Cost escalation can be defined as changes in the cost or price of specific goods or services in a given economy over a period. This is similar to the concepts of inflation and deflation except that escalation is specific to an item or class of items (not as general in nature), it is often not primarily driven by changes in the money supply, and it tends to be less sustained. While escalation includes general inflation related to the money supply, it is also driven by changes in technology, practices, and particularly supply-demand imbalances that are specific to a good or service in a given economy. For example, while general inflation (e.g., consumer price index) in the US was less than 5% in the 2003-2007 time period, steel prices increased (escalated) by over 50% because of supply-demand imbalance. Cost escalation may contribute to a project cost overrun but it is not synonymous with it.

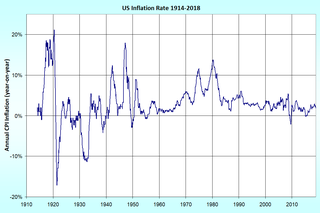

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index, usually the consumer price index, over time. The opposite of inflation is deflation.

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. Inflation reduces the value of currency over time, but deflation increases it. This allows one to buy more goods and services than before with the same amount of currency. Deflation is distinct from disinflation, a slow-down in the inflation rate, i.e. when inflation declines to a lower rate but is still positive.

A Consumer Price Index measures changes in the price level of market basket of consumer goods and services purchased by households.

Over long periods of time, as market supply and demand imbalances are corrected, escalation will tend to more-or-less equal inflation unless there are sustained technology or efficiency changes in a market.

Escalation is usually calculated by examining the changes in price index measures for a good or service. Future escalation can be forecast using econometrics. Unfortunately, because escalation (unlike inflation) may occur in a micro-market, and it may be hard to measure with surveys, indices can be difficult to find. For example, the Bureau of Labor Statistics has a price index for construction wages and compensation (what the construction contractor's labor cost), but has none for the prices that owners must pay the construction contractor for their services. [1]

A price index is a normalized average of price relatives for a given class of goods or services in a given region, during a given interval of time. It is a statistic designed to help to compare how these price relatives, taken as a whole, differ between time periods or geographical locations.

Econometrics is the application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference". An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships". The first known use of the term "econometrics" was by Polish economist Paweł Ciompa in 1910. Jan Tinbergen is considered by many to be one of the founding fathers of econometrics. Ragnar Frisch is credited with coining the term in the sense in which it is used today.

The Bureau of Labor Statistics (BLS) is a unit of the United States Department of Labor. It is the principal fact-finding agency for the U.S. government in the broad field of labor economics and statistics and serves as a principal agency of the U.S. Federal Statistical System. The BLS is a governmental statistical agency that collects, processes, analyzes, and disseminates essential statistical data to the American public, the U.S. Congress, other Federal agencies, State and local governments, business, and labor representatives. The BLS also serves as a statistical resource to the United States Department of Labor, and conducts research into how much families need to earn to be able to enjoy a decent standard of living.

In cost engineering and project management usage, escalation and cost contingency are both considered risk funds, that should be included in project estimates and budgets. When escalation is minimal, it is sometimes estimated together with contingency. However, this is not a best practice, particularly when escalation is significant. [2]

Cost engineering is "the engineering practice devoted to the management of project cost, involving such activities as estimating, cost control, cost forecasting, investment appraisal and risk analysis." "Cost Engineers budget, plan and monitor investment projects. They seek the optimum balance between cost, quality and time requirements."

Project management is the practice of initiating, planning, executing, controlling, and closing the work of a team to achieve specific goals and meet specific success criteria at the specified time.

When estimating the cost for a project, product or other item or investment, there is always uncertainty as to the precise content of all items in the estimate, how work will be performed, what work conditions will be like when the project is executed and so on. These uncertainties are risks to the project. Some refer to these risks as "known-unknowns" because the estimator is aware of them, and based on past experience, can even estimate their probable costs. The estimated costs of the known-unknowns is referred to by cost estimators as cost contingency.