A statute of frauds is a form of statute requiring that certain kinds of contracts be memorialized in writing, signed by the party against whom they are to be enforced, with sufficient content to evidence the contract.

Sales are activities related to selling or the number of goods sold in a given targeted time period. The delivery of a service for a cost is also considered a sale. A period during which goods are sold for a reduced price may also be referred to as a "sale".

The Uniform Commercial Code (UCC), first published in 1952, is one of a number of uniform acts that have been established as law with the goal of harmonizing the laws of sales and other commercial transactions across the United States through UCC adoption by all 50 states, the District of Columbia, and the Territories of the United States.

In business or commerce, an order is a stated intention, either spoken or written, to engage in a commercial transaction for specific products or services. From a buyer's point of view it expresses the intention to buy and is called a purchase order. From a seller's point of view it expresses the intention to sell and is referred to as a sales order. When the purchase order of the buyer and the sales order of the seller agree, the orders become a contract between the buyer and seller.

The term pro forma is most often used to describe a practice or document that is provided as a courtesy or satisfies minimum requirements, conforms to a norm or doctrine, tends to be performed perfunctorily or is considered a formality. The term is used in legal and business fields to refer to various types of documents that are generated as a matter of course.

Market value or OMV is the price at which an asset would trade in a competitive auction setting. Market value is often used interchangeably with open market value, fair value or fair market value, although these terms have distinct definitions in different standards, and differ in some circumstances.

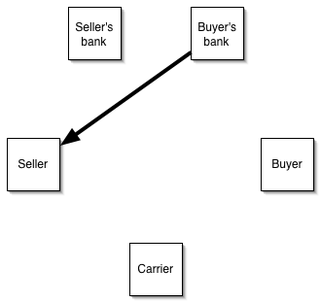

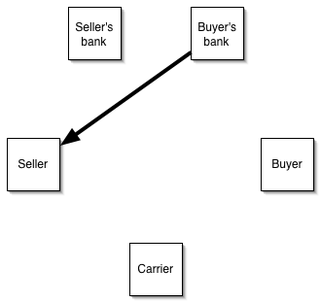

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.

In common law jurisdictions, an implied warranty is a contract law term for certain assurances that are presumed to be made in the sale of products or real property, due to the circumstances of the sale. These assurances are characterized as warranties regardless of whether the seller has expressly promised them orally or in writing. They include an implied warranty of fitness for a particular purpose, an implied warranty of merchantability for products, implied warranty of workmanlike quality for services, and an implied warranty of habitability for a home.

Risk of loss is a term used in the law of contracts to determine which party should bear the burden of risk for damage occurring to goods after the sale has been completed, but before delivery has occurred. Such considerations generally come into play after the contract is formed but before buyer receives goods, something bad happens.

Lost volume seller is a legal term in the law of contracts. Such a seller is a special case in contract law. Ordinarily, a seller whose buyer breaches a contract and refuses to purchase the goods can recover from the breaching buyer only the difference between the contract price and the price for which the seller ultimately sells the goods to another buyer.

In finance, a floating charge is a security interest over a fund of changing assets of a company or other legal person. Unlike a fixed charge, which is created over ascertained and definite property, a floating charge is created over property of an ambulatory and shifting nature, such as receivables and stock.

Consignment is a process whereby a person gives permission to another party to take care of their property and retains full ownership of the property until the item is sold to the final buyer. It is generally done during auctions, shipping, goods transfer, or putting something up for sale in a consignment store. The owner of the goods pays the third-party a portion of the sale for facilitating the sale. Consignors maintain the rights to their property until the item is sold or abandoned. Many consignment shops and online consignment platforms have a set time limit at which an item's availability for sale expires. Within the time of contract, reductions of the price are common to promote the sale of the item, but vary by the type of item sold.

In finance, a security interest is a legal right granted by a debtor to a creditor over the debtor's property which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations. One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

The United Nations Convention on Contracts for the International Sale of Goods (CISG), sometimes known as the Vienna Convention, is a multilateral treaty that establishes a uniform framework for international commerce. As of December 2023, it has been ratified by 97 countries, representing two-thirds of world trade.

The Sale of Goods Act 1979 is an Act of the Parliament of the United Kingdom which regulated English contract law and UK commercial law in respect of goods that are sold and bought. The Act consolidated the original Sale of Goods Act 1893 and subsequent legislation, which in turn had codified and consolidated the law. Since 1979, there have been numerous minor statutory amendments and additions to the 1979 act. It was replaced for some aspects of consumer contracts from 1 October 2015 by the Consumer Rights Act 2015 but remains the primary legislation underpinning business-to-business transactions involving selling or buying goods.

Sale of Goods Acts regulate the sale of goods in several legal jurisdictions including Malaysia, New Zealand, the United Kingdom and the common law provinces of Canada.

In United States income tax law, an installment sale is generally a "disposition of property where at least 1 loan payment is to be received after the close of the taxable year in which the disposition occurs." The term "installment sale" does not include, however, a "dealer disposition" or, generally, a sale of inventory. The installment method of accounting provides an exception to the general principles of income recognition by allowing a taxpayer to defer the inclusion of income of amounts that are to be received from the disposition of certain types of property until payment in cash or cash equivalents is received. The installment method defers the recognition of income when compared with both the cash and accrual methods of accounting. Under the cash method, the taxpayer would recognize the income when it is received, including the entire sum paid in the form of a negotiable note. The deferral advantages of the installment method are the most pronounced when comparing to the accrual method, under which a taxpayer must recognize income as soon as he or she has a right to the income.

Contract law regulates the obligations established by agreement, whether express or implied, between private parties in the United States. The law of contracts varies from state to state; there is nationwide federal contract law in certain areas, such as contracts entered into pursuant to Federal Reclamation Law.

The South African law of sale is an area of the legal system in that country that describes rules applicable to a contract of sale, generally described as a contract whereby one person agrees to deliver to another the free possession of a thing in return for a price in money.

Bulk-sale restrictions — also known as bulk-sale restraints, finished-form limitations and dosage-form limitations — are, as the term is used in United States antitrust case law, clauses in patent licenses that provide that the licensee shall make and sell the licensed product only in "finished pharmaceutical form" or "dosage form", not in bulk. Bulk form is the form in which drug chemicals are manufactured by chemical or other processes. These clauses are found primarily in pharmaceutical product licenses and are used to keep active drug ingredients out of the hands of generic manufacturers and price-cutters.