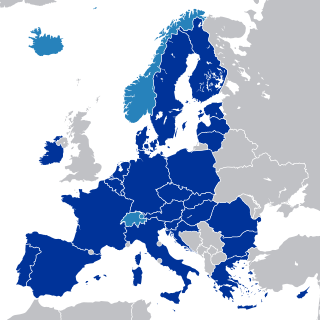

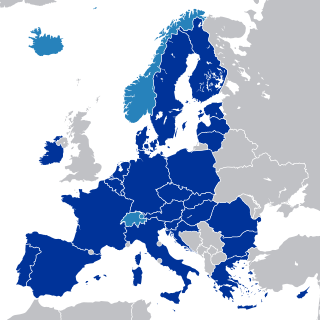

State aid in the European Union is the name given to a subsidy or any other aid provided by a government that distorts competition. Under European Union competition law, the term has a legal meaning, being any measure that demonstrates any of the characteristics in Article 107 of the Treaty on the Functioning of the European Union, in that if it distorts competition or the free market, it is classified by the European Union as illegal state aid. Measures that fall within the definition of state aid are considered unlawful unless provided under an exemption or notified by the European Commission. In 2019, the EU member states provided state aid corresponding to 0.81% of the bloc's GDP.

LexisNexis Quicklaw is a Canadian electronic legal research database that catalogues court decisions, news reports, provincial and federal statutes, journals, and other legal commentary. The database also includes a case citator and case digests. In 2002, Quicklaw was purchased by LexisNexis and is now a subsidiary of LexisNexis Canada.

Europeanisation refers to a number of related phenomena and patterns of change:

The EFTA Surveillance Authority (ESA) monitors compliance with the Agreement on the European Economic Area (EEA) in Iceland, Liechtenstein and Norway (the EEA EFTA States). ESA operates independently of the States and safeguards the rights of individuals and undertakings under the EEA Agreement, ensuring free movement, fair competition, and control of state aid.

A vertical agreement is a term used in competition law to denote agreements between firms at different levels of a supply chain. For instance, a manufacturer of consumer electronics might have a vertical agreement with a retailer according to which the latter would promote their products in return for lower prices. Franchising is a form of vertical agreement, and under European Union competition law this falls within the scope of Article 101.

European Union merger law is a part of the law of the European Union. It is charged with regulating mergers between two or more entities in a corporate structure. This institution has jurisdiction over concentrations that might or might not impede competition. Although mergers must comply with policies and regulations set by the commission; certain mergers are exempt if they promote consumer welfare. Mergers that fail to comply with the common market may be blocked. It is part of competition law and is designed to ensure that firms do not acquire such a degree of market power on the free market so as to harm the interests of consumers, the economy and society as a whole. Specifically, the level of control may lead to higher prices, less innovation and production.

Computer-assisted legal research (CALR) or computer-based legal research is a mode of legal research that uses databases of court opinions, statutes, court documents, and secondary material. Electronic databases make large bodies of case law easily available. Databases also have additional benefits, such as Boolean searches, evaluating case authority, organizing cases by topic, and providing links to cited material. Databases are available through paid subscription or for free.

Bloomberg Law is a subscription-based service that uses data analytics and artificial intelligence for online legal research. The service, which Bloomberg L.P. introduced in 2009, provides legal content, proprietary company information and news information to attorneys, law students, and other legal professionals. More specifically, this commercial legal and business technology platform integrates Bloomberg Law News with Bloomberg Industry Group's primary and secondary legal content and business development tools.

The Council of Bars and Law Societies of Europe (CCBE) is an association gathering together bar associations of 32 countries in Europe (those of the European Union, of the European Economic Area and of Switzerland), The United Kingdom, and an additional eleven associate and observer members. The CCBE represents around a million European lawyers before EU institutions mainly, but also before other international organisations. The CCBE is an international non-profit organisation (AISBL) under Belgian law and has its seat in Brussels.

The law of the U.S. state of Georgia consists of several levels, including constitutional, statutory, and regulatory law, as well as case law and local law. The Official Code of Georgia Annotated forms the general statutory law.

Jonathan David Chattyn Turner is an English barrister who specialises in intellectual property and competition law. A member of 13 Old Square Chambers in London, he is the author of a textbook on the application of European Union competition law to intellectual property, Intellectual Property and EU Competition Law (2010), which has received strong reviews describing it as " authoritative" and "very obviously the last word on the subject for the time being". Turner is also a director of the Authors' Licensing and Collecting Society and of the Copyright Licensing Agency.

The Union Internationale des Avocats (UIA) or International Association of Lawyers is an international non-governmental organisation, created in 1927, that brings together more than two million legal professionals from all over the world.

Christine Kaddous is Professor of European Union law at the University of Geneva, Jean Monnet Chair ad personam and Director of the Centre d'études juridiques européennes – Centre d'excellence Jean Monnet of Geneva University. She is also Visiting Professor at the College of Europe.

Mergers in United Kingdom law is a theory-based regulation that helps forecast and avoid abuse, while indirectly maintaining a competitive framework within the market. A true merger is one in which two separate entities merge into an entirely new entity. In Law the term ‘merger’ has a much broader application, for example where A acquires all, or a majority of, the shares in B, and is able to control the affairs of B as such.