A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich.

A Pigovian tax is a tax on any market activity that generates negative externalities. The tax is intended to correct an undesirable or inefficient market outcome, and does so by being set equal to the external marginal cost of the negative externalities. Social cost includes private cost and external cost. However, in the presence of negative externalities, the social cost of a market activity is not covered by the private cost of the activity. In such a case, the market outcome is not efficient and may lead to over-consumption of the product. Often-cited examples of such externalities are environmental pollution, and increased public healthcare costs associated with tobacco and sugary drink consumption.

A corporate tax, also called corporation tax or company tax, is a direct tax imposed by a jurisdiction on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. Partnerships are generally not taxed at the entity level. A country's corporate tax may apply to:

Klassekampen is a Norwegian daily newspaper, which styles itself as "the daily newspaper of the left".

Double taxation is the levying of tax by two or more jurisdictions on the same income, asset, or financial transaction.

Dividend imputation is a corporate tax system in which some or all of the tax paid by a company may be attributed, or imputed, to the shareholders by way of a tax credit to reduce the income tax payable on a distribution. In comparison to the classical system, it reduces or eliminates the tax disadvantages of distributing dividends to shareholders by only requiring them to pay the difference between the corporate rate and their marginal tax rate. The imputation system effectively taxes distributed company profit at the shareholders' average tax rates.

Income taxes in the United States are imposed by the federal, most states, and many local governments. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels.

Income taxes in Canada constitute the majority of the annual revenues of the Government of Canada, and of the governments of the Provinces of Canada. In the fiscal year ending 31 March 2018, the federal government collected just over three times more revenue from personal income taxes than it did from corporate income taxes.

Boreal Bane AS, trading, and formerly known as, AS Gråkallbanen, is a Norwegian company that operates the remaining part of the Trondheim Tramway, Norway. It operates six trams on the Gråkall Line, that connects the city centre to parts of the suburb of Byåsen, and the recreational area at Lian. It has 800,000 annual passengers, and operates as Line 1. The trams operate each 15 minutes during the day, and each 30 minutes in the evenings and during the weekends.

Texas Monthly v. Bullock, 489 U.S. 1 (1989), was a case brought before the US Supreme Court in November 1988. The case was to test the legality of a Texas statute that exempted religious publications from paying state sales tax.

The mass media in Bulgaria refers to mass media outlets based in Bulgaria. Television, magazines, and newspapers are all operated by both state-owned and for-profit corporations which depend on advertising, subscription, and other sales-related revenues. The Constitution of Bulgaria guarantees freedom of speech. As a country in transition, Bulgaria's media system is under transformation.

Participation exemption is a general term relating to an exemption from taxation for a shareholder in a company on dividends received, and potential capital gains arising on the sale of shares.

Trondhjems Omnibus Aktieselskab was the first provider of public transport in Trondheim, Norway. From 1893 to 1902, it operated a horse-hauled coach service in Trondheim. Until 1901 it operated the profitable Voldsminde–Ila route, but then the Trondheim Tramway took over the route, and the company was forced to operate a less profitable route from the railway station to Øya. The company went bankrupt the following year.

The decline of newspapers has been debated, as the industry has faced slumping ad sales, the loss of much classified advertising and precipitous drops in circulation. In recent years, newspapers' weekday circulation fell 7% and Sunday circulation fell 4%, both showing their greatest declines since 2010. Overall, the industry continues to shrink, with Editor & Publisher’s DataBook listing 126 fewer daily papers in 2014 than in 2004. To survive, newspapers are considering combining and other options, although the outcome of such partnerships has been criticized. Despite these problems, newspaper companies with significant brand value and which have published their work online have had a significant rise in viewership.

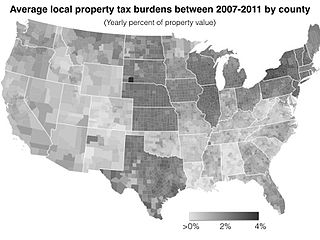

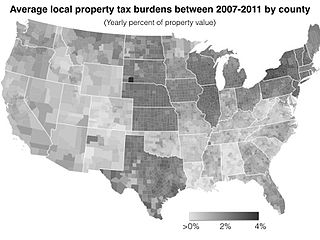

Most local governments in the United States impose a property tax, also known as a millage rate, as a principal source of revenue. This tax may be imposed on real estate or personal property. The tax is nearly always computed as the fair market value of the property times an assessment ratio times a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners. For the taxing authority, one advantage of the property tax over the sales tax or income tax is that the revenue always equals the tax levy, unlike the other taxes. The property tax typically produces the required revenue for municipalities' tax levies. A disadvantage to the taxpayer is that the tax liability is fixed, while the taxpayer's income is not.

Taxation in Norway is levied by the central government, the county municipality (fylkeskommune) and the municipality (kommune). In 2012 the total tax revenue was 42.2% of the gross domestic product (GDP). Many direct and indirect taxes exist. The most important taxes – in terms of revenue – are VAT, income tax in the petroleum sector, employers' social security contributions and tax on "ordinary income" for persons. Most direct taxes are collected by the Norwegian Tax Administration (Skatteetaten) and most indirect taxes are collected by the Norwegian Customs and Excise Authorities.

Government incentives for plug-in electric vehicles have been established around the world to support policy-driven adoption of plug-in electric vehicles. These incentives mainly take the form of purchase rebates, tax exemptions and tax credits, and additional perks that range from access to bus lanes to waivers on fees. The amount of the financial incentives may depend on vehicle battery size or all-electric range. Often hybrid electric vehicles are included. Some countries extend the benefits to fuel cell vehicles, and electric vehicle conversions.

"Journalism and Freedom" was an article by Rupert Murdoch that appeared in The Wall Street Journal 's online Opinion Journal on 8 December 2009.

The Research and Development Network in Norway or FUNN was fourteen computing centers established in regional districts in Norway established by Norsk Data (ND) and the Ministry of Trade and Industry in 1989. These were located in Ålesund, Alta, Bø, Gjøvik, Grimstad, Kirkenes, Kristiansund, Mo i Rana, Narvik, Sarpsborg, Sogndal, Steinkjer, Stord and Tromsø. Each had two Norsk Data-built minicomputers, one running Sintran III and one running Unix. Participating agencies included the Regional Development Fund, the Ministry of Local Government and Regional Development, the Norwegian Telecommunications Administration (NTA) and the Royal Norwegian Council for Scientific and Industrial Research (NTNF).

The Norwegian Audit Bureau of Circulations is a company that monitors the print runs of Norwegian newspapers, magazines, and weekly publications, and offers advice on calculating circulation numbers. It was established in 2001 and is owned by: