In economics and finance, arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price.

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

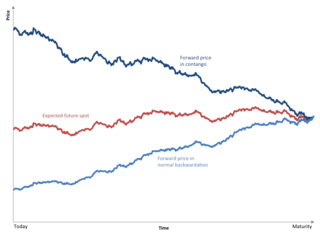

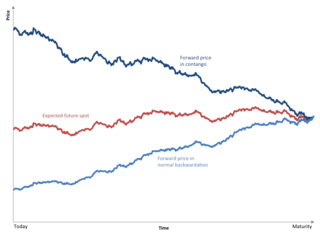

Contango, also sometimes called forwardation, is a situation where the futures price of a commodity is higher than the anticipated spot price at maturity of the futures contract. In a contango situation, arbitrageurs/speculators, are "willing to pay more [now] for a commodity at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, hedgers are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a normal market, or carrying-cost market.

In economic terms, electricity is a commodity capable of being bought, sold, and traded. An electricity market is a system enabling purchases, through bids to buy; sales, through offers to sell; and short-term trades, generally in the form of financial or obligation swaps. Bids and offers use supply and demand principles to set the price. Long-term trades are contracts similar to power purchase agreements and generally considered private bi-lateral transactions between counterparties.

Day trading is speculation in securities, specifically buying and selling financial instruments within the same trading day, such that all positions are closed before the market closes for the trading day. Traders who trade in this capacity with the motive of profit are therefore speculators. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. Day traders exit positions before the market closes to avoid unmanageable risks negative price gaps between one day's close and the next day's price at the open.

In finance, a forward contract or simply a forward is a non-standardized contract between two parties to buy or to sell an asset at a specified future time at a price agreed upon today, making it a type of derivative instrument. The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position. The price agreed upon is called the delivery price, which is equal to the forward price at the time the contract is entered into.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts; that is, a contract to buy specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. These types of contracts fall into the category of derivatives. The opposite of the futures market is the spots market, where trades will occur immediately after a transaction agreement has been made, rather than at a predetermined time in the future. Futures instruments are priced according to the movement of the underlying asset. The aforementioned category is named "derivatives" because the value of these instruments are derived from another asset class.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. The U.S. Securities and Exchange Commission defines a "market maker" as a firm that stands ready to buy and sell stock on a regular and continuous basis at a publicly quoted price.

A regional transmission organization (RTO) in the United States is an electric power transmission system operator (TSO) that coordinates, controls, and monitors a multi-state electric grid. The transfer of electricity between states is considered interstate commerce, and electric grids spanning multiple states are therefore regulated by the Federal Energy Regulatory Commission (FERC). The voluntary creation of RTOs was initiated by FERC Order No. 2000, issued on December 20, 1999. The purpose of the RTO is to promote economic efficiency, reliability, and non-discriminatory practices while reducing government oversight.

Algorithmic trading is a method of executing a large order using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order out to the market over time. They were developed so that traders do not need to constantly watch a stock and repeatedly send those slices out manually. Popular "algos" include Percentage of Volume, Pegged, VWAP, TWAP, Implementation Shortfall, Target Close. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Algorithmic trading is not an attempt to make a trading profit. It is simply a way to minimize the cost, market impact and risk in execution of an order. It is widely used by investment banks, pension funds, mutual funds, and hedge funds because these institutional traders need to execute large orders in markets that cannot support all of the size at once.

In finance, a calendar spread is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. The legs of the spread vary only in expiration date; they are based on the same underlying market and strike price.

Scalping, when used in reference to trading in securities, commodities and foreign exchange, may refer to

- a legitimate method of arbitrage of small price gaps created by the bid-ask spread.

- a fraudulent form of market manipulation

The National Balancing Point, commonly referred to as the NBP, is a virtual trading location for the sale and purchase and exchange of UK natural gas. It is the pricing and delivery point for the ICE Futures Europe (IntercontinentalExchange) natural gas futures contract. It is the 2nd most liquid gas trading point in Europe and is a major influence on the price that domestic consumers pay for their gas at home. Gas at the NBP trades in pence per therm. It is similar in concept to the Henry Hub in the United States – but differs in that it is not an actual physical location.

Market manipulation is a type of market abuse where there is a deliberate attempt to interfere with the free and fair operation of the market and create artificial, false or misleading appearances with respect to the price of, or market for, a product, security, commodity or currency.

The price discovery process is the process of determining the price of an asset in the marketplace through the interactions of buyers and sellers. The futures and options market serve all important functions of price discovery. The individuals with better information and judgement participate in these markets to take advantage of such information. When some new information arrives, perhaps some good news about the economy, for instance, the actions of speculators quickly feed their information into the derivatives market causing changes in price of derivatives. These markets are usually the first ones to react as the transaction cost is much lower in these markets than in the spot market. Therefore these markets indicate what is likely to happen and thus assist in better price discovery.

A smart market is a periodic auction which is cleared by the operations research technique of mathematical optimization, such as linear programming. The smart market is operated by a market manager. Trades are not bilateral, between pairs of people, but rather to or from a pool. A smart market can assist market operation when trades would otherwise have significant transaction costs or externalities.

Convergence trade is a trading strategy consisting of two positions: buying one asset forward—i.e., for delivery in future —and selling a similar asset forward for a higher price, in the expectation that by the time the assets must be delivered, the prices will have become closer to equal, and thus one profits by the amount of convergence.