The New York Stock Exchange is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is the largest stock exchange in the world by market capitalization.

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic trading platform.

Wall Street is a street in the Financial District of Lower Manhattan in New York City. Eight city blocks long, it runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for the financial markets of the United States as a whole, the American financial services industry, New York–based financial interests, or the Financial District itself. Anchored by Wall Street, New York has been described as the world's principal financial and fintech center.

A stockbroker is an individual or company that buys and sells stocks and other investments for a financial market participant in return for a commission, markup, or fee. In most countries they are regulated as a broker or broker-dealer and may need to hold a relevant license and may be a member of a stock exchange. They generally act as a financial advisor and investment manager. In this case they may also be licensed as a financial adviser such as a registered investment adviser.

Philadelphia Stock Exchange (PHLX), now known as Nasdaq PHLX, is the first stock exchange established in the United States and the oldest stock exchange in the nation. The exchange is owned by Nasdaq, which acquired it in 2007 for $652 million, and is headquartered in Philadelphia.

The Depository Trust & Clearing Corporation (DTCC) is an American post-trade financial services company providing clearing and settlement services to the financial markets. It performs the exchange of securities on behalf of buyers and sellers and functions as a central securities depository by providing central custody of securities.

The Broad Street station is a station on the BMT Nassau Street Line of the New York City Subway at the intersection of Broad and Wall Streets in the Financial District of Manhattan. It serves as the southern terminal for J trains at all times and for Z trains during rush hours in the peak direction.

Broad Street is a north–south street in the Financial District of Lower Manhattan in New York City. Originally the Broad Canal in New Amsterdam, it stretches from today's South Street to Wall Street.

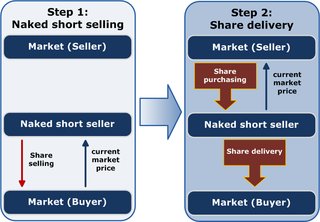

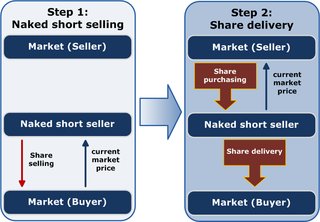

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf.

Anthony Stockholm was the first president of the New York Stock Exchange from 1817 to 1818.

Buttonwood or Buttonwoods may refer to:

Ephraim Hart was an American merchant who helped to organize the Board of Stock-Brokers, now known as the New York Stock Exchange.

The Tontine Coffee House was a coffeehouse in Manhattan, New York City, established in early 1793. Situated at 82 Wall Street, on the north-west corner of Water Street, it was built by a group of stockbrokers to serve as a meeting place for trade and correspondence. It was organized as a tontine, a type of investment plan, and funded by the sale of 203 shares of £200 each. The May 17, 1792, creation of the Buttonwood Agreement, which bound its signatories to trade only with each other, effectively gave rise to a new organization of tradespeople.

The phrase curbstone broker or curb-stone broker refers to a broker who conducts trading on the literal curbs of a financial district. Such brokers were prevalent in the 1800s and early 1900s, and the most famous curb market existed on Broad Street in the financial district of Manhattan. Curbstone brokers often traded stocks that were speculative in nature, as well as stocks in small industrial companies such as iron, textiles and chemicals. Efforts to organize and standardize the market started early in the 20th century under notable curb-stone brokers such as Emanuel S. Mendels.

Interactive Brokers LLC (IB) is an American multinational brokerage firm. It operates the largest electronic trading platform in the United States by number of daily average revenue trades. The company brokers stocks, options, futures, EFPs, futures options, forex, bonds, funds, and some cryptocurrencies.

Anthony Lispenard Bleecker was a prominent banker, merchant and auctioneer, and one of the richest men in New York. He worked as well as a vestryman and churchwarden for Trinity Church in Lower Manhattan. He is the namesake for Bleecker Street and Lispenard Street in lower Manhattan.

The New York Stock Exchange Building, in the Financial District of Lower Manhattan in New York City, is the headquarters of the New York Stock Exchange (NYSE). It is composed of two connected structures occupying part of the city block bounded by Wall Street, Broad Street, New Street, and Exchange Place. The central section of the block contains the original structure at 18 Broad Street, designed in the Classical Revival style by George B. Post. The northern section contains a 23-story office annex at 11 Wall Street, designed by Trowbridge & Livingston in a similar style.

James Ward Bleecker was an American banker and the fourth president of the New York Stock Exchange.

George Washington Bleecker was an American teacher and politician from New York. He was the son of Leonard Bleecker, a Major General during the Revolutionary war, and personal friend of George Washington.

Webull Corporation is a holding company incorporated in the Cayman Islands and headquartered in New York. Its subsidiaries operate an electronic trading platform, accessible via mobile app and desktop computer, offering commission-free and low-cost trading of stocks, exchange traded funds, options, margins, and cryptocurrencies. Its U.S.-based subsidiary, Webull Financial LLC, is a security broker registered with the U.S. Securities and Exchange Commission and a member of FINRA and SIPC, offering trading services to customers in the U.S. It also has licensed subsidiaries offering trading services in Hong Kong and Singapore.