Related Research Articles

Dependent and independent variables are variables in mathematical modeling, statistical modeling and experimental sciences. Dependent variables are studied under the supposition or demand that they depend, by some law or rule, on the values of other variables. Independent variables, in turn, are not seen as depending on any other variable in the scope of the experiment in question. In this sense, some common independent variables are time, space, density, mass, fluid flow rate, and previous values of some observed value of interest to predict future values.

In statistics, homogeneity and its opposite, heterogeneity, arise in describing the properties of a dataset, or several datasets. They relate to the validity of the often convenient assumption that the statistical properties of any one part of an overall dataset are the same as any other part. In meta-analysis, which combines the data from several studies, homogeneity measures the differences or similarities between the several studies.

In statistics, the Breusch–Pagan test, developed in 1979 by Trevor Breusch and Adrian Pagan, is used to test for heteroskedasticity in a linear regression model. It was independently suggested with some extension by R. Dennis Cook and Sanford Weisberg in 1983. Derived from the Lagrange multiplier test principle, it tests whether the variance of the errors from a regression is dependent on the values of the independent variables. In that case, heteroskedasticity is present.

Cross-sectional data, or a cross section of a study population, in statistics and econometrics, is a type of data collected by observing many subjects at the one point or period of time. The analysis might also have no regard to differences in time. Analysis of cross-sectional data usually consists of comparing the differences among selected subjects.

In economics and econometrics, the parameter identification problem arises when the value of one or more parameters in an economic model cannot be determined from observable variables. It is closely related to non-identifiability in statistics and econometrics, which occurs when a statistical model has more than one set of parameters that generate the same distribution of observations, meaning that multiple parameterizations are observationally equivalent.

In statistics, the White test is a statistical test that establishes whether the variance of the errors in a regression model is constant: that is for homoskedasticity.

In statistics, the Durbin–Watson statistic is a test statistic used to detect the presence of autocorrelation at lag 1 in the residuals from a regression analysis. It is named after James Durbin and Geoffrey Watson. The small sample distribution of this ratio was derived by John von Neumann. Durbin and Watson applied this statistic to the residuals from least squares regressions, and developed bounds tests for the null hypothesis that the errors are serially uncorrelated against the alternative that they follow a first order autoregressive process. Note that the distribution of this test statistic does not depend on the estimated regression coefficients and the variance of the errors.

Apple to the Core: The Unmaking of the Beatles is a book by Peter McCabe and Robert D. Schonfeld, first published in the United States by Pocket Books in 1972. Released two years after the break-up of the English band the Beatles, the book covers the business aspect of the group's career, particularly the problems that befell their Apple Corps enterprise.

In probability theory and statistics, the empirical probability, relative frequency, or experimental probability of an event is the ratio of the number of outcomes in which a specified event occurs to the total number of trials, not in a theoretical sample space but in an actual experiment. More generally, empirical probability estimates probabilities from experience and observation.

In statistics, model specification is part of the process of building a statistical model: specification consists of selecting an appropriate functional form for the model and choosing which variables to include. For example, given personal income together with years of schooling and on-the-job experience , we might specify a functional relationship as follows:

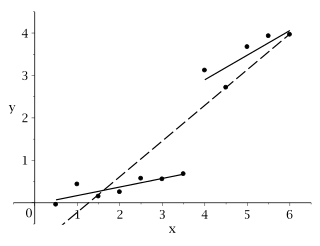

In econometrics and statistics, a structural break is an unexpected change over time in the parameters of regression models, which can lead to huge forecasting errors and unreliability of the model in general. This issue was popularised by David Hendry, who argued that lack of stability of coefficients frequently caused forecast failure, and therefore we must routinely test for structural stability. Structural stability − i.e., the time-invariance of regression coefficients − is a central issue in all applications of linear regression models.

A log-linear model is a mathematical model that takes the form of a function whose logarithm equals a linear combination of the parameters of the model, which makes it possible to apply linear regression. That is, it has the general form

In statistics, the precision matrix or concentration matrix is the matrix inverse of the covariance matrix or dispersion matrix, . For univariate distributions, the precision matrix degenerates into a scalar precision, defined as the reciprocal of the variance, .

Following the development of Keynesian economics, applied economics began developing forecasting models based on economic data including national income and product accounting data. In contrast with typical textbook models, these large-scale macroeconometric models used large amounts of data and based forecasts on past correlations instead of theoretical relations. These models estimated the relations between different macroeconomic variables using regression analysis on time series data. These models grew to include hundreds or thousands of equations describing the evolution of hundreds or thousands of prices and quantities over time, making computers essential for their solution. While the choice of which variables to include in each equation was partly guided by economic theory, variable inclusion was mostly determined on purely empirical grounds. Large-scale macroeconometric model consists of systems of dynamic equations of the economy with the estimation of parameters using time-series data on a quarterly to yearly basis.

In econometrics, the Park test is a test for heteroscedasticity. The test is based on the method proposed by Rolla Edward Park for estimating linear regression parameters in the presence of heteroscedastic error terms.

Peter McCabe was an English author and music journalist, who wrote in a variety of genres. He was an editor at Rolling Stone and Oui magazine, and is the former editor-in-chief of Country Music magazine and a nationally syndicated country music columnist.

Ira N. Levine was an American author, scientist, professor and faculty member in the Chemistry Department at Brooklyn College. He widely acknowledged for his research in the field of microwave spectroscopy, and for several widely known textbooks in physical chemistry and quantum chemistry.

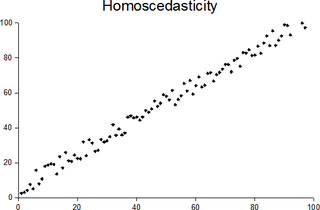

In statistics, a sequence of random variables is homoscedastic if all its random variables have the same finite variance; this is also known as homogeneity of variance. The complementary notion is called heteroscedasticity, also known as heterogeneity of variance. The spellings homoskedasticity and heteroskedasticity are also frequently used. Assuming a variable is homoscedastic when in reality it is heteroscedastic results in unbiased but inefficient point estimates and in biased estimates of standard errors, and may result in overestimating the goodness of fit as measured by the Pearson coefficient.

Dawn Cheree Porter is an American expert on business statistics, business analytics, and econometrics, known for her textbooks on these subjects. She is professor of clinical data sciences and operations management in the USC Marshall School of Business, where she directs the master's degree program in business analytics and holds the Fubon Teaching Chair in Business Administration.

References

- ↑ About the authors Novella [ dead link ]

- ↑ Gujarati, Damodar. "Basic Econometrics". AbeBooks. Retrieved 3 June 2023.

- ↑ Library Thing

- ↑ Gujarati, Damodar N. (1978). Basic econometrics. New York: McGraw-Hill. ISBN 978-0-07-025182-3. OCLC 3223818.

- ↑ Mar. - Apr., 1998, vol. 13, no. 2, p. 209-212

- ↑ "Pensions and New York City's fiscal crisis". WorldCat.org. Retrieved 3 June 2023.

- ↑ "Government and business". WorldCat.org. Retrieved 3 June 2023.