In common law and statutory law, a life estate is the ownership of immovable property for the duration of a person's life. In legal terms, it is an estate in real property that ends at death, when the property rights may revert to the original owner or to another person. The owner of a life estate is called a "life tenant". The person who will take over the rights upon death is said to have a "remainder" interest and is known as a "remainderman".

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt, usually a mortgage loan. Hypothec is the corresponding term in civil law jurisdictions, albeit with a wider sense, as it also covers non-possessory lien.

This aims to be a complete list of the articles on real estate.

Title insurance is a form of indemnity insurance predominantly found in the United States and Canada which insures against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage loans. Unlike some land registration systems in countries outside the United States, US states' recorders of deeds generally do not guarantee indefeasible title to those recorded titles. Title insurance will defend against a lawsuit attacking the title or reimburse the insured for the actual monetary loss incurred up to the dollar amount of insurance provided by the policy.

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

A real estate contract is a contract between parties for the purchase and sale, exchange, or other conveyance of real estate. The sale of land is governed by the laws and practices of the jurisdiction in which the land is located. Real estate called leasehold estate is actually a rental of real property such as an apartment, and leases cover such rentals since they typically do not result in recordable deeds. Freehold conveyances of real estate are covered by real estate contracts, including conveying fee simple title, life estates, remainder estates, and freehold easements. Real estate contracts are typically bilateral contracts and should have the legal requirements specified by contract law in general and should also be in writing to be enforceable.

Clear title is the phrase used to state that the owner of real property owns it free and clear of encumbrances. In a more limited sense, it is used to state that, although the owner does not own clear title, it is nevertheless within the power of the owner to convey clear title. For example, a property may be encumbered by a mortgage. This encumbrance means that no one has clear title to the property. However, standard terms in a mortgage require the mortgage holder to release the mortgage if a certain amount of money is paid. Therefore, a buyer with enough money to satisfy both the mortgage and the current owner can get clear title.

In property law, a concurrent estate or co-tenancy is any of various ways in which property is owned by more than one person at a time. If more than one person owns the same property, they are commonly referred to as co-owners. Legal terminology for co-owners of real estate is either co-tenants or joint tenants, with the latter phrase signifying a right of survivorship. Most common law jurisdictions recognize tenancies in common and joint tenancies.

Generally, a quitclaim is a formal renunciation of a legal claim against some other person, or of a right to land. A person who quitclaims renounces or relinquishes a claim to some legal right, or transfers a legal interest in land. Originally a common-law concept dating back to Medieval England, the expression is in modern times mostly restricted to North American law, where it often refers specifically to a transfer of ownership or some other interest in real property.

An action to quiet title is a lawsuit brought in a court having jurisdiction over property disputes, in order to establish a party's title to real property, or personal property having a title, of against anyone and everyone, and thus "quiet" any challenges or claims to the title.

In finance, a security interest is a legal right granted by a debtor to a creditor over the debtor's property which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations. One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

In real estate business and law, a title search or property title search is the process of examining public records and retrieving documents on the history of a piece of real property to determine and confirm property's legal ownership, and find out what claims or liens are on the property. A title search is also performed when an owner wishes to sell mortgage property and the bank requires the owner to insure this transaction.

A land contract,, is a contract between the buyer and seller of real property in which the seller provides the buyer financing in the purchase, and the buyer repays the resulting loan in installments. Under a land contract, the seller retains the legal title to the property but permits the buyer to take possession of it for most purposes other than that of legal ownership. The sale price is typically paid in periodic installments, often with a balloon payment at the end to make the timelength of payments shorter than in the corresponding fully amortized loan. When the full purchase price has been paid including any interest, the seller is obligated to convey legal title to the property. An initial down payment from the buyer to the seller is usually also required.

In the United States, a mortgage note is a promissory note secured by a specified mortgage loan.

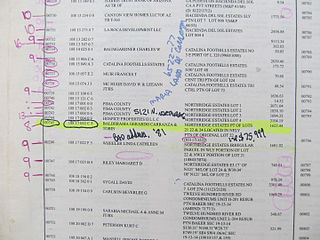

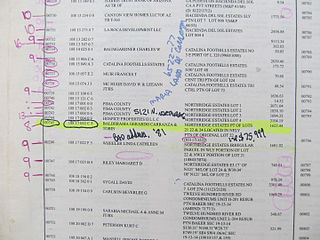

A tax sale is the forced sale of property by a governmental entity for unpaid taxes by the property's owner.

In real estate, creative financing is non-traditional or uncommon means of buying land or property. The goal of creative financing is generally to purchase, or finance a property, with the buyer/investor using as little of his own money as possible, otherwise known as leveraging. Using these techniques an investor may be able to purchase multiple properties using little, or none, of his "own money".

Seller financing is a loan provided by the seller of a property or business to the purchaser. When used in the context of residential real estate, it is also called "bond-for-title" or "owner financing." Usually, the purchaser will make some sort of down payment to the seller, and then make installment payments over a specified time, at an agreed-upon interest rate, until the loan is fully repaid. In layman's terms, this is when the seller in a transaction offers the buyer a loan rather than the buyer obtaining one from a bank. To a seller, this is an investment in which the return is guaranteed only by the buyer's credit-worthiness or ability and motivation to pay the mortgage. For a buyer it is often beneficial, because he/she may not be able to obtain a loan from a bank. In general, the loan is secured by the property being sold. In the event that the buyer defaults, the property is repossessed or foreclosed on exactly as it would be by a bank.

A deed of trust refers to a type of legal instrument which is used to create a security interest in real property and real estate. In a deed of trust, a person who wishes to borrow money conveys legal title in real property to a trustee, who holds the property as security for a loan (debt) from the lender to the borrower. The equitable title remains with the borrower. The borrower is referred to as the trustor, while the lender is referred to as the beneficiary.

Mortgage Electronic Registration Systems, Inc. (MERS) is an American privately held corporation. MERS is a separate and distinct corporation that serves as a nominee on mortgages after the turn of the century and is owned by holding company MERSCORP Holdings, Inc., which owns and operates an electronic registry known as the MERS system, which is designed to track servicing rights and ownership of mortgages in the United States. According to the Department of the Treasury, the Board of Governors of the Federal Reserve, The Federal Deposit Insurance Corporation and the Federal Housing Finance Agency, MERS is an agent for lenders without any reference to MERS as a principal. On October 5, 2018, Intercontinental Exchange and MERS announced that ICE had acquired all of MERS.

The vast majority of states in the United States employ a system of recording legal instruments that affect the title of real estate as the exclusive means for publicly documenting land titles and interests. This system differs significantly from land registration systems, such as the Torrens system, that have been adopted in a few states. The principal difference is that the recording system does not determine who owns the title or interest involved, which is ultimately established through litigation in the courts. The system provides a framework for determining who the law will protect in relation to those titles and interests when a dispute arises.