Related Research Articles

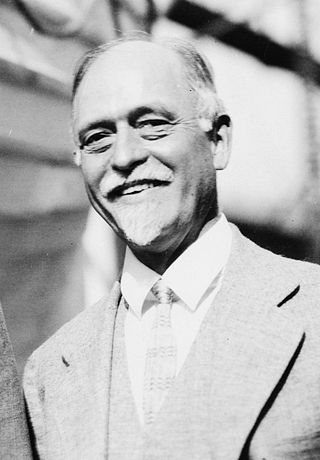

Joseph Alois Schumpeter was an Austrian political economist. He served briefly as Finance Minister of German-Austria in 1919. In 1932, he emigrated to the United States to become a professor at Harvard University, where he remained until the end of his career, and in 1939 obtained American citizenship.

Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation.

John Maynard Keynes, 1st Baron Keynes was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics.

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on national output in the short run and on price levels over longer periods. Monetarists assert that the objectives of monetary policy are best met by targeting the growth rate of the money supply rather than by engaging in discretionary monetary policy. Monetarism is commonly associated with neoliberalism.

Post-Keynesian economics is a school of economic thought with its origins in The General Theory of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Weintraub, Paul Davidson, Piero Sraffa and Jan Kregel. Historian Robert Skidelsky argues that the post-Keynesian school has remained closest to the spirit of Keynes' original work. It is a heterodox approach to economics.

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production.

Irving Fisher was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

The Long Depression was a worldwide price and economic recession, beginning in 1873 and running either through March 1879, or 1896, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the "Great Depression" at the time, and it held that designation until the Great Depression of the 1930s. Though a period of general deflation and a general contraction, it did not have the severe economic retrogression of the Great Depression.

Underconsumption is a theory in economics that recessions and stagnation arise from an inadequate consumer demand, relative to the amount produced. In other words, there is a problem of overproduction and overinvestment during a demand crisis. The theory formed the basis for the development of Keynesian economics and the theory of aggregate demand after the 1930s.

Charles Poor Kindleberger was an American economic historian and author of over 30 books. His 1978 book Manias, Panics, and Crashes, about speculative stock market bubbles, was reprinted in 2000 after the dot-com bubble. He is well known for his role in developing what would become hegemonic stability theory, arguing that a hegemonic power was needed to maintain a stable international monetary system. He has been referred to as "the master of the genre" on financial crisis by The Economist.

The Austrian business cycle theory (ABCT) is an economic theory developed by the Austrian School of economics about how business cycles occur. The theory views business cycles as the consequence of excessive growth in bank credit due to artificially low interest rates set by a central bank or fractional reserve banks. The Austrian business cycle theory originated in the work of Austrian School economists Ludwig von Mises and Friedrich Hayek. Hayek won the Nobel Prize in Economics in 1974 in part for his work on this theory.

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy.

The history of economic thought is the study of the philosophies of the different thinkers and theories in the subjects that later became political economy and economics, from the ancient world to the present day in the 21st century. This field encompasses many disparate schools of economic thought. Ancient Greek writers such as the philosopher Aristotle examined ideas about the art of wealth acquisition, and questioned whether property is best left in private or public hands. In the Middle Ages, Thomas Aquinas argued that it was a moral obligation of businesses to sell goods at a just price.

In the history of economic thought, a school of economic thought is a group of economic thinkers who share or shared a common perspective on the way economies work. While economists do not always fit into particular schools, particularly in modern times, classifying economists into schools of thought is common. Economic thought may be roughly divided into three phases: premodern, early modern and modern. Systematic economic theory has been developed mainly since the beginning of what is termed the modern era.

The Panic of 1847 was a major British commercial and banking crisis, possibly triggered by the announcement in early March 1847 of government borrowing to pay for relief to combat the Great Famine in Ireland. It is also associated with the end of the 1840s railway industry boom and the failure of many non-bank lenders. The crisis was composed of two phases, one in April 1847 and one in October 1847 which was more serious and known as 'The Week of Terror'.

The following outline is provided as an overview of and topical guide to economics:

Inflationism is a heterodox economic, fiscal, or monetary policy, that predicts that a substantial level of inflation is harmless, desirable or even advantageous. Similarly, inflationist economists advocate for an inflationist policy.

Thomas MacGillivray Humphrey is an American economist. Until 2005 he was a research advisor and senior economist in the research department of the Federal Reserve Bank of Richmond and editor of the Bank's flagship publication, the Economic Quarterly. His publications cover macroeconomics, monetary economics, and the history of economic thought. Mark Blaug called him the "undisputed master" of British classical monetary thought.

Crisis theory, concerning the causes and consequences of the tendency for the rate of profit to fall in a capitalist system, is associated with Marxian critique of political economy, and was further popularised through Marxist economics.

References

- ↑ Checkland 1948 , p. 2

- ↑ Kindleberger 1985 , pp. 109–110

- ↑ Glasner 1997 , p. 22

- ↑ Schumpeter 1954 , p. 683