Brownian motion is the random motion of particles suspended in a medium.

In mathematics, the Lp spaces are function spaces defined using a natural generalization of the p-norm for finite-dimensional vector spaces. They are sometimes called Lebesgue spaces, named after Henri Lebesgue, although according to the Bourbaki group they were first introduced by Frigyes Riesz.

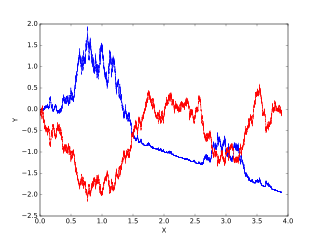

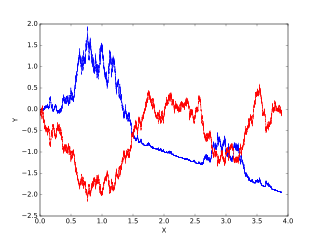

In mathematics, the Wiener process is a real-valued continuous-time stochastic process named in honor of American mathematician Norbert Wiener for his investigations on the mathematical properties of the one-dimensional Brownian motion. It is often also called Brownian motion due to its historical connection with the physical process of the same name originally observed by Scottish botanist Robert Brown. It is one of the best known Lévy processes and occurs frequently in pure and applied mathematics, economics, quantitative finance, evolutionary biology, and physics.

In statistical mechanics and information theory, the Fokker–Planck equation is a partial differential equation that describes the time evolution of the probability density function of the velocity of a particle under the influence of drag forces and random forces, as in Brownian motion. The equation can be generalized to other observables as well. The Fokker-Planck equation has multiple applications in information theory, graph theory, data science, finance, economics etc.

In the calculus of variations and classical mechanics, the Euler–Lagrange equations are a system of second-order ordinary differential equations whose solutions are stationary points of the given action functional. The equations were discovered in the 1750s by Swiss mathematician Leonhard Euler and Italian mathematician Joseph-Louis Lagrange.

In probability theory, in particular in the study of stochastic processes, a stopping time is a specific type of “random time”: a random variable whose value is interpreted as the time at which a given stochastic process exhibits a certain behavior of interest. A stopping time is often defined by a stopping rule, a mechanism for deciding whether to continue or stop a process on the basis of the present position and past events, and which will almost always lead to a decision to stop at some finite time.

A stochastic differential equation (SDE) is a differential equation in which one or more of the terms is a stochastic process, resulting in a solution which is also a stochastic process. SDEs have many applications throughout pure mathematics and are used to model various behaviours of stochastic models such as stock prices, random growth models or physical systems that are subjected to thermal fluctuations.

Itô calculus, named after Kiyosi Itô, extends the methods of calculus to stochastic processes such as Brownian motion. It has important applications in mathematical finance and stochastic differential equations.

In mathematics, the theory of optimal stopping or early stopping is concerned with the problem of choosing a time to take a particular action, in order to maximise an expected reward or minimise an expected cost. Optimal stopping problems can be found in areas of statistics, economics, and mathematical finance. A key example of an optimal stopping problem is the secretary problem. Optimal stopping problems can often be written in the form of a Bellman equation, and are therefore often solved using dynamic programming.

In probability theory, a real valued stochastic process X is called a semimartingale if it can be decomposed as the sum of a local martingale and a càdlàg adapted finite-variation process. Semimartingales are "good integrators", forming the largest class of processes with respect to which the Itô integral and the Stratonovich integral can be defined.

An -superprocess, , within mathematics probability theory is a stochastic process on that is usually constructed as a special limit of near-critical branching diffusions.

In mathematics — specifically, in stochastic analysis — the infinitesimal generator of a Feller process is a Fourier multiplier operator that encodes a great deal of information about the process.

In mathematics, some boundary value problems can be solved using the methods of stochastic analysis. Perhaps the most celebrated example is Shizuo Kakutani's 1944 solution of the Dirichlet problem for the Laplace operator using Brownian motion. However, it turns out that for a large class of semi-elliptic second-order partial differential equations the associated Dirichlet boundary value problem can be solved using an Itō process that solves an associated stochastic differential equation.

The Brownian motion models for financial markets are based on the work of Robert C. Merton and Paul A. Samuelson, as extensions to the one-period market models of Harold Markowitz and William F. Sharpe, and are concerned with defining the concepts of financial assets and markets, portfolios, gains and wealth in terms of continuous-time stochastic processes.

In probability theory, a McKean–Vlasov process is a stochastic process described by a stochastic differential equation where the coefficients of the diffusion depend on the distribution of the solution itself. The equations are a model for Vlasov equation and were first studied by Henry McKean in 1966. It is an example of propagation of chaos, in that it can be obtained as a limit of a mean-field system of interacting particles: as the number of particles tends to infinity, the interactions between any single particle and the rest of the pool will only depend on the particle itself.

Stochastic portfolio theory (SPT) is a mathematical theory for analyzing stock market structure and portfolio behavior introduced by E. Robert Fernholz in 2002. It is descriptive as opposed to normative, and is consistent with the observed behavior of actual markets. Normative assumptions, which serve as a basis for earlier theories like modern portfolio theory (MPT) and the capital asset pricing model (CAPM), are absent from SPT.

In mathematics, Katugampola fractional operators are integral operators that generalize the Riemann–Liouville and the Hadamard fractional operators into a unique form. The Katugampola fractional integral generalizes both the Riemann–Liouville fractional integral and the Hadamard fractional integral into a single form and It is also closely related to the Erdelyi–Kober operator that generalizes the Riemann–Liouville fractional integral. Katugampola fractional derivative has been defined using the Katugampola fractional integral and as with any other fractional differential operator, it also extends the possibility of taking real number powers or complex number powers of the integral and differential operators.

In mathematics, the Leimkuhler-Matthews method is an algorithm for finding discretized solutions to the Brownian dynamics

A Brownian snake is a stochastic Markov process on the space of stopped paths. It has been extensively studied., and was in particular successfully used as a representation of superprocesses.

In mathematics, stochastic analysis on manifolds or stochastic differential geometry is the study of stochastic analysis over smooth manifolds. It is therefore a synthesis of stochastic analysis and differential geometry.