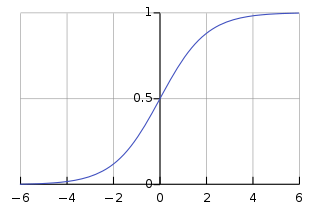

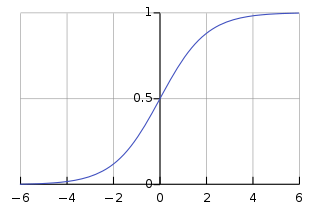

A logistic function or logistic curve is a common S-shaped curve with the equation

In mathematics, a recurrence relation is an equation according to which the th term of a sequence of numbers is equal to some combination of the previous terms. Often, only previous terms of the sequence appear in the equation, for a parameter that is independent of ; this number is called the order of the relation. If the values of the first numbers in the sequence have been given, the rest of the sequence can be calculated by repeatedly applying the equation.

In economics and econometrics, the Cobb–Douglas production function is a particular functional form of the production function, widely used to represent the technological relationship between the amounts of two or more inputs and the amount of output that can be produced by those inputs. The Cobb–Douglas form is developed and tested against statistical evidence by Charles Cobb and Paul Douglas between 1927 and 1947; according to Douglas, the functional form itself was developed earlier by Philip Wicksteed.

Endogenous growth theory holds that economic growth is primarily the result of endogenous and not external forces. Endogenous growth theory holds that investment in human capital, innovation, and knowledge are significant contributors to economic growth. The theory also focuses on positive externalities and spillover effects of a knowledge-based economy which will lead to economic development. The endogenous growth theory primarily holds that the long run growth rate of an economy depends on policy measures. For example, subsidies for research and development or education increase the growth rate in some endogenous growth models by increasing the incentive for innovation.

In economics, a production function gives the technological relation between quantities of physical inputs and quantities of output of goods. The production function is one of the key concepts of mainstream neoclassical theories, used to define marginal product and to distinguish allocative efficiency, a key focus of economics. One important purpose of the production function is to address allocative efficiency in the use of factor inputs in production and the resulting distribution of income to those factors, while abstracting away from the technological problems of achieving technical efficiency, as an engineer or professional manager might understand it.

In control engineering and system identification, a state-space representation is a mathematical model of a physical system specified as a set of input, output and variables related by first-order differential equations or difference equations. Such variables, called state variables, evolve over time in a way that depends on the values they have at any given instant and on the externally imposed values of input variables. Output variables’ values depend on the values of the state variables and may also depend on the values of the input variables.

In economics and in particular neoclassical economics, the marginal product or marginal physical productivity of an input is the change in output resulting from employing one more unit of a particular input, assuming that the quantities of other inputs are kept constant.

In economics, the concept of returns to scale arises in the context of a firm's production function. It explains the long-run linkage of increase in output (production) relative to associated increases in the inputs.

The Solow residual is a number describing empirical productivity growth in an economy from year to year and decade to decade. Robert Solow, the Nobel Memorial Prize in Economic Sciences-winning economist, defined rising productivity as rising output with constant capital and labor input. It is a "residual" because it is the part of growth that is not accounted for by measures of capital accumulation or increased labor input. Increased physical throughput – i.e. environmental resources – is specifically excluded from the calculation; thus some portion of the residual can be ascribed to increased physical throughput. The example used is for the intracapital substitution of aluminium fixtures for steel during which the inputs do not alter. This differs in almost every other economic circumstance in which there are many other variables. The Solow residual is procyclical and measures of it are now called the rate of growth of multifactor productivity or total factor productivity, though Solow (1957) did not use these terms.

The Solow–Swan model or exogenous growth model is an economic model of long-run economic growth. It attempts to explain long-run economic growth by looking at capital accumulation, labor or population growth, and increases in productivity largely driven by technological progress. At its core, it is an aggregate production function, often specified to be of Cobb–Douglas type, which enables the model "to make contact with microeconomics". The model was developed independently by Robert Solow and Trevor Swan in 1956, and superseded the Keynesian Harrod–Domar model.

The Harrod–Domar model is a Keynesian model of economic growth. It is used in development economics to explain an economy's growth rate in terms of the level of saving and of capital. It suggests that there is no natural reason for an economy to have balanced growth. The model was developed independently by Roy F. Harrod in 1939, and Evsey Domar in 1946, although a similar model had been proposed by Gustav Cassel in 1924. The Harrod–Domar model was the precursor to the exogenous growth model.

In economics, the Golden Rule savings rate is the rate of savings which maximizes steady state level of the growth of consumption, as for example in the Solow–Swan model. Although the concept can be found earlier in the work of John von Neumann and Maurice Allais, the term is generally attributed to Edmund Phelps who wrote in 1961 that the golden rule "do unto others as you would have them do unto you" could be applied inter-generationally inside the model to arrive at some form of "optimum", or put simply "do unto future generations as we hope previous generations did unto us."

Constant elasticity of substitution (CES), in economics, is a property of some production functions and utility functions. Several economists have featured in the topic and have contributed in the final finding of the constant. They include Tom McKenzie, John Hicks and Joan Robinson. The vital economic element of the measure is that it provided the producer a clear picture of how to move between different modes or types of production.

The Ramsey–Cass–Koopmans model, or Ramsey growth model, is a neoclassical model of economic growth based primarily on the work of Frank P. Ramsey, with significant extensions by David Cass and Tjalling Koopmans. The Ramsey–Cass–Koopmans model differs from the Solow–Swan model in that the choice of consumption is explicitly microfounded at a point in time and so endogenizes the savings rate. As a result, unlike in the Solow–Swan model, the saving rate may not be constant along the transition to the long run steady state. Another implication of the model is that the outcome is Pareto optimal or Pareto efficient.

Luigi L. Pasinetti was an Italian economist of the post-Keynesian school. Pasinetti was considered the heir of the "Cambridge Keynesians" and a student of Piero Sraffa and Richard Kahn. Along with them, as well as Joan Robinson, he was one of the prominent members on the "Cambridge, UK" side of the Cambridge capital controversy. His contributions to economics include developing the analytical foundations of neo-Ricardian economics, including the theory of value and distribution, as well as work in the line of Kaldorian theory of growth and income distribution. He also developed the theory of structural change and economic growth, structural economic dynamics and uneven sectoral development.

The Goodwin model, sometimes called Goodwin's class struggle model, is a model of endogenous economic fluctuations first proposed by the American economist Richard M. Goodwin in 1967. It combines aspects of the Harrod–Domar growth model with the Phillips curve to generate endogenous cycles in economic activity unlike most modern macroeconomic models in which movements in economic aggregates are driven by exogenously assumed shocks. Since Goodwin's publication in 1967, the model has been extended and applied in various ways.

In the technological theory of social production, the growth of output, measured in money units, is related to achievements in technological consumption of labour and energy. This theory is based on concepts of classical political economy and neo-classical economics and appears to be a generalisation of the known economic models, such as the neo-classical model of economic growth and input-output model.

Econodynamics is an empirical science that studies emergences, motion and disappearance of value—a specific concept that is used for description of the processes of creation and distribution of wealth. Any economic theory deals with the interpretation of economic processes based on the law of production of value, and various scientific approaches differ in the choice of factors of production that determine, in the end, the creation of wealth. Marxists insist that only labor creates value, neoclassicists believe that, in addition to labor, capital must also be taken into account as the important source of value. Econodynamics demonstrates that the statement about the productive power of capital is a hoax that hides the real role of labor and energy in the production of value. Econodynamics offers a more adequate interpretation of economic growth and other phenomena.Econodynamics is based on the achievements of classical political economy and neo-classical economics and has been using the methods of phenomenological science to investigate evolution of economic system. Econodynamics has been proposing methods of analysis and forecasting of economic processes. The comprehensive review of the problems of econodynamics is given recently by Vladimir Pokrovskii.

Uzawa's theorem, also known as the steady state growth theorem, is a theorem in economic growth theory concerning the form that technological change can take in the Solow–Swan and Ramsey–Cass–Koopmans growth models. It was first proved by Japanese economist Hirofumi Uzawa.