Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. Central characteristics of capitalism include capital accumulation, competitive markets, price systems, private property, property rights recognition, voluntary exchange, and wage labor. In a market economy, decision-making and investments are determined by owners of wealth, property, or ability to maneuver capital or production ability in capital and financial markets—whereas prices and the distribution of goods and services are mainly determined by competition in goods and services markets.

Anti-capitalism is a political ideology and movement encompassing a variety of attitudes and ideas that oppose capitalism. In this sense, anti-capitalists are those who wish to replace capitalism with another type of economic system, such as socialism, anarchism, communism, syndicalism, or some combination of the latter four.

Nicholas Kaldor, Baron Kaldor, born Káldor Miklós, was a Cambridge economist in the post-war period. He developed the "compensation" criteria called Kaldor–Hicks efficiency for welfare comparisons (1939), derived the cobweb model, and argued for certain regularities observable in economic growth, which are called Kaldor's growth laws. Kaldor worked alongside Gunnar Myrdal to develop the key concept Circular Cumulative Causation, a multicausal approach where the core variables and their linkages are delineated. Both Myrdal and Kaldor examine circular relationships, where the interdependencies between factors are relatively strong, and where variables interlink in the determination of major processes. Gunnar Myrdal got the concept from Knut Wicksell and developed it alongside Nicholas Kaldor when they worked together at the United Nations Economic Commission for Europe. Myrdal concentrated on the social provisioning aspect of development, while Kaldor concentrated on demand-supply relationships to the manufacturing sector. Kaldor also coined the term "convenience yield" related to commodity markets and the so-called theory of storage, which was initially developed by Holbrook Working.

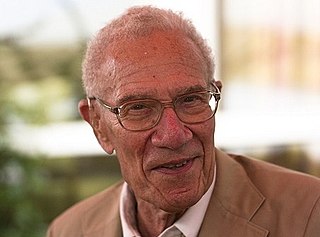

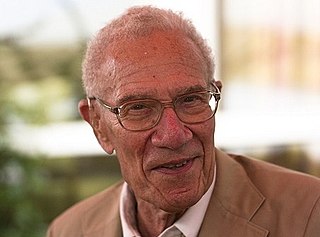

Robert Merton Solow, GCIH is an American economist whose work on the theory of economic growth culminated in the exogenous growth model named after him. He is currently Emeritus Institute Professor of Economics at the Massachusetts Institute of Technology, where he has been a professor since 1949. He was awarded the John Bates Clark Medal in 1961, the Nobel Memorial Prize in Economic Sciences in 1987, and the Presidential Medal of Freedom in 2014. Four of his PhD students, George Akerlof, Joseph Stiglitz, Peter Diamond and William Nordhaus later received Nobel Memorial Prizes in Economic Sciences in their own right.

Joan Violet Robinson was a British economist well known for her wide-ranging contributions to economic theory. She was a central figure in what became known as post-Keynesian economics.

Capital accumulation is the dynamic that motivates the pursuit of profit, involving the investment of money or any financial asset with the goal of increasing the initial monetary value of said asset as a financial return whether in the form of profit, rent, interest, royalties or capital gains. The aim of capital accumulation is to create new fixed and working capitals, broaden and modernize the existing ones, grow the material basis of social-cultural activities, as well as constituting the necessary resource for reserve and insurance. The process of capital accumulation forms the basis of capitalism, and is one of the defining characteristics of a capitalist economic system.

In Marxian economics, economic reproduction refers to recurrent processes. Michel Aglietta views economic reproduction as the process whereby the initial conditions necessary for economic activity to occur are constantly re-created. Marx viewed reproduction as the process by which society re-created itself, both materially and socially.

The Harrod–Domar model is a Keynesian model of economic growth. It is used in development economics to explain an economy's growth rate in terms of the level of saving and of capital. It suggests that there is no natural reason for an economy to have balanced growth. The model was developed independently by Roy F. Harrod in 1939, and Evsey Domar in 1946, although a similar model had been proposed by Gustav Cassel in 1924. The Harrod–Domar model was the precursor to the exogenous growth model.

Michał Kalecki was a Polish Marxian economist. Over the course of his life, Kalecki worked at the London School of Economics, University of Cambridge, University of Oxford and Warsaw School of Economics and was an economic advisor to the governments of Poland, France, Cuba, Israel, Mexico and India. He also served as the deputy director of the United Nations Economic Department in New York City.

Criticism of capitalism is a critique of political economy involving the rejection of, or dissatisfaction with the economic system of capitalism and its outcomes. Criticisms typically range from expressing disagreement with particular aspects or outcomes of capitalism to rejecting the principles of the capitalist system in its entirety.

Kaldor's facts are six statements about economic growth, proposed by Nicholas Kaldor in his article of 1961. He described these as "a stylized view of the facts", which coined the term stylized fact.

Luigi L. Pasinetti was an Italian economist of the post-Keynesian school. Pasinetti was considered the heir of the "Cambridge Keynesians" and a student of Piero Sraffa and Richard Kahn. Along with them, as well as Joan Robinson, he was one of the prominent members on the "Cambridge, UK" side of the Cambridge capital controversy. His contributions to economics include developing the analytical foundations of neo-Ricardian economics, including the theory of value and distribution, as well as work in the line of Kaldorian theory of growth and income distribution. He also developed the theory of structural change and economic growth, structural economic dynamics and uneven sectoral development.

Athanasios "Tom" Asimakopulos was a Canadian economist, who was the "William Dow Professor of Political Economy" in the Department of Economics, McGill University, Montreal, Quebec, Canada. His monograph, Keynes's General Theory and Accumulation, reviews important areas of Keynes's General Theory and the theories of accumulation of two of his most distinguished followers, Roy Harrod and Joan Robinson.

The social dividend is the return on the natural resources and capital assets owned by society in a socialist economy. The concept notably appears as a key characteristic of market socialism, where it takes the form of a dividend payment to each citizen derived from the property income generated by publicly owned enterprises, representing the individual's share of the capital and natural resources owned by society.

An Essay on Marxian Economics is an analytical essay written by in 1942 by economist Joan Robinson. The essay deals with the orthodox teachings of capital accumulation, the essential demand crisis and real wages by comparing it to Karl Marx's Das Kapital. It is a wide-ranging critique on Marx and Orthodox economics while also arguing for a long-term economic view that builds on the problems that Marx first identified in the exploitative nature of capitalism.

The Cambridge capital controversy, sometimes called "the capital controversy" or "the two Cambridges debate", was a dispute between proponents of two differing theoretical and mathematical positions in economics that started in the 1950s and lasted well into the 1960s. The debate concerned the nature and role of capital goods and a critique of the neoclassical vision of aggregate production and distribution. The name arises from the location of the principals involved in the controversy: the debate was largely between economists such as Joan Robinson and Piero Sraffa at the University of Cambridge in England and economists such as Paul Samuelson and Robert Solow at the Massachusetts Institute of Technology, in Cambridge, Massachusetts, United States.

In Marxian economics, surplus value is the difference between the amount raised through a sale of a product and the amount it cost to manufacture it: i.e. the amount raised through sale of the product minus the cost of the materials, plant and labour power. The concept originated in Ricardian socialism, with the term "surplus value" itself being coined by William Thompson in 1824; however, it was not consistently distinguished from the related concepts of surplus labor and surplus product. The concept was subsequently developed and popularized by Karl Marx. Marx's formulation is the standard sense and the primary basis for further developments, though how much of Marx's concept is original and distinct from the Ricardian concept is disputed. Marx's term is the German word "Mehrwert", which simply means value added, and is cognate to English "more worth".

Marxian economics, or the Marxian school of economics, is a heterodox school of political economic thought. Its foundations can be traced back to Karl Marx's critique of political economy. However, unlike critics of political economy, Marxian economists tend to accept the concept of the economy prima facie. Marxian economics comprises several different theories and includes multiple schools of thought, which are sometimes opposed to each other; in many cases Marxian analysis is used to complement, or to supplement, other economic approaches. Because one does not necessarily have to be politically Marxist to be economically Marxian, the two adjectives coexist in usage, rather than being synonymous: They share a semantic field, while also allowing both connotative and denotative differences.

Engels' pause is a term coined by economic historian Robert C. Allen to describe the period from 1790 to 1840, when British working-class wages stagnated and per-capita gross domestic product expanded rapidly during a technological upheaval. Allen named the period after German philosopher Friedrich Engels, who describes it in The Condition of the Working Class in England. Economists have analyzed its causes and effects since the nineteenth century, with some questioning its existence. Twenty-first-century technological upheaval and wage stagnation have led economists and academics to draw parallels between the two periods.

Donald Jasper Harris is a Jamaican-American economist and professor emeritus at Stanford University, known for applying post-Keynesian ideas to development economics. He is the father of the 49th and current vice president of the United States, Kamala Harris, as well as of her sister, lawyer and political commentator Maya Harris.