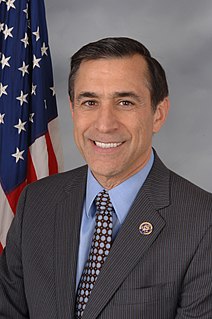

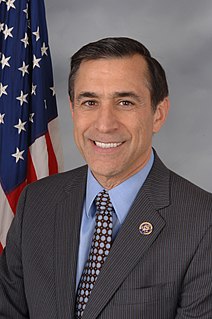

Darrell Edward Issa is an American businessman and Republican politician. He served in the United States House of Representatives from 2001 to 2019, representing districts primarily covering north San Diego County, California. From January 2011 to January 2015, he served as Chairman of the House Oversight and Government Reform Committee. Issa served as CEO of Directed Electronics, which he co-founded in 1982. It is currently one of the largest makers of automobile aftermarket security and convenience products in the United States. Sporting a net worth of approximately 250 million dollars, Issa during his tenure was the wealthiest serving member of Congress.

Elijah Eugene Cummings is an American politician and the U.S. Representative for Maryland's 7th congressional district, currently serving in his 13th term in the House, having served since 1996. The district includes just over half of Baltimore City, most of the majority-black precincts of Baltimore County, as well as most of Howard County. He previously served in the Maryland House of Delegates. He is a member of the Democratic Party and current chair of the United States House Committee on Oversight and Reform.

Andrew Marshall Saul is an American businessman from Katonah, New York who served as the Chairman of the Federal Retirement Thrift Investment Board (FRTIB) and Vice Chairman of the Metropolitan Transportation Authority (MTA) in New York City, United States. Saul has been a General Partner in the investment firm Saul Partners, L.P., since 1986.

The Streamlining Claims Processing for Federal Contractor Employees Act was signed into law by President Barack Obama in 2013. It transfers some authority from the Government Accountability Office to the United States Department of Labor in order to streamline the implementation and enforcement of federal contractor wage laws. Previously, the United States Department of Labor was responsible for implementing the Davis–Bacon Act, "which requires that federally-contracted workers be paid the 'local prevailing wage' on government projects, and the Contract Work Hours and Safety Standards Act (CWHSSA), which mandates that federal contractors pay their employees overtime for hours worked in excess of 40 per week." Meanwhile, the Government Accountability Office was responsible for dealing with the claims of workers who did not make the correct wage. This law was designed to improve efficiency by transferring that responsibility to the Department of Labor.

The Retail Investor Protection Act is a bill that would delay some pending regulations being written by the United States Department of Labor until the Securities and Exchange Commission has finalized their own rules. The rules in question are rules that would describe "when financial advisors are considered a fiduciary, which means they must work in their clients' best interest." The bill passed the United States House of Representatives during the 113th United States Congress.

The Digital Accountability and Transparency Act of 2013 aims to make information on federal expenditures more easily available, accessible, and transparent. The bill would change reporting requirements about financial data and start a pilot program to research best practices. The bill was introduced in the House during the 113th United States Congress.

The Small Business Capital Access and Job Preservation Act is a bill that would exempt investment advisers from the Security and Exchange Commission’s (SEC’s) registration and reporting requirements when they provide advice to a private equity fund with outstanding debt that is less than twice the amount of capital that has been committed to and invested by the fund. This requirement was created by the Dodd–Frank Wall Street Reform and Consumer Protection Act. The Small Business Capital Access and Job Preservation Act passed in the United States House of Representatives during the 113th United States Congress.

The FOIA Oversight and Implementation Act of 2014 is a bill that would amend the Freedom of Information Act in order to make it easier and faster to request and receive information. The bill would require the Office of Management and Budget to create a single FOIA website for people to use to make FOIA requests and check on the status of their request. The bill would also create a Chief FOIA Officers Council charged with reviewing compliance and recommending improvements. This bill would also require the federal agency to release the information it disclosed to the person who requested it publicly afterwards.

The Federal Information Technology Acquisition Reform Act made changes to the ways the U.S. federal government buys and manages computer technology. It became law as a part of the National Defense Authorization Act for Fiscal Year 2015 (Title VIII, Subtitle D, H.R. 3979.

The Cooperative and Small Employer Charity Pension Flexibility Act is a law that allows some charities, schools, and volunteer organizations to remain exempt from pension plan rules under the Employee Retirement Income Security Act of 1974 (ERISA) and the Internal Revenue Code.

The Government Reports Elimination Act of 2014 is a bill that eliminates 18 specific reports that various federal agencies are required to give to Congress and an additional 85 reports that they are required to prepare.

Pub.L. 113–103, officially titled To amend the Act entitled An Act to regulate the height of buildings in the District of Columbia to clarify the rules of the District of Columbia regarding human occupancy of penthouses above the top story of the building upon which the penthouse is placed, is a United States Public Law that amends the Height of Buildings Act of 1910 in order to allow some penthouses to be built on the tops of buildings in District of Columbia.

The DHS Acquisition Accountability and Efficiency Act is a bill that would direct the United States Department of Homeland Security (DHS) to improve the accountability, transparency, and efficiency of its major acquisition programs. The bill would specify procedures for the department to follow if it fails to meet timelines, cost estimates, or other performance parameters for these programs.

The Federal Register Modernization Act is a bill that would require the Federal Register to be published, rather than printed, and that documents in the Federal Register be made available for sale or distribution to the public in published form.

The District of Columbia Courts, Public Defender Service, and Court Services and Offender Supervision Agency Act of 2014 is a bill that would make changes to the District of Columbia Official Code that governs the D.C. Courts system.

The All Circuit Review Extension Act is a bill that would extend for three years the authority for federal employees who appeal a judgment of the Merit Systems Protection Board (MSPB) to file their appeal at any federal court, instead of only the U.S. Court of Appeals. This was a pilot program established in the Whistleblower Protection Enhancement Act of 2012 to last only two years.

The Gerardo Hernandez Airport Security Act of 2014 is a bill that would direct the Transportation Security Administration (TSA) to undertake a variety of activities aimed at enhancing security at airports where the TSA performs or oversees security-related activities. The bill would require the TSA to verify that all such airports have appropriate response plans, to share best practices with each airport, and to report to Congress on the capacity of law enforcement, fire, and medical response teams to communicate and respond to security threats at airports.

The TSA Office of Inspection Accountability Act of 2014 is a bill that would direct the Inspector General of the Department of Homeland Security (DHS) to review the data and methods that the Transportation Security Administration (TSA) uses to classify personnel as law enforcement officers and to reclassify, as necessary, any staff of the Office of Inspection that are currently misclassified according to the results of that review. The TSA would be required to adhere to existing federal law about what positions are classified as criminal investigators, a fact that determines pay and benefits.

The Presidential and Federal Records Act Amendments of 2014 is a United States federal statute which amended the Presidential Records Act and Federal Records Act. Introduced as H.R. 1233, it was signed into law by President Barack Obama on November 26, 2014.

The Senior Executive Service Accountability Act is a bill that would make it less difficult to fire or suspend members of the Senior Executive Service (SES).