Related Research Articles

Bermuda is a British Overseas Territory in the North Atlantic Ocean. The closest land outside the territory is in the American state of North Carolina, about 1,035 km (643 mi) to the west-northwest.

The British Virgin Islands (BVI), officially the Virgin Islands, is a British Overseas Territory in the Caribbean, to the east of Puerto Rico and the US Virgin Islands and north-west of Anguilla. The islands are geographically part of the Virgin Islands archipelago and are located in the Leeward Islands of the Lesser Antilles and part of the West Indies.

Guernsey is the second largest island in the Channel Islands, located 27 miles (43 km) west of the Cotentin Peninsula, Normandy. It forms the major part of the jurisdiction of the same name, which also comprises three other inhabited islands and many small islets and rocks. The jurisdiction has a population of 63,950 and the island has a land area of 24 square miles (62 km2).

The Isle of Man, also known as Mann, is a self-governing British Crown Dependency in the Irish Sea between Great Britain and Ireland. As head of state, Charles III holds the title Lord of Mann and is represented by a Lieutenant Governor. The government of the United Kingdom is responsible for the isle's military defence and represents it abroad.

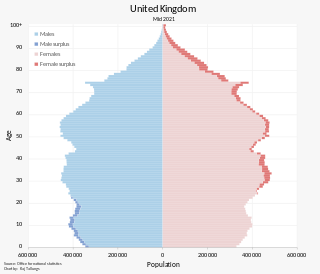

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales, and Northern Ireland. It includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of the smaller islands within the British Isles. Northern Ireland shares a land border with the Republic of Ireland; otherwise, the United Kingdom is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. The total area of the United Kingdom is 94,060 square miles (243,610 km2), with an estimated 2022 population of nearly 67 million people.

The population of the United Kingdom was estimated at over 67.0 million in 2020. It is the 21st most populated country in the world and has a population density of 270 people per square kilometre, with England having significantly greater density than Wales, Scotland, and Northern Ireland. Almost a third of the population lives in south east England, which is predominantly urban and suburban, with about 9 million in the capital city, London, whose population density is just over 5,200 per square kilometre.

The welfare state of the United Kingdom began to evolve in the 1900s and early 1910s, and comprises expenditures by the government of the United Kingdom of Great Britain and Northern Ireland intended to improve health, education, employment and social security. The British system has been classified as a liberal welfare state system.

The Anglosphere is the Anglo-American sphere of influence, with a core group of nations that today maintain close political, diplomatic and military co-operation. While the nations included in different sources vary, the Anglosphere is usually not considered to include all countries where English is an official language, so it is not synonymous with the sphere of anglophones, though commonly included nations are those that were formerly part of the British Empire and retained the English language and English Common Law.

In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

Tax advantage refers to the economic bonus which applies to certain accounts or investments that are, by statute, tax-reduced, tax-deferred, or tax-free. Examples of tax-advantaged accounts and investments include retirement plans, education savings accounts, medical savings accounts, and government bonds. Governments establish tax advantages to encourage private individuals to contribute money when it is considered to be in the public interest.

British Chinese are people of Chinese – particularly Han Chinese – ancestry who reside in the United Kingdom, constituting the second-largest group of Overseas Chinese in Western Europe after France.

Employee benefits and benefits in kind, also called fringe benefits, perquisites, or perks, include various types of non-wage compensation provided to employees in addition to their normal wages or salaries. Instances where an employee exchanges (cash) wages for some other form of benefit is generally referred to as a "salary packaging" or "salary exchange" arrangement. In most countries, most kinds of employee benefits are taxable to at least some degree. Examples of these benefits include: housing furnished or not, with or without free utilities; group insurance ; disability income protection; retirement benefits; daycare; tuition reimbursement; sick leave; vacation ; social security; profit sharing; employer student loan contributions; conveyancing; long service leave; domestic help (servants); and other specialized benefits.

The economy of Scotland is an open mixed economy which, in 2023, had an estimated nominal gross domestic product (GDP) of £211.7 billion including oil and gas extraction in Scottish waters. Since the Acts of Union 1707, Scotland's economy has been closely aligned with the economy of the rest of the United Kingdom (UK), and England has historically been its main trading partner. Scotland still conducts the majority of its trade within the UK: in 2017, Scotland's exports totalled £81.4 billion, of which £48.9 billion (60%) was with the countries of the United Kingdom, £14.9 billion with the European Union (EU), and £17.6 billion with other parts of the world. Scotland’s imports meanwhile totalled £94.4 billion including intra-UK trade leaving Scotland with a trade deficit of £10.4 billion in 2017.

Poverty in the United Kingdom is the condition experienced by the portion of the population of the United Kingdom that lacks adequate financial resources for a certain standard of living, as defined under the various measures of poverty.

Portuguese in the United Kingdom are citizens or residents of the UK who are connected to the country of Portugal by birth, descent or citizenship.

Overseas Pakistanis, or the Pakistani diaspora, refers to Pakistanis who live outside of Pakistan. These include citizens that have migrated to another country as well as people born abroad of Pakistani descent. According to the Ministry of Overseas Pakistanis and Human Resource Development, approximately 8.8 million Pakistanis live abroad according to December 2017 estimates. According to Ministry of Emigration and Overseas Employment, data released in 2023, states that more than 10.80 Million people moved abroad in last 3 decades years since 1990. beoe.gov.pk

Brazilians in the United Kingdom or Brazilian Britons including Brazilian-born immigrants to the UK and their British-born descendants form the single largest Latin American group in the country.

Median household disposable income in the UK was £29,400 in the financial year ending (FYE) 2019, up 1.4% (£400) compared with growth over recent years; median income grew by an average of 0.7% per year between FYE 2017 and FYE 2019, compared with 2.8% between FYE 2013 and FYE 2017.

Pakistan–United Kingdom relations refer to the bilateral ties between the Islamic Republic of Pakistan and the United Kingdom of Great Britain and Northern Ireland. Both countries are members of the Commonwealth of Nations, and the United Kingdom is home to a large Pakistani diaspora population. Until 1956, Pakistan was nominally part of the British Empire as a post-independence federal Dominion in the aftermath of the partition of British India in 1947. After years of efforts the Foreign and Commonwealth Office now consider most of Pakistan safe for travel. It was a final wish of founder Muhammad Ali Jinnah for the British and Pakistani people to enjoy friendship and good relations.

The Zimbabwean diaspora refers to the diaspora of immigrants from the nation of Zimbabwe and their descendants who now reside in other countries. The number of Zimbabweans living outside Zimbabwe varies significantly from 4 to 7 million people, though it is generally accepted at over 5 million people, some 30 per cent of all Zimbabweans. Varying degrees of assimilation and a high degree of interethnic marriages in the Zimbabwean diaspora communities makes determining exact figures difficult. The diaspora population is extremely diverse and consists of Shona people, Ndebele, white Zimbabweans, mixed-race people, Asians, Jewish people and other minority groups. The diaspora traces their origin to several waves of emigration, starting with the exodus that followed the 1965, unilateral declaration of independence in Rhodesia, but significantly since the sociopolitical crisis that began in 2000.

References

- ↑ "Brits Abroad". BBC. Retrieved 14 March 2017.

- ↑ "Portugal: tax treaties - www.gov.uk" . Retrieved 16 March 2017.

- ↑ "The ultimate pension freedom: Retire in Portugal and reduce your tax" . Retrieved 16 March 2017.