The monetary policy of Sweden is decided by Sveriges Riksbank, the central bank of Sweden. The monetary policy is instrumental in determining how the Swedish currency is valued.

The main events in the monetary history of the Krona are:

In late 1992 (Monday 14 September) the British pound began a steep decline that made it "leave" the Exchange Rate Mechanism on the Wednesday of that week. At the same time the Swedish currency began to decline; the first reaction from the central bank was to try to keep the current fixed exchange rates in place, and they set a target for their equivalent to the federal funds rate ("marginal rate") at 500%. The bank began to sell short-term government securities in large amounts but soon realized that market forces were strong, so they lowered their target rate, and let everyone sell what they wanted to sell, and the country saw a large selling of SEK, and SEK denominated papers. Between September 1992 and February 1993 the Swedish currency "TCW" index went from 125 to 100 (20% fall), while the British currency XBP index fell from 200 to 142 (29% fall).

The krona is the official currency of Sweden. Both the ISO code "SEK" and currency sign "kr" are in common use; the former precedes or follows the value, the latter usually follows it but, especially in the past, it sometimes preceded the value. In English, the currency is sometimes referred to as the Swedish crown, as krona literally means "crown" in Swedish. The Swedish krona was the ninth-most traded currency in the world by value in April 2016.

The krone[ˈkrùːnə], plural kroner, is the currency of Norway and its dependent territories. It is subdivided into 100 øre, which have existed only electronically since 2012. The name translates into English as crown.

Robert Alexander Mundell, is a Canadian economist. Currently, he is a professor of economics at Columbia University and the Chinese University of Hong Kong.

The króna or krona is the currency of Iceland. Iceland is the second smallest country by population, after the Seychelles, to have its own currency and monetary policy.

In finance, an exchange rate is the rate at which one national currency will be exchanged for another. It is also regarded as the value of one country's currency in relation to another currency. For example, an interbank exchange rate of 114 Japanese yen to the United States dollar means that ¥114 will be exchanged for US$1 or that US$1 will be exchanged for ¥114. In this case it is said that the price of a dollar in relation to yen is ¥114, or equivalently that the price of a yen in relation to dollars is $1/114.

The riksdaler was the name of a Swedish coin first minted in 1604. Between 1777 and 1873, it was the currency of Sweden. The daler, like the dollar, was named after the German Thaler. The similarly named Reichsthaler, rijksdaalder, and rigsdaler were used in Germany and Austria-Hungary, the Netherlands, and Denmark-Norway, respectively. Riksdaler is still used as a colloquial term for Sweden's modern-day currency.

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency.

The Scandinavian Monetary Union was a monetary union formed by Denmark and the Swedish part of the Union between Sweden and Norway on 5 May 1873, by fixing their currencies against gold at par to each other. After the dissolution of the Swedish-Norwegian union, in 1905, Norway continued to be a part of this monetary union. The union ended with the outbreak of World War I.

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. The opposite of devaluation, a change in the exchange rate making the domestic currency more expensive, is called a revaluation. A monetary authority maintains a fixed value of its currency by being ready to buy or sell foreign currency with the domestic currency at a stated rate; a devaluation is an indication that the monetary authority will buy and sell foreign currency at a lower rate.

The impossible trinity is a concept in international economics which states that it is impossible to have all three of the following at the same time:

An exchange rate regime is the way a monetary authority of a country or currency union manages the currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors, such as economic scale and openness, inflation rate, elasticity of the labor market, financial market development, capital mobility etc.

In macroeconomics and economic policy, a floating exchange rate is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market events. A currency that uses a floating exchange rate is known as a floating currency, in contrast to a fixed currency, the value of which is instead specified in terms of material goods, another currency, or a set of currencies.

Currency depreciation is the loss of value of a country's currency with respect to one or more foreign reference currencies, typically in a floating exchange rate system in which no official currency value is maintained. Currency appreciation in the same context is an increase in the value of the currency. Short-term changes in the value of a currency are reflected in changes in the exchange rate.

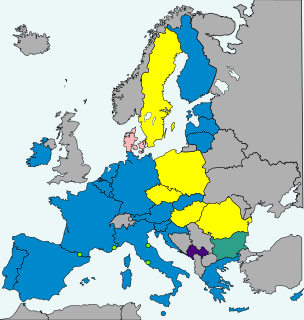

Sweden does not currently use the euro as its currency and has no plans to replace the krona in the near future. Sweden's Treaty of Accession of 1994 made it subject to the Treaty of Maastricht, which obliges states to join the eurozone once they meet the necessary conditions. Sweden maintains that joining the European Exchange Rate Mechanism II, participation in which for at least two years is a requirement for euro adoption, is voluntary, and has chosen to remain outside pending public approval by a referendum, thereby intentionally avoiding the fulfilment of the adoption requirements.

Sveriges riksbank, or simply the Riksbank, is the central bank of Sweden. It is the world's oldest central bank and the third oldest bank in operation.

Currency intervention, also known as foreign exchange market intervention or currency manipulation, is a monetary policy operation. It occurs when a government or central bank buys or sells foreign currency in exchange for its own domestic currency, generally with the intention of influencing the exchange rate and trade policy.

A fixed exchange rate, sometimes called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold.

In macroeconomics, sterilization is action taken by a country's central bank to counter the effects on the money supply caused by a balance of payments surplus or deficit. This can involve open market operations undertaken by the central bank whose aim is to neutralize the impact of associated foreign exchange operations. The opposite is unsterilized intervention, where monetary authorities have not insulated their country's domestic money supply and internal balance against foreign exchange intervention.

Besides being the main currency of the United States, the American dollar is used as the standard unit of currency in international markets for commodities such as gold and petroleum. Some non-U.S. companies dealing in globalized markets, such as Airbus, list their prices in dollars.

Fear of floating refers to situations where a country prefers a fixed exchange rate to a floating exchange rate regime. This is more relevant in emerging economies, especially when they suffered from financial crisis in last two decades. In foreign exchange markets of the emerging market economies, there is evidence showing that countries who claim they are floating their currency, are actually reluctant to let the nominal exchange rate fluctuate in response to macroeconomic shocks. In the literature, this is first convincingly documented by Calvo and Reinhart with "fear of floating" as the title of one of their papers in 2000. Since then, this widespread phenomenon of reluctance to adjust exchange rates in emerging markets is usually called "fear of floating". Most of the studies on "fear of floating" are closely related to literature on costs and benefits of different exchange rate regimes.