Related Research Articles

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation.

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after the stock market crash of 1929. It is an integral part of United States securities regulation. It is legislated pursuant to the Interstate Commerce Clause of the Constitution.

Charles Christopher Cox is an American attorney and politician who served as chair of the U.S. Securities and Exchange Commission, a 17-year Republican member of the United States House of Representatives, and member of the White House staff in the Reagan Administration. Prior to his Washington service he was a practicing attorney, teacher, and entrepreneur. Following his retirement from government in 2009, he returned to law practice and currently serves as a director, trustee, and advisor to several for-profit and nonprofit organizations.

The Securities Exchange Act of 1934 is a law governing the secondary trading of securities in the United States of America. A landmark piece of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law.

The Investment Company Act of 1940 is an act of Congress which regulates investment funds. It was passed as a United States Public Law on August 22, 1940, and is codified at 15 U.S.C. §§ 80a-1–80a-64. Along with the Securities Exchange Act of 1934, the Investment Advisers Act of 1940, and extensive rules issued by the U.S. Securities and Exchange Commission; it is central to financial regulation in the United States. It has been updated by the Dodd-Frank Act of 2010. It is the primary source of regulation for mutual funds and closed-end funds, now a multi-trillion dollar investment industry. The 1940 Act also impacts the operations of hedge funds, private equity funds and even holding companies.

In the United States under the Securities Act of 1933, any offer to sell securities must either be registered with the United States Securities and Exchange Commission (SEC) or meet certain qualifications to exempt them from such registration. Regulation D contains the rules providing exemptions from the registration requirements, allowing some companies to offer and sell their securities without having to register the securities with the SEC. A Regulation D offering is intended to make access to the capital markets possible for small companies that could not otherwise bear the costs of a normal SEC registration. Reg D may also refer to an investment strategy, mostly associated with hedge funds, based upon the same regulation. The regulation is found under Title 17 of the Code of Federal Regulations, part 230, Sections 501 through 508. The legal citation is 17 C.F.R. §230.501 et seq.

A Form 10-K is an annual report required by the U.S. Securities and Exchange Commission (SEC), that gives a comprehensive summary of a company's financial performance. Although similarly named, the annual report on Form 10-K is distinct from the often glossy "annual report to shareholders," which a company must send to its shareholders when it holds an annual meeting to elect directors. The 10-K includes information such as company history, organizational structure, executive compensation, equity, subsidiaries, and audited financial statements, among other information.

OTC Markets Group, Inc. is an American financial market providing price and liquidity information for almost 12,400 over-the-counter (OTC) securities. The group has its headquarters in New York City. OTC-traded securities are organized into three markets to inform investors of opportunities and risks: OTCQX, OTCQB and Pink.

Securities regulation in the United States is the field of U.S. law that covers transactions and other dealings with securities. The term is usually understood to include both federal and state-level regulation by governmental regulatory agencies, but sometimes may also encompass listing requirements of exchanges like the New York Stock Exchange and rules of self-regulatory organizations like the Financial Industry Regulatory Authority (FINRA).

A proxy statement is a statement required of a firm when soliciting shareholder votes. This statement is filed in advance of the annual meeting. The firm needs to file a proxy statement, otherwise known as a Form DEF 14A, with the U.S. Securities and Exchange Commission. This statement is useful in assessing how management is paid and potential conflict of interest issues with auditors.

A red herring prospectus, as a first or preliminary prospectus, is a document submitted by a company (issuer) as part of a public offering of securities. Most frequently associated with an initial public offering (IPO), this document, like the previously submitted Form S-1 registration statement, must be filed with the Securities and Exchange Commission (SEC).

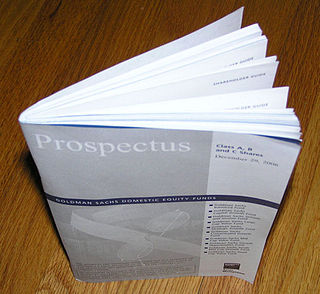

A prospectus, in finance, is a disclosure document that describes a financial security for potential buyers. It commonly provides investors with material information about mutual funds, stocks, bonds and other investments, such as a description of the company's business, financial statements, biographies of officers and directors, detailed information about their compensation, any litigation that is taking place, a list of material properties and any other material information. In the context of an individual securities offering, such as an initial public offering, a prospectus is distributed by underwriters or brokerages to potential investors. Today, prospectuses are most widely distributed through websites such as EDGAR and its equivalents in other countries.

Rule 144A. Securities Act of 1933, as amended provides a safe harbor from the registration requirements of the Securities Act of 1933 for certain private resales of minimum $500,000 units of restricted securities to qualified institutional buyers (QIBs), which generally are large institutional investors that own at least $100 million in investable assets. When a broker or dealer is selling securities in reliance on Rule 144A, it may make offers to non-QIBs through general solicitations following an amendment to the Rule in 2012.

Form S-1 is an SEC filing used by companies planning on going public to register their securities with the U.S. Securities and Exchange Commission (SEC) as the "registration statement by the Securities Act of 1933". The S-1 contains the basic business and financial information on an issuer with respect to a specific securities offering. Investors may use the prospectus to consider the merits of an offering and make educated investment decisions. A prospectus is one of the main documents used by an investor to research a company prior to an initial public offering (IPO). Other less detailed registration forms, such as Form S-3, may be used for certain registrations.

The Canadian Securities Administrators is an umbrella organization of Canada's provincial and territorial securities regulators whose objective is to improve, coordinate, and harmonize regulation of the Canadian capital markets.

The Electronic Municipal Market Access (EMMA) system, operated by the Municipal Securities Rulemaking Board (MSRB), serves as the official source for municipal securities disclosures and related financial data in the United States. EMMA provides free on-line access to centralized new issue municipal securities disclosure documents, on-going continuing disclosures for all municipal securities, escrow deposit agreements for advance refundings of outstanding bonds, real-time municipal bond trade price information, interest rates and auction results for municipal auction rate securities and interest rate reset information for variable rate demand obligations, together with daily statistics on trading activity and investor education materials.

Regulation S-K is a prescribed regulation under the US Securities Act of 1933 that lays out reporting requirements for various SEC filings used by public companies. Companies are also often called issuers, filers or registrants.

Regulation S-X is a prescribed regulation in the United States of America that lays out the specific form and content of financial reports, specifically the financial statements of public companies. It is cited as 17 C.F.R. Part 210; the name of the part is "Form and Content of and Requirements for Financial Statements, Securities Act of 1933, Securities Exchange Act of 1934, Public Utility Holding Company Act of 1935, Investment Company Act of 1940, Investment Advisers Act of 1940, and Energy Policy and Conservation Act of 1975".

The Jumpstart Our Business Startups Act, or JOBS Act, is a law intended to encourage funding of small businesses in the United States by easing many of the country's securities regulations. It passed with bipartisan support, and was signed into law by President Barack Obama on April 5, 2012. Title III, also known as the CROWDFUND Act, has drawn the most public attention because it creates a way for companies to use crowdfunding to issue securities, something that was not previously permitted. Title II went into effect on September 23, 2013. On October 30, 2015, the SEC adopted final rules allowing Title III equity crowdfunding. These rules went into effect on May 16, 2016; this section of the law is known as Regulation CF. Other titles of the Act had previously become effective in the years since the Act's passage.

In the United States under the Securities Act of 1933, any offer to sell securities must either be registered with the United States Securities and Exchange Commission (SEC) or meet certain qualifications to exempt it from such registration. Regulation A contains rules providing exemptions from the registration requirements, allowing some companies to use equity crowdfunding to offer and sell their securities without having to register the securities with the SEC. Regulation A offerings are intended to make access to capital possible for small and medium-sized companies that could not otherwise bear the costs of a normal SEC registration and to allow nonaccredited investors to participate in the offering. The regulation is found under Title 17 of the Code of Federal Regulations, chapter 2, part 230. The legal citation is 17 C.F.R. §230.251 et seq.

References

- ↑ "Six commonly asked questions (and answers) about quiet periods". www.irmagazine.com.

- ↑ "Quiet Period". www.investor.gov.

- ↑ "Shhh It's The Quiet Period". www.investor.gov.