Passive management is an investing strategy that tracks a market-weighted index or portfolio. Passive management is most common on the equity market, where index funds track a stock market index, but it is becoming more common in other investment types, including bonds, commodities and hedge funds.

In finance, an equity derivative is a class of derivatives whose value is at least partly derived from one or more underlying equity securities. Options and futures are by far the most common equity derivatives, however there are many other types of equity derivatives that are actively traded.

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility. There is no unique classification as each classification may refer to different aspects of market risk. Nevertheless, the most commonly used types of market risk are:

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

Volatility risk is the risk of an adverse change of price, due to changes in the volatility of a factor affecting that price. It usually applies to derivative instruments, and their portfolios, where the volatility of the underlying asset is a major influencer of option prices. It is also relevant to portfolios of basic assets, and to foreign currency trading.

In finance, the beta is a statistic that measures the expected increase or decrease of an individual stock price in proportion to movements of the stock market as a whole. Beta can be used to indicate the contribution of an individual asset to the market risk of a portfolio when it is added in small quantity. It refers to an asset's non-diversifiable risk, systematic risk, or market risk. Beta is not a measure of idiosyncratic risk.

In finance, statistical arbitrage is a class of short-term financial trading strategies that employ mean reversion models involving broadly diversified portfolios of securities held for short periods of time. These strategies are supported by substantial mathematical, computational, and trading platforms.

Long/short equity is an investment strategy generally associated with hedge funds. It involves buying equities that are expected to increase in value and selling short equities that are expected to decrease in value. This is different from the risk reversal strategies where investors will simultaneously buy a call option and sell a put option to simulate being long in a stock.

Fixed-income arbitrage is a group of market-neutral-investment strategies that are designed to take advantage of differences in interest rates between varying fixed-income securities or contracts. Arbitrage in terms of investment strategy, involves buying securities on one market for immediate resale on another market in order to profit from a price discrepancy.

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent.

In finance, correlation trading is a strategy in which the investor gets exposure to the average correlation of an index.

An investment strategy or portfolio is considered market-neutral if it seeks to avoid some form of market risk entirely, typically by hedging. To evaluate market neutrality requires specifying the risk to avoid. For example, convertible arbitrage attempts to fully hedge fluctuations in the price of the underlying common stock. A portfolio is truly market-neutral if it exhibits zero correlation with the unwanted source of risk. Market neutrality is an ideal, which is seldom possible in practice. A portfolio that appears market-neutral may exhibit unexpected correlations as market conditions change. The risk of this occurring is called basis risk.

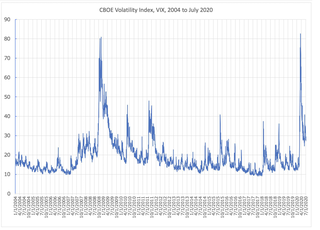

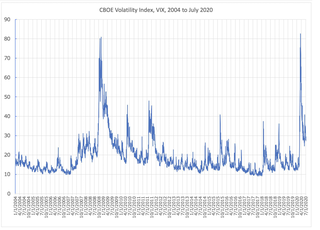

VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options. It is calculated and disseminated on a real-time basis by the CBOE, and is often referred to as the fear index or fear gauge.

Currency overlay is a financial trading strategy or method conducted by specialist firms who manage the currency exposures of large clients, typically institutions such as pension funds, endowments and corporate entities. Typically the institution will have a pre-existing exposure to foreign currencies, and will be seeking to:

The following outline is provided as an overview of and topical guide to finance:

In finance, a stock market index future is a cash-settled futures contract on the value of a particular stock market index. The turnover for the global market in exchange-traded equity index futures is notionally valued, for 2008, by the Bank for International Settlements at US$130 trillion.

In trading strategy, news analysis refers to the measurement of the various qualitative and quantitative attributes of textual news stories. Some of these attributes are: sentiment, relevance, and novelty. Expressing news stories as numbers and metadata permits the manipulation of everyday information in a mathematical and statistical way. This data is often used in financial markets as part of a trading strategy or by businesses to judge market sentiment and make better business decisions.

IVX is a volatility index providing an intraday, VIX-like measure for any of US securities and exchange traded instruments. IVX is the abbreviation of Implied Volatility Index and is a popular measure of the implied volatility of each individual stock. IVX represents the cost level of the options for a particular security and comparing to its historical levels one can see whether IVX is high or low and thus whether options are more expensive or cheaper. IVX values can be compared for the stocks within one industry to find names which significantly differ from what is observed in overall sector.

Betashares is an Australian provider of exchange-traded funds (ETFs). The company manages the broadest range of ETFs in Australia across major assets classes. Betashares is based in Sydney, Australia with offices in Melbourne, Brisbane and Perth.

A managed futures account (MFA) or managed futures fund (MFF) is a type of alternative investment in the US in which trading in the futures markets is managed by another person or entity, rather than the fund's owner. Managed futures accounts include, but are not limited to, commodity pools. These funds are operated by commodity trading advisors (CTAs) or commodity pool operators (CPOs), who are generally regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. As of June 2016, the assets under management held by managed futures accounts totaled $340 billion.