As a project progress tracking index

In 1999, a simplified form of the DIPP was introduced [4] as a technique for monetizing and integrating all three variables of the traditional project "Iron Triangle" into a single value-based baseline for measuring what the project's expected return is scheduled to be at any given future progress reporting date. The Tracking DIPP baseline formula is:

- where

- EMV is a quantification of the scope reflecting the expected monetary value if the designated scope is delivered as of the target date. Changes in scope should be reflected by changes in the value breakdown structure (VBS) that would increase or decrease the EMV.

- acceleration or delay is the premium or cost due to change in the delivery date, which will usually impact the value of the scope (EMV). (In the rare cases where it won't, that fact is important information for the management team.) At the start, the project is usually scheduled to finish on its target date, so the $acceleration or delay is usually zero in the baseline DIPP.

- Cost is the planned cost estimate-to-complete (Cost ETC) of the project. This can usually be derived from earned value management planning by using the complement of the planned value (PV) (i.e., budgeted cost of work performed, or BCWS), which estimates what the sunk cost will be at key reporting points during the project. By subtracting the PV from budget, the expected sunk cost at any point during project execution is factored out.

As project work is performed and sunk costs accrue, the Cost ETC is expected to decrease at a planned rate. Since the planned Cost ETC is the denominator of the DIPP formula, the DIPP can be plotted to rise steadily during project execution, reflecting the fact that as a project nears completion, the return on the remaining investment becomes greater and greater (thus usually making it unwise to kill an ongoing project unless its Actual DIPP approaches 1.0 or less).

As the project is executed, the DIPP provides an integrated metric, reflecting the project's investment value, against which any changes in the three variables of scope, time and cost can be measured. Any changes in the expected value of the scope, any acceleration or delay in schedule, and any change in the planned Cost ETC can be reflected in the Actual DIPP. This can be measured against the Planned DIPP to produce the DIPP Progress Index (DPI), an extension to the project's expected business value of the earned value indices the schedule performance index (SPI) and the cost performance index (CPI). The DIPP Progress Index formula is:

- A DPI of less than 1.0 indicates that the rest of the project will generate less expected value per dollar to be invested than was originally expected, due to changes in the value of the scope or changes in schedule or changes in Cost ETC, or any combination thereof. A DPI of more than 1.0 indicates that the rest of the project will generate more expected value per dollar to be invested.

The DIPP baseline presents the project team with a planned metric against which to manage, and provides guidance for individual team members who seek opportunities to enhance the project's overall business value and expected project profit (EPP) by generating a DPI of greater than 1.0. This can generally be accomplished most easily through identifying schedule acceleration opportunities identified through critical path drag and drag cost computation.

Earned Value Management (EVM), earned value project management, or earned value performance management (EVPM) is a project management technique for measuring project performance and progress in an objective manner.

Project management is the process of leading the work of a team to achieve all project goals within the given constraints. This information is usually described in project documentation, created at the beginning of the development process. The primary constraints are scope, time, and budget. The secondary challenge is to optimize the allocation of necessary inputs and apply them to meet pre-defined objectives.

Project planning is part of project management, which relates to the use of schedules such as Gantt charts to plan and subsequently report progress within the project environment. Project planning can be done manually or by the use of project management software.

A project plan, according to the Project Management Body of Knowledge (PMBOK), is: "...a formal, approved document used to guide both project execution and project control. The primary uses of the project plan are to document planning assumptions and decisions, facilitate communication among project stakeholders, and document approved scope, cost, and schedule baselines. A project plan may be sumarized or detailed."

The critical path method (CPM), or critical path analysis (CPA), is an algorithm for scheduling a set of project activities. A critical path is determined by identifying the longest stretch of dependent activities and measuring the time required to complete them from start to finish. It is commonly used in conjunction with the program evaluation and review technique (PERT).

The program evaluation and review technique (PERT) is a statistical tool used in project management, which was designed to analyze and represent the tasks involved in completing a given project.

In project management, a schedule is a listing of a project's milestones, activities, and deliverables. Usually dependencies and resources are defined for each task, then start and finish dates are estimated from the resource allocation, budget, task duration, and scheduled events. A schedule is commonly used in the project planning and project portfolio management parts of project management. Elements on a schedule may be closely related to the work breakdown structure (WBS) terminal elements, the Statement of work, or a Contract Data Requirements List.

In project management, float or slack is the amount of time that a task in a project network can be delayed without causing a delay to:

Return on capital (ROC), or return on invested capital (ROIC), is a ratio used in finance, valuation and accounting, as a measure of the profitability and value-creating potential of companies relative to the amount of capital invested by shareholders and other debtholders. It indicates how effective a company is at turning capital into profits.

Project portfolio management (PPM) is the centralized management of the processes, methods, and technologies used by project managers and project management offices (PMOs) to analyze and collectively manage current or proposed projects based on numerous key characteristics. The objectives of PPM are to determine the optimal resource mix for delivery and to schedule activities to best achieve an organization’s operational and financial goals, while honouring constraints imposed by customers, strategic objectives, or external real-world factors. Standards for Portfolio Management include Project Management Institute's framework for project portfolio management, Management of Portfolios by Office of Government Commerce and the PfM² Portfolio Management Methodology by the PM² Foundation.

In finance, tracking error or active risk is a measure of the risk in an investment portfolio that is due to active management decisions made by the portfolio manager; it indicates how closely a portfolio follows the index to which it is benchmarked. The best measure is the standard deviation of the difference between the portfolio and index returns.

A schedule or a timetable, as a basic time-management tool, consists of a list of times at which possible tasks, events, or actions are intended to take place, or of a sequence of events in the chronological order in which such things are intended to take place. The process of creating a schedule — deciding how to order these tasks and how to commit resources between the variety of possible tasks — is called scheduling, and a person responsible for making a particular schedule may be called a scheduler. Making and following schedules is an ancient human activity.

A glossary of terms relating to project management and consulting.

The project management triangle is a model of the constraints of project management. While its origins are unclear, it has been used since at least the 1950s. It contends that:

- The quality of work is constrained by the project's budget, deadlines and scope (features).

- The project manager can trade between constraints.

- Changes in one constraint necessitate changes in others to compensate or quality will suffer.

Total project control (TPC) is a project management method that emphasizes continuous tracking and optimization of return on investment (ROI). It was developed by Stephen Devaux. It builds upon earlier techniques such as earned value management, critical path method, and program evaluation and review technique, but uses these to track and index projected project profitability as well as the more traditional cost and schedule. In this way it aims to manage projects as profit and investment centers, rather than cost centers.

The following outline is provided as an overview of and topical guide to project management:

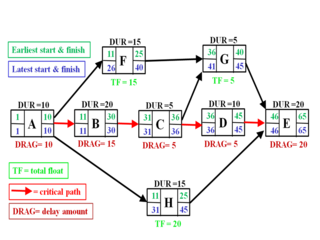

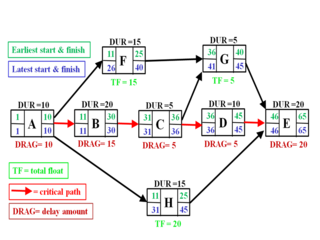

Critical path drag is a project management metric developed by Stephen Devaux as part of the Total Project Control (TPC) approach to schedule analysis and compression in the critical path method of scheduling. Critical path drag is the amount of time that an activity or constraint on the critical path is adding to the project duration. Alternatively, it is the maximum amount of time that one can shorten the activity before it is no longer on the critical path or before its duration becomes zero.

Drag cost is a project management metric developed by Stephen Devaux as part of the Total Project Control (TPC) approach to project schedule and cost analysis. It is the amount by which a project’s expected return on investment (ROI) is reduced due to the critical path drag of a specific critical path activity Task or other specific schedule factor such as a schedule lag or other delaying constraint.

A value breakdown structure (VBS) is a project management technique introduced by Stephen Devaux as part of the total project control (TPC) approach to project and program value analysis.

Spider Project is a project management software, developed by a company, called Spider Project Team.