External links

- "A complete online copy of Other People's Money and How the Bankers Use It" . Retrieved 2015-03-30.

- "The Value of Other People's Money" in the New York Times

Other People's Money public domain audiobook at LibriVox

Other People's Money public domain audiobook at LibriVox

Other People's Money And How the Bankers Use It (1914) is a collection of essays written by Louis Brandeis first published as a book in 1914, and reissued in 1933. [1] This book is critical of banks and insurance companies.

All the chapters of the book appeared as articles in Harper's Weekly between 22 November 1913 and 17 January 1914,[ citation needed ] and were written before November 1913.

The book attacked the use of investment funds to promote the consolidation of various industries under the control of a small number of corporations, which Brandeis alleged were working in concert to prevent competition. Brandeis harshly criticized investment bankers who controlled large amounts of money deposited in their banks by middle-class people. The heads of these banks, Brandeis pointed out, routinely sat on the boards of railroad companies and large industrial manufacturers of various products, and routinely directed the resources of their banks to promote the interests of their own companies. These companies, in turn, sought to maintain control of their industries by crushing small businesses and stamping out innovators who developed better products to compete against them.

Brandeis supported his contentions with a discussion of the actual dollar amounts—in millions of dollars—controlled by specific banks, industries, and industrialists such as J. P. Morgan, noting that these interests had recently acquired a far larger proportion of American wealth than corporate entities had ever had before. He extensively cited testimony from a Congressional investigation performed by the Pujo Committee, named after Louisiana Representative Arsène Pujo, into self-serving and monopolistic business dealing.

Chapter V of the book ("What Publicity Can Do") contains in its opening section a well-known line that has frequently been cited in support of regulation through disclosure obligations: "Sunlight is said to be the best of disinfectants; electric light the most efficient policeman."

Corporatocracy is a term used to refer to an economic, political and judicial system controlled by corporations or corporate interests.

An investment bank is a financial services company or corporate division that engages in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, and FICC services. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

John Pierpont Morgan was an American financier and investment banker who dominated corporate finance on Wall Street throughout the Gilded Age. As the head of the banking firm that ultimately became known as J.P. Morgan and Co., he was the driving force behind the wave of industrial consolidation in the United States spanning the late 19th and early 20th centuries.

Bank fraud is the use of potentially illegal means to obtain money, assets, or other property owned or held by a financial institution, or to obtain money from depositors by fraudulently posing as a bank or other financial institution. In many instances, bank fraud is a criminal offence. While the specific elements of particular banking fraud laws vary depending on jurisdictions, the term bank fraud applies to actions that employ a scheme or artifice, as opposed to bank robbery or theft. For this reason, bank fraud is sometimes considered a white-collar crime.

BNP Paribas S.A. is a French international banking group, born in 2000 from the merger between Banque Nationale de Paris and Paribas.

A privately held company or private company is a company which does not offer or trade its company stock (shares) to the general public on the stock market exchanges, but rather the company's stock is offered, owned and traded or exchanged privately or over-the-counter. In the case of a close corporation, there are a relatively small number of shareholders or company members. Related terms are closely held corporation, unquoted company, and unlisted company.

J.P. Morgan & Co. was a commercial and investment banking institution founded by J. P. Morgan in 1871. The company was a predecessor of three of the largest banking institutions in the world—JPMorgan Chase, Morgan Stanley, and Deutsche Bank —and was involved in the formation of Drexel Burnham Lambert. The company is sometimes referred to as the "House of Morgan" or simply "Morgan".

Arsène Paulin Pujo, was a member of the United States House of Representatives best known for chairing the "Pujo Committee", which sought to expose an anticompetitive conspiracy among some of the nation's most powerful financial interests (trusts).

Dollar diplomacy of the United States, particularly during the presidency of William Howard Taft (1909–1913) was a form of American foreign policy to minimize the use or threat of military force and instead further its aims in Latin America and East Asia through the use of its economic power by guaranteeing loans made to foreign countries. In his message to Congress on 3 December 1912, Taft summarized the policy of Dollar diplomacy:

Westamerica Bancorporation is the holding company for Westamerica Bank and its subsidiaries. The commercial and regional community bank, headquartered in San Rafael, California, has $4.7 billion in assets and more than 90 branches in Northern and Central California.

The Pujo Committee was a United States congressional subcommittee in 1912–1913 that was formed to investigate the so-called "money trust", a community of Wall Street bankers and financiers that exerted powerful control over the nation's finances. After a resolution introduced by congressman Charles Lindbergh Sr. for a probe on Wall Street power, congressman Arsène Pujo of Louisiana was authorized to form a subcommittee of the House Committee on Banking and Currency. In 1913–1914, the findings inspired public support for ratification of the Sixteenth Amendment that authorized a federal income tax, passage of the Federal Reserve Act, and passage of the Clayton Antitrust Act.

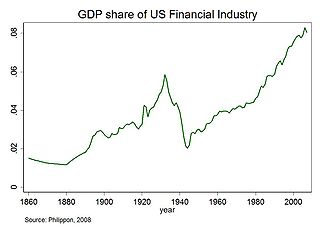

Financialization is a term sometimes used to describe the development of financial capitalism during the period from 1980 to present, in which debt-to-equity ratios increased and financial services accounted for an increasing share of national income relative to other sectors.

This article is about the history of the United States Federal Reserve System from its creation to the present.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

The New York State Banking Department was created by the New York Legislature on April 15, 1851, with a chief officer to be known as the Superintendent. The New York State Banking Department was the oldest bank regulatory agency in the United States.

United States corporate law regulates the governance, finance and power of corporations in US law. Every state and territory has its own basic corporate code, while federal law creates minimum standards for trade in company shares and governance rights, found mostly in the Securities Act of 1933 and the Securities and Exchange Act of 1934, as amended by laws like the Sarbanes–Oxley Act of 2002 and the Dodd–Frank Wall Street Reform and Consumer Protection Act. The US Constitution was interpreted by the US Supreme Court to allow corporations to incorporate in the state of their choice, regardless of where their headquarters are. Over the 20th century, most major corporations incorporated under the Delaware General Corporation Law, which offered lower corporate taxes, fewer shareholder rights against directors, and developed a specialized court and legal profession. Nevada has done the same. Twenty-four states follow the Model Business Corporation Act, while New York and California are important due to their size.

Louis Dembitz Brandeis was an American lawyer and associate justice on the Supreme Court of the United States from 1916 to 1939.

The main belief behind the concept of a money trust is that the majority of the world's financial wealth and political power could be controlled by a powerful few.

Philadelphia financier Jay Cooke established the first modern American investment bank during the Civil War era. However, private banks had been providing investment banking functions since the beginning of the 19th century and many of these evolved into investment banks in the post-bellum era. However, the evolution of firms into investment banks did not follow a single trajectory. For example, some currency brokers such as Prime, Ward & King and John E. Thayer and Brother moved from foreign exchange operations to become private banks, taking on some investment bank functions. Other investment banks evolved from mercantile firms such as Thomas Biddle and Co. and Alexander Brothers.

This article details the history of banking in the United States. Banking in the United States is regulated by both the federal and state governments.